(Bloomberg) -- Japan's biggest commercial banks are letting money accumulate in negative interest-rate accounts at the central bank — another sign that the world's last sub-zero rate policy is coming close to the end.

When the Bank of Japan started charging -0.1% interest on certain accounts where lenders parked excess funds eight years ago, policymakers got the result they wanted: cash flowed elsewhere, to more productive parts of the financial system, supporting the BOJ's campaign to revive the economy and spur inflation.

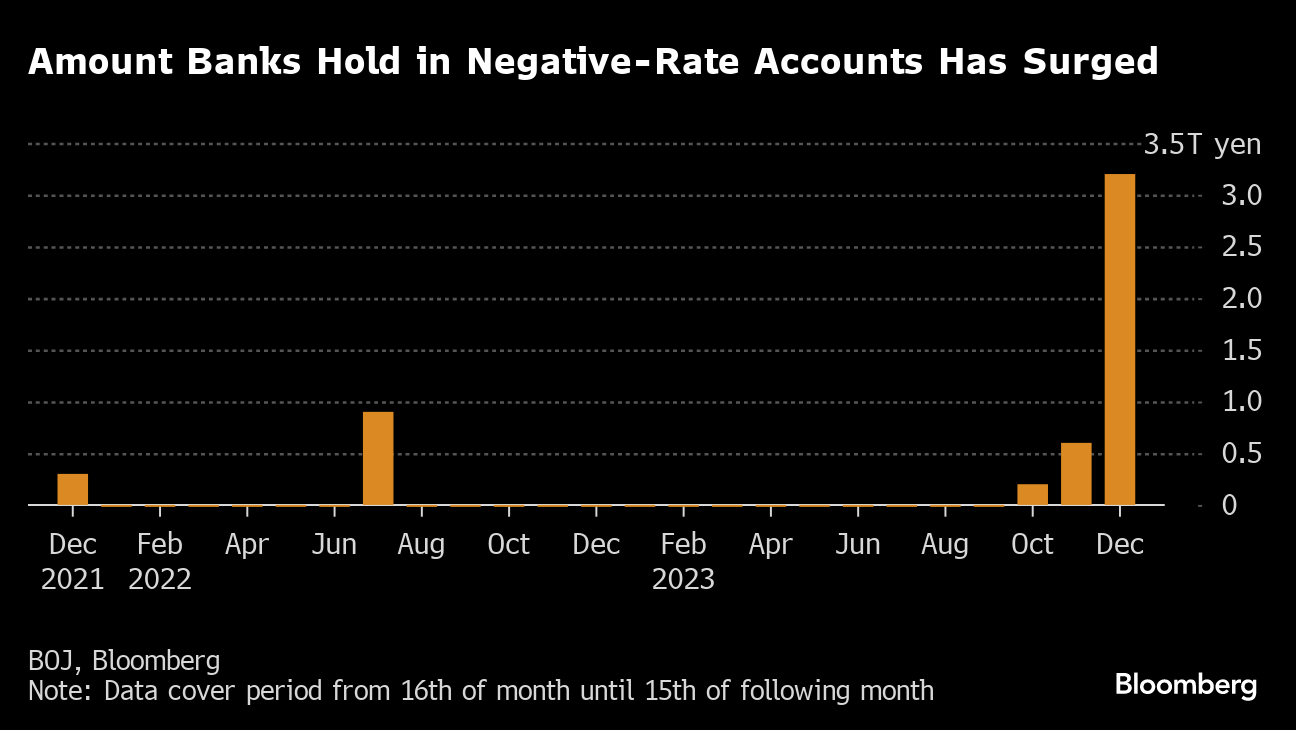

That changed in recent months, with the latest data for December indicating that the nation's major banks have ¥3.2 trillion ($22 billion) sitting in the accounts, the most since the then Governor Haruhiko Kuroda introduced his unconventional policy in early 2016.

Banks that had been reluctant to hold negative interest-rate balances “seem to be changing their minds because if a policy exit is near, there is no need to forcefully invest funds to eliminate balances,” said Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities Co.

The amount in these negative-rate accounts started climbing from October, when the BOJ made a further adjustment to yield curve control, fueling bets that a broader policy change was on the way.

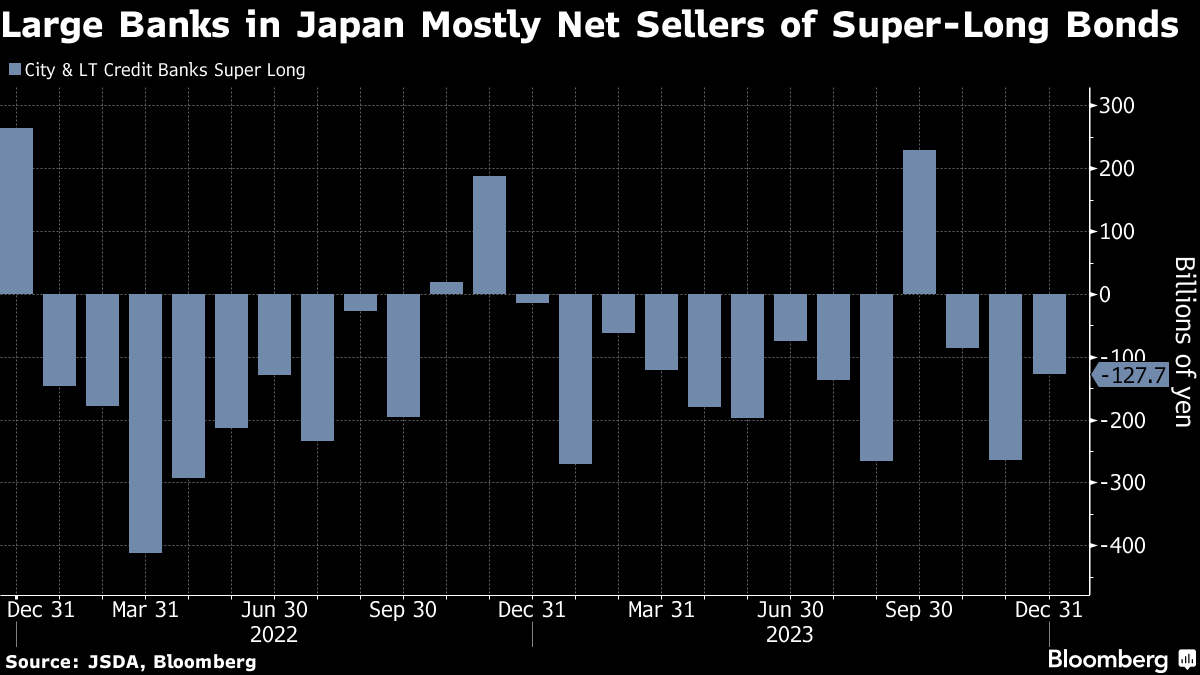

The YCC tweaks also increased instability in the bond market, making it more challenging to buy sovereign debt, adding to reasons for the banks to have money sitting in the negative-rate accounts.

While interest-rate arbitrage trades can be used to make profit even on funds held in negative-rate accounts, the big change in the December data indicates expectations of a BOJ policy shift, said Yosuke Takahama, chief manager at money broker Central Tanshi Co.

The BOJ's January board meeting has provided more reason for the banks to bet on change, with one of the nine members indicating “conditions for policy revision, including the termination of the negative interest rate policy, are being met.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.