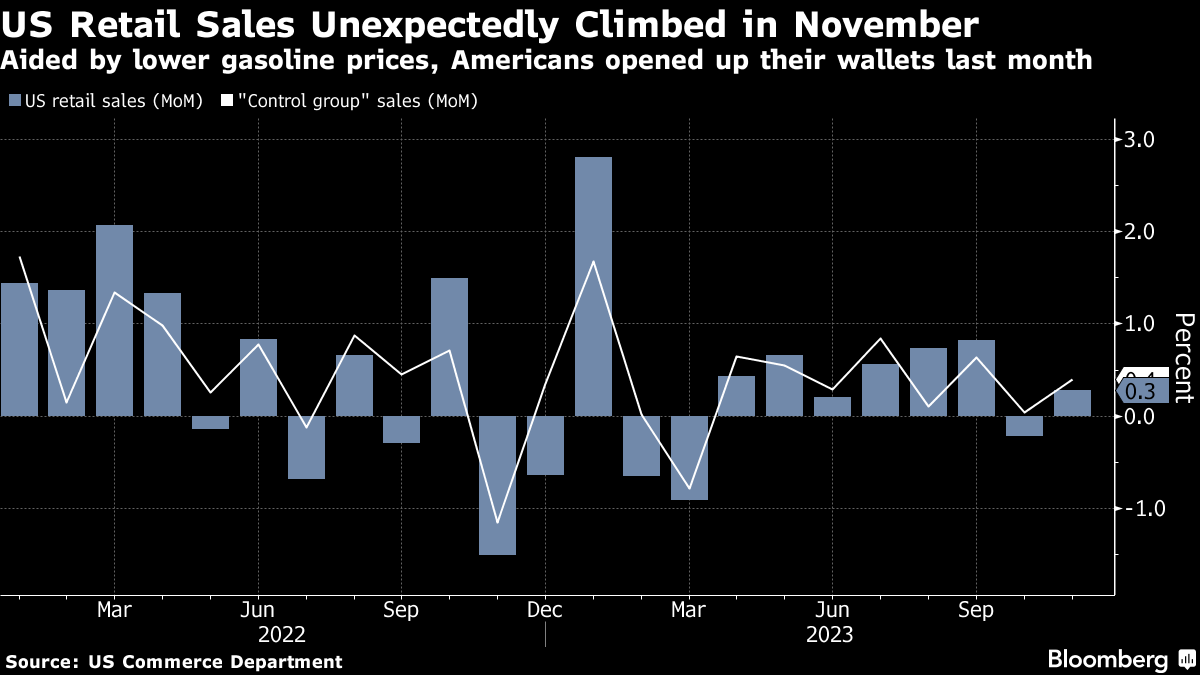

(Bloomberg) -- US retail sales unexpectedly picked up in November as lower gasoline prices allowed consumers to spend more to kick off the holiday shopping season.

The value of retail purchases, unadjusted for inflation, increased 0.3%, Commerce Department data showed Thursday. Figures for the prior month were revised lower. Excluding gasoline, sales rose 0.6%.

A separate report Thursday showed applications for US unemployment benefits dropped 19,000 last week to 202,000, the lowest level since October and near historic lows.

Consumers are holding in better than expected, particularly as they contend with lingering inflation and elevated borrowing costs. The labor market has continued to defy expectations for a slowdown, giving Americans the power to keep spending — especially with lower gas prices.

The data this morning are “stronger than expected across the board,” said Alex Pelle, an economist at Mizuho Securities USA. November is “clearly a strong month for US economic performance after a soft October.”

In retail sales, eight out of 13 categories posted increases, led by restaurants and bars — the only service-sector category in the report — as well as sporting goods stores and online retailers. Gasoline sales dropped nearly 3% as pump prices continued to fall in the month. Meantime, department-store sales declined by the most since March, reflecting tepid Black Friday shopping.

Read More: Slow Black Friday for Best Buy, Gap Is Bad Omen for US Economy

So-called control group sales — which are used to calculate gross domestic product — advanced 0.4% after stalling in the prior month. The measure, which excludes food services, auto dealers, building materials stores and gasoline stations.

Read More: Americans Earning at Least $100,000 Begin to Curb Their Shopping

A report earlier this week showed goods prices excluding food and energy declined for a sixth month in November, including declines for clothes and household furniture. That likely means the unexpected strength in the numbers reflected more purchasing activity.

What Bloomberg Economics Says...

“The robust November retail sales report suggests US consumers continue to prefer to bargain hunt online and are still leaning away from big-ticket and interest-rate sensitive spending categories. In our view, that means while consumers are getting into the spirit of the gift-giving season, they're still feeling the pinch from higher prices and interest rates.”

— Estelle Ou. To read the full note, click here

The Federal Reserve decided to leave interest rates at a 22-year high this week, and fresh projections showed a significant upward revision to economic growth estimates for this year compared to the September meeting. While officials expect the economy to cool, they're also forecasting a series of rate cuts, which should help support employment and spending.

The retail figures largely reflect spending on merchandise, limiting the takeaways of this particular report. Real spending on both goods and services for November are scheduled for later this month.

--With assistance from Kristy Scheuble and Reade Pickert.

(Adds Bloomberg Economics comment)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.