(Bloomberg) -- Mention the government's annual revisions to seasonal adjustment factors for monthly inflation data and you're likely to make eyes glaze over, even among hardcore economics nerds. Not this year.

Economists on Wall Street and in Washington will be tuning in for this year's update, due Friday morning, because of what happened a year ago: The revisions to the consumer price index — typically small and therefore ignored — were large enough to cast doubt on overall inflation progress.

A year later — with Federal Reserve officials anxiously seeking more evidence they've tamed price pressures before committing to interest-rate cuts — the risk of another dramatic revision this week has put policymakers and investors on edge.

Fed Governor Christopher Waller trained focus on the numbers in a Jan. 16 speech, prompting a flurry of research reports from investment banks on the subject.

“Recall that a year ago, when it looked like inflation was coming down quickly, the annual update to the seasonal factors erased those gains,” Waller said in the speech. “My hope is that the revisions confirm the progress we have seen, but good policy is based on data and not hope.”

The Bureau of Labor Statistics regularly adjusts monthly CPI data to remove seasonal factors that affect the numbers. Those might include, for example, things like the estimated impact of harvests, or trends related to holiday shopping. Smoothing through these with seasonal adjustments makes it possible to meaningfully compare inflation across months within the same year.

But, as the BLS explains on its website, the process for quantifying seasonal patterns itself needs adjusting from time to time to keep up with changes in climate, production cycles, model changeovers and other factors. Thus the annual revisions to the seasonal adjustments.

Last year's tweaks hit with a bang.

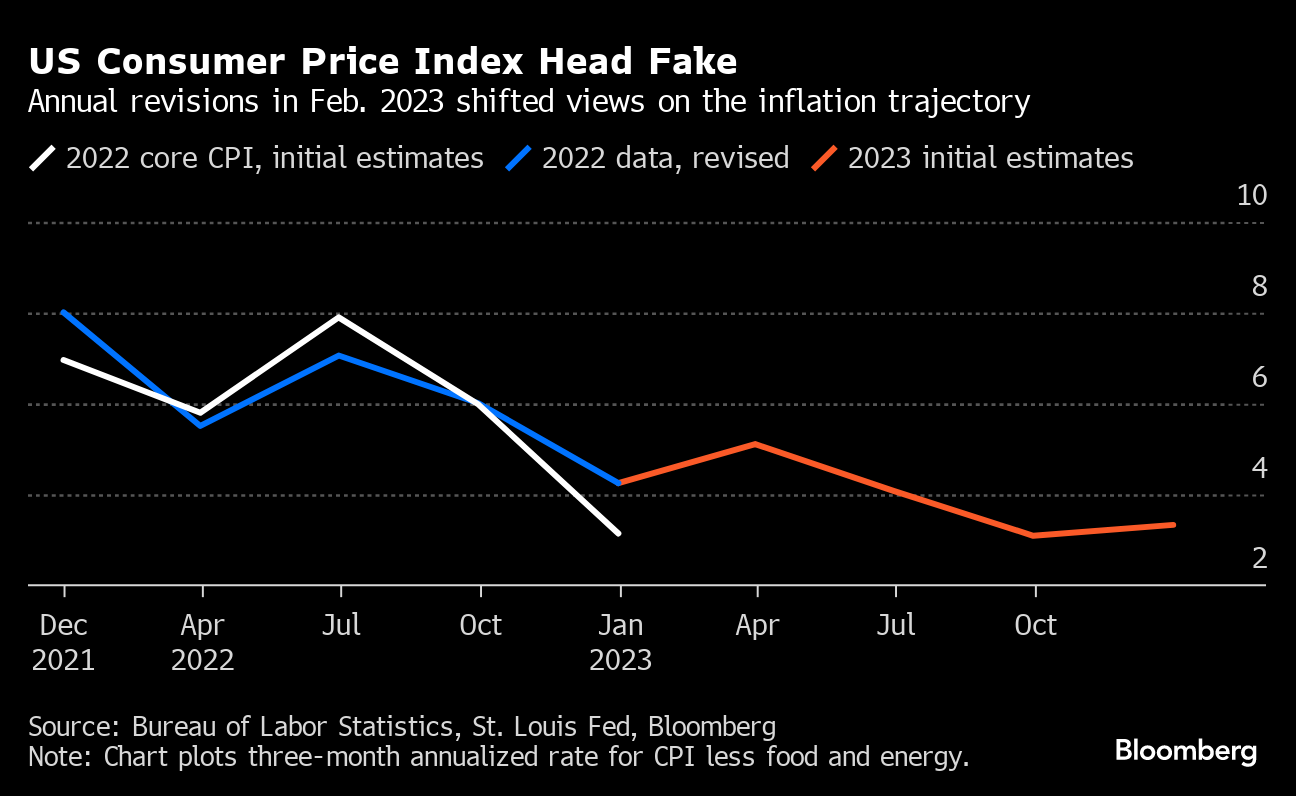

Initial readings had shown consumer prices excluding food and energy — an important gauge of inflation's underlying trend, closely watched by the Fed — had risen by just 3.1% on an annualized basis in the final three months of 2022, down from 8% in the same period of 2021.

Head Fake

That positive signal proved a head fake. After the revisions, the 3.1% was recalculated at a meaningfully higher 4.3%. And four days later, core CPI for January came in at an annualized 5.1%. Suddenly the tone around inflation, and the outlook for rates, had shifted.

Fast forward a year and Friday's release is receiving an unusual amount of attention, even as some economists are trying to tamp down the drama.

“Over our 10-year sample, the absolute average of the monthly revision was just 2.6 basis points,” compared to the average 9-basis-point revision to months in the fourth quarter of 2022, Bank of America economists led by Michael Gapen wrote in a Jan. 25 note to clients.

“We do not expect a repeat of last year,” the BofA team said, adding that they don't think the revisions will affect the outlook for monetary policy this time around.

What Bloomberg Economics Says...

“Fed Chair Jerome Powell has shown that in conditions of uncertainty, he prefers to move slowly in setting policy. That's one key reason to delay a rate cut — even though inflation data, including revisions to CPI seasonal factors due Feb. 9, would support a cut in March.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists

To read the full note, click here

Morgan Stanley economists led by Ellen Zentner had more cold water in their own Jan. 30 report on the topic.

“Last year's CPI revision was an outlier,” they said. “From a purely statistical standpoint, the chances of seeing another outlier in the upcoming revisions are low.”

But then the Morgan Stanley team sowed a kernel of doubt by noting Covid-19 had caused large distortions to seasonal factors that are likely to affect CPI for years to come.

“The last revision might be the starting point of a sequence of large swings in seasonals, but it is hard to tell with just one extreme example,” they said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.