Benchmark stock indices ended the budget week higher on Friday, led by gains in IT companies and index heavyweight Reliance Industries Ltd.

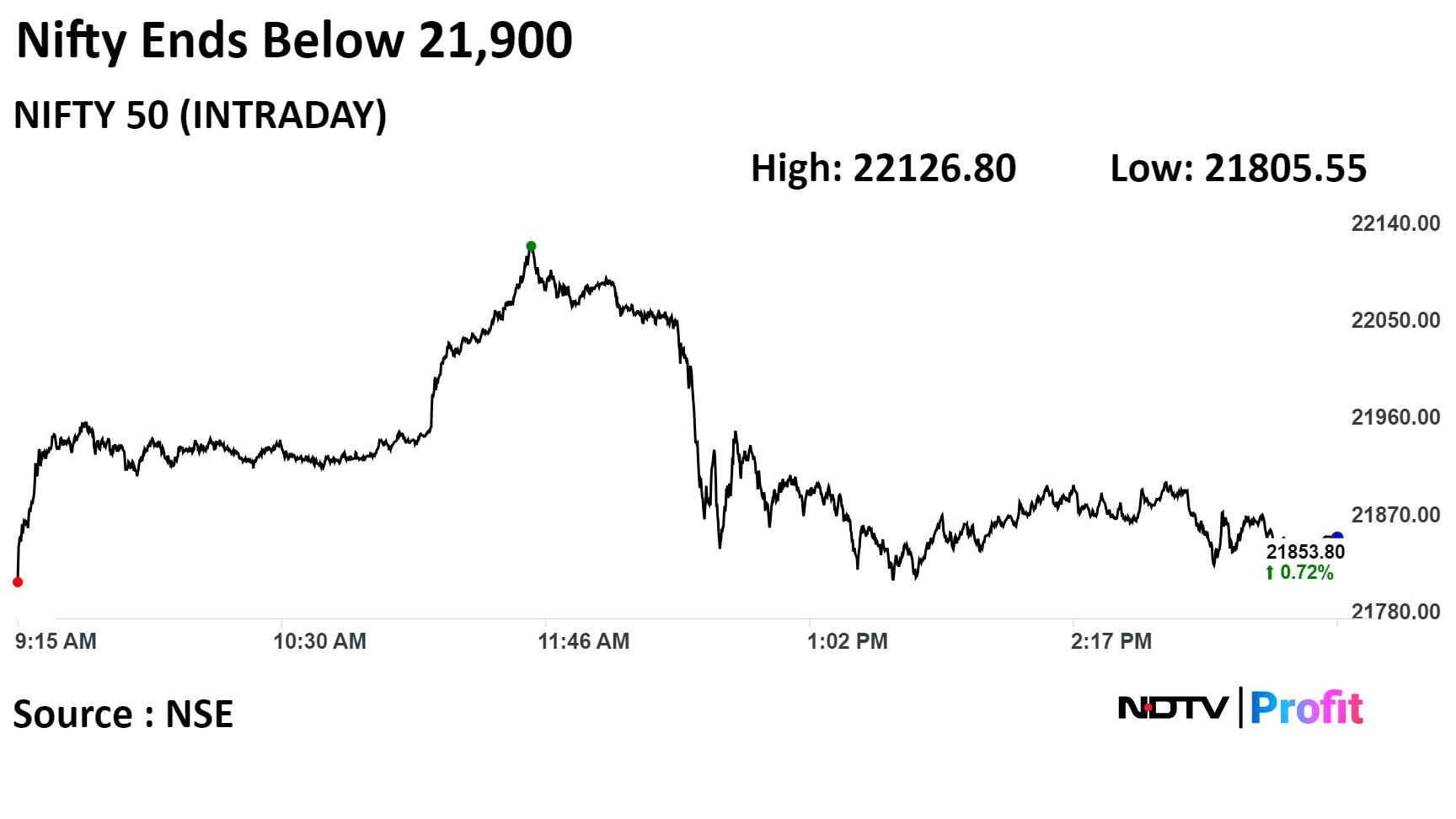

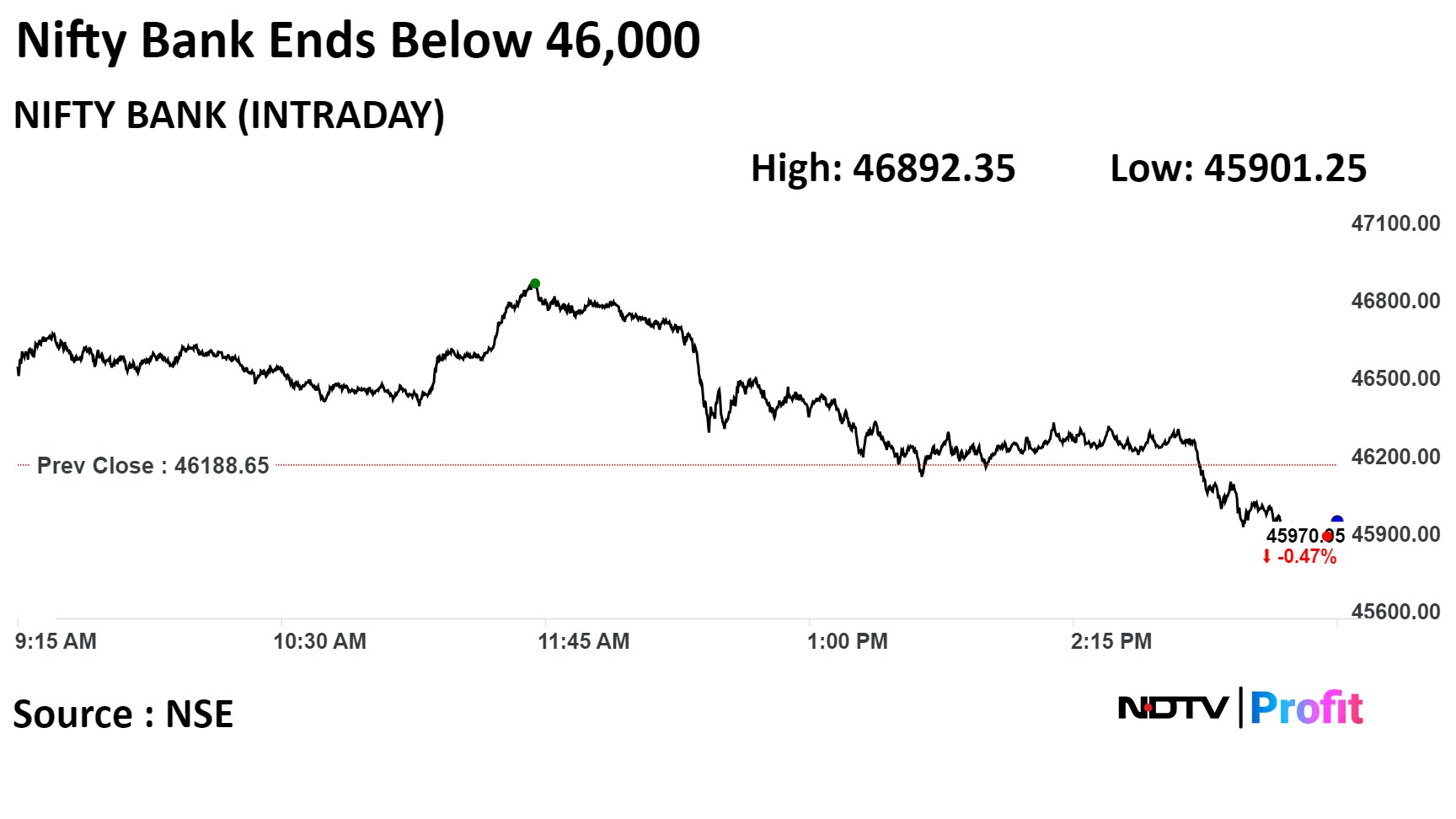

The Nifty breached 22,000 for the first time since Jan. 16 to hit a fresh record high but was unable to hold on to a bout of profit booking. The Sensex increased by as much as 2.02%, coming close to its all-time high, but it fell in late trade due to losses at Axis Bank and HDFC Bank Ltd.

On a weekly basis, the indices snapped two straight weeks of losses to end higher.

The Nifty closed 156.35 points, or 0.72%, higher at 21,853.80, while the Sensex gained 440.34 points, or 0.6%, to end at 72,085.63.

"Nifty surpassed the 22,000 mark during the first half of the Friday session but subsequently formed a double top on the hourly chart," said Rupak De, senior technical analyst, LKP Securities. "Confirmation of a bullish trend resumption would only occur with a decisive breakout above the double top, which is currently identified around 22,125."

"Conversely, a break below the support level at 21,500 could indicate bearish momentum. If it breakouts above 22,150, Nifty may experience upward momentum, potentially reaching levels such as 22,500 and beyond," he said.

Shares of Reliance Industries Ltd., Infosys Ltd., Tata Consultancy Services Ltd., NTPC Ltd., and Power Grid Corp. Of India Ltd. contributed the most to the gains.

Meanwhile, those of HDFC Bank Ltd., Axis Bank Ltd., Larsen & Toubro Ltd., ITC Ltd., and Hindustan Unilever Ltd. capped the upside.

The Nifty 50 ended 2.35% higher this week with only Nifty FMCG and Nifty Media posting losses.

Nifty PSU Bank gained the most followed by Nifty Oil & Gas.

The broader markets rose in line with the benchmark indices. The S&P BSE Midcap gained 0.80%, and the S&P BSE Smallcap rose 0.49%.

On BSE, 16 out of 20 sectoral indices rose, while four declined. The S&P BSE Oil and Gas surged over 4% to become the best performing sector.

The market breadth was skewed in favour of the buyers. About 2,040 stocks rose, 1,805 declined, and 98 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.