(Bloomberg) -- British company executives urged the Bank of England to slash interest rates soon to prop up the flagging economy after “depressed” confidence sank to a four-month low.

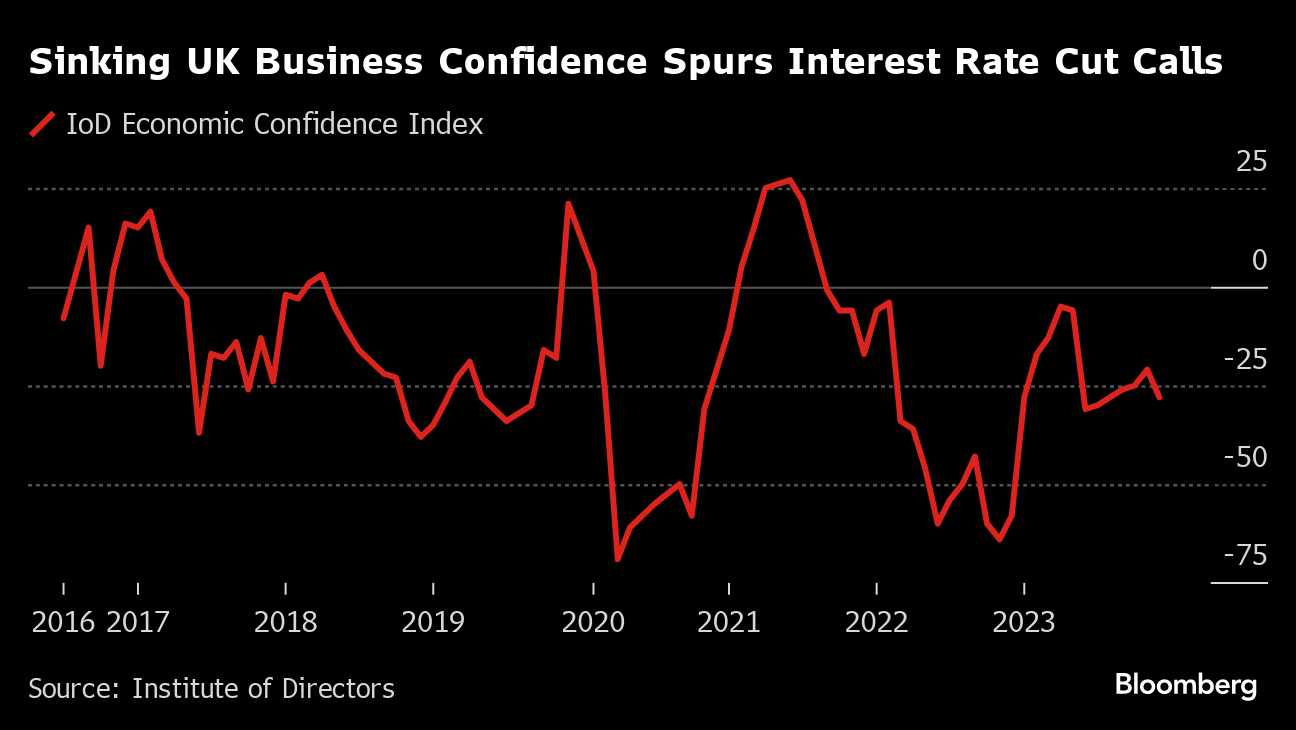

Mounting recession fears helped drive the Institute of Directors' Economic Confidence Index down to minus 28 in December from minus 21 the previous month, hitting the lowest level since August and close to 2023's low. The survey measures directors' optimism about the UK economy for the next 12 months.

The setback suggests “an early cut in interest rates would be justified in terms of helping to kick-start business confidence,” Roger Barker, director of policy at the IOD, said in a statement Wednesday. He said sentiment among bosses ended 2023 in a “relatively depressed place.”

There's growing speculation that the BOE will be forced to cut rates as soon as May as policymakers switch their focus from high inflation to a stagnant economy.

Investors are increasingly betting on an early cut, a sharp contrast with the central bank's message that borrowing costs need to stay higher for longer to curtail inflation that's still almost double its target. Markets now expect as many as six quarter-point cuts by the end of 2024.

A small contraction in the third quarter of 2023 and a drop in GDP in October leaves the UK needing to catch up in November and December to avoid suffering a technical recession — two consecutive quarters of falling output. A recession would hand opponents of Conservative Prime Minister Rishi Sunak a key attack line ahead of an election this year with his party well behind the opposition Labour Party in the polls.

“With inflationary pressures abating, business is in dire need of a boost if it is help drive meaningful economic growth in 2024,” Barker said. “Although aspects of the business environment have improved in the last couple of months, particularly with regard to inflation, this is not yet exerting a meaningful impact on business decision-making.”

While directors' confidence in the economy slipped in December, their confidence in their own business grew, the survey showed.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.