.png?downsize=773:435)

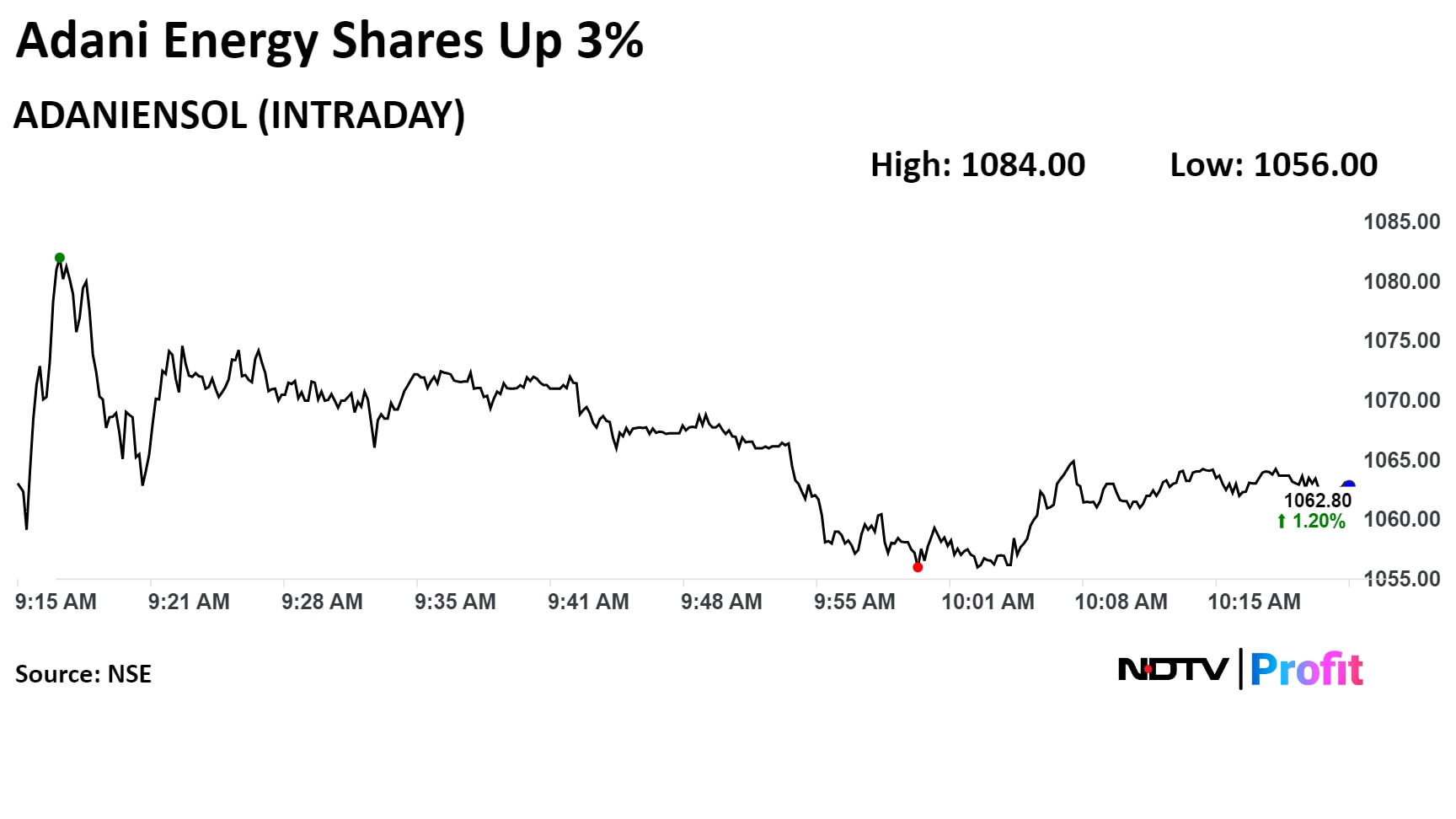

Shares of Adani Energy Solutions Ltd. and Adani Green Energy Ltd. rose over 3% and 4%, respectively, after the companies reported a rise in revenues in the first quarter of fiscal 2025.

Adani Energy Solutions reported a 47% year-on-year increase in revenue to Rs 5,379 crore for the quarter ended June 30, 2024, according to its exchange filing.

While, Adani Green Energy's revenue was also up 31% year-on-year to Rs 2,834 crore. Its net profit surged 95% YoY to Rs 629 crore in the April-June quarter.

Adani Energy Q1 FY25 Highlights (Consolidated, YoY)

Revenue from operations up 47% to Rs 5,379 crore versus Rs 3,664 crore.

Ebitda rose 43% to Rs 2,244 crore versus Rs 1,574 crore.

Ebitda margin at 41.7% versus 42.9%.

Net loss at Rs 1,190 crore versus profit of Rs 182 crore.

Net loss was led by exceptional item of Rs 1,506 crore in the quarter ended June 30, 2024.

Revenue increased by 47% due to contributions from the freshly commissioned Warora-Kurnool, Karur, Kharghar-Vikhroli, and Khavda-Bhuj transmission lines. Higher demand for electricity in Adani Electricity Mumbai Ltd. and contributions from the smart metering business helped boost earnings, the company said.

Adani Energy Solutions Ltd. stock rose as much as 3.22% before paring gains to trade 1.27% higher at Rs 1,063.20 apiece, compared to a 0.77% advance in the benchmark NSE Nifty 50 as of 10:19 a.m.

The stock has risen 30.44% in the last 12 months and 1.73% year-to-date. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 64.02.

In a post results note, Jefferies maintained its ‘buy' rating on the stock with a target price of Rs 1,365 apiece, implying a potential upside of 28% from the previous close.

The company will benefit from the Distribution Reforms Act, if it goes through. Smart metering remains exciting opportunity with 120 million government bids left, the brokerage said.

Downside risks include inability to maintain interest rate and market share loss, Jefferies noted.

Two analysts tracking Adani Energy Solutions have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 29.2%.

Adani Green Energy Q1 Results Key Highlights (Consolidated, YoY)

Revenue rose 31% to Rs 2,834 crore.

Ebitda rose 26% to Rs 2,420 crore.

Ebitda margin at 85.4% versus 88.9%.

Net profit rose 95% to Rs 629 crore.

The substantial growth in revenue, Ebitda and cash profit is primarily due to a capacity addition of 2,618 megawatts over the previous year, the company said. It also reported that energy sales climbed by 22% YoY, driven by significant capacity additions and strong operational performance.

The company increased its operating capacity by 31% YoY to 10,934 MW through greenfield additions, which included 2,000 MW of solar capacity in Khavda, 418 MW of solar capacity in Rajasthan, and 200 MW of wind capacity in Gujarat.

Shares of Adani Green Energy Ltd. rose as much as 4.57% during the day. They pared gains to trade 0.71% higher at Rs 1,834.35 apiece, compared to a 0.81% advance in the benchmark NSE Nifty 50 as of 10:20 a.m.

The stock has risen 60.73% in the last 12 months and 14.72% year-to-date. Total traded volume so far in the day stood at 7.7 times its 30-day average. The relative strength index was at 60.40.

Bernstein research has a 'sell' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 67.2%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.