Shark Tank India judge, Namita Thapar, is set to reap substantial returns following her decision to partially divest her stake in Emcure Pharmaceuticals Ltd., where she is an executive director. Thapar is expected to achieve over 293-fold return on her initial investment at the upper end of the price band set for the company's initial public offering, according to the red herring prospectus. The IPO has listed at a premium of 31.4% at Rs 1,325 apiece on the exchanges, bumping the shark tank judge's returns.

The IPO, which opened on July 3, comprised a fresh issue worth Rs 800 crore and an offer for sale of 1.14 crore equity shares from shareholders and promoters. The price band has been fixed at Rs 960 to Rs 1,008 per share.

Thapar, holding 63,39,800 shares amounting to a 3.5% stake in Emcure, sold 12,68,600 shares through offer for sale. Her average cost of acquisition per share stands at Rs 3.44, resulting in a total initial investment of Rs 2.18 crore.

Follow the steps mentioned here to check Emcure Pharma IPO allotment status.

Who Is Namita Thapar

Born on March 21, 1977, in Pune, Maharashtra, Thapar is an alumna of the Fuqua School of Business and a chartered accountant. She joined Emcure Pharmaceuticals as chief financial officer in 1999. Beyond her corporate roles, she has engaged in angel investing across various ventures as part of her stint in business reality show Shark Tank India. During the show's first season, she invested Rs 10 crore in 25 companies. Thapar also founded Incredible Ventures Ltd., an education company promoting youth entrepreneurship. She also serves on the board of Fuqua School of Business and is a trustee of TiE Mumbai

Satish Ramanlal Mehta, managing director of Emcure Pharmaceuticals, is among other shareholders participating in the OFS. He owns a significant 41.85% stake in the company pre-issue. Mehta will offer up to 4.2 lakh equity shares, potentially realising a return of 52 times on his original investment at the upper price band.

Emcure Pharmaceuticals Listing Today

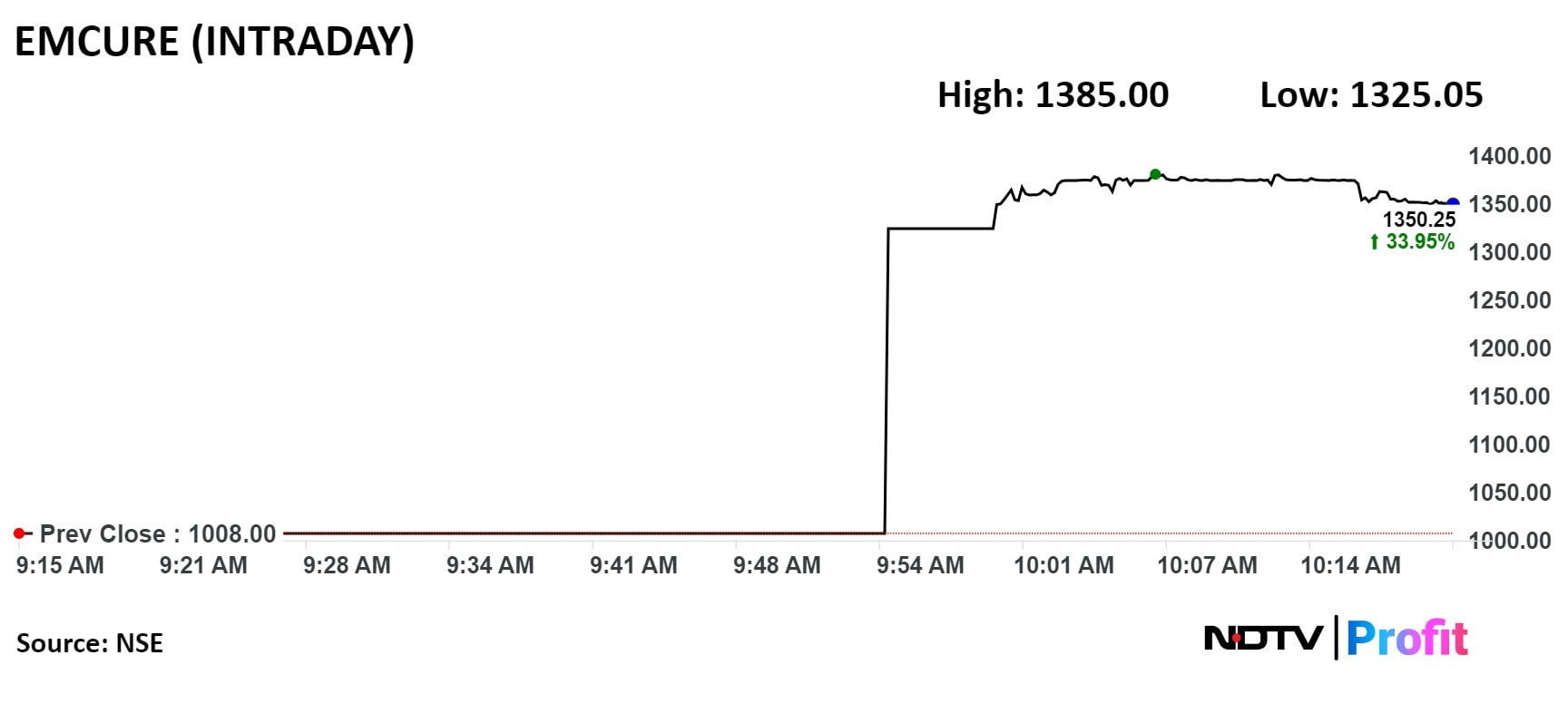

Emcure Pharmaceuticals had a robust debut on the stock exchanges on Wednesday. The company's shares listed at a premium of 31.4% at Rs 1,325 apiece on both the National Stock Exchange and the Bombay Stock Exchange, compared to its issue price of Rs 1,008 per share

The public offering attracted substantial investor interest, with bids received for 92.99 crore shares against the 1.37-crore shares offered. This strong demand was largely driven by qualified institutional buyers, whose portion was oversubscribed by 195.83 times. Non-institutional investors also showed keen interest, subscribing 48.32 times, while retail individual investors subscribed 7.21 times of their allocated portion.

Emcure Pharmaceuticals' initial public offering, which was open for subscription from July 3 to July 5, had set a price band of Rs 960 to Rs 1,008 per share.

Emcure Pharmaceuticals Financials

The IPO launch was expected to attract significant investor interest, given Emcure's robust financial performance. In the financial year 2024, Emcure reported a revenue increase of over 11% to Rs 6,658 crore, while its net worth surged by 18% to Rs 2,952.3 crore.

The company has garnered attention in the pharmaceutical sector with operations spanning 70 countries and 13 manufacturing facilities in India.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.