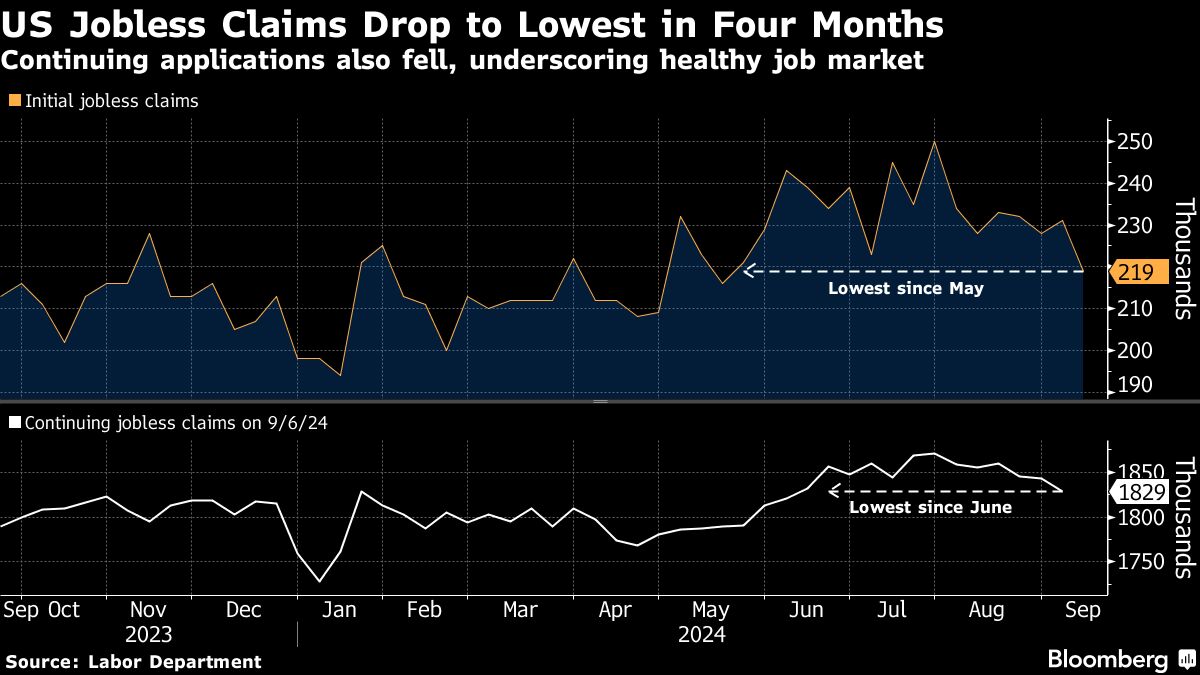

Applications for US unemployment benefits fell to the lowest level since May, indicating the job market remains healthy despite a slowdown in hiring.

Initial claims decreased by 12,000 to 219,000 in the week ended Sept. 14, according to Labor Department data released Thursday. That was below all estimates in a Bloomberg survey of economists. The period also corresponds with the so-called reference week when the survey is conducted for the September employment report.

Continuing claims, a proxy for the number of people receiving benefits, also dropped in the previous week, to the lowest in three months.

The four-week moving average, a metric that helps smooth out volatility in the data, fell to 227,500, the lowest since June.

Continuing claims, a proxy for the number of people receiving benefits, also dropped in the previous week, to the lowest in three months.

What Bloomberg Economics Says

“Initial jobless claims declined more than expected in the survey week for September's employment report, due in part to difficulty adjusting the data around a major holiday like Labor Day. Claims tend to be depressed in holiday-shortened weeks, then rebound the following week — so the current data have limited value as a guide to September's payroll print.” — Eliza Winger.

Claims for unemployment benefits have remained subdued in recent months even as labor demand cooled. The US central bank's decision to lower interest rates by a half percentage point this week reflected policymakers' intention to maintain what Federal Reserve Chair Jerome Powell described as “still a solid” labor market.

“We're trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with disinflation,” Powell said during a press conference Wednesday following the rate-cut announcement.

Initial claims, before adjustment for seasonal factors, rose by 6,436 to 184,845. Texas, New York and California saw the largest increases. Applications in Massachusetts fell by the most since the end of April.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.