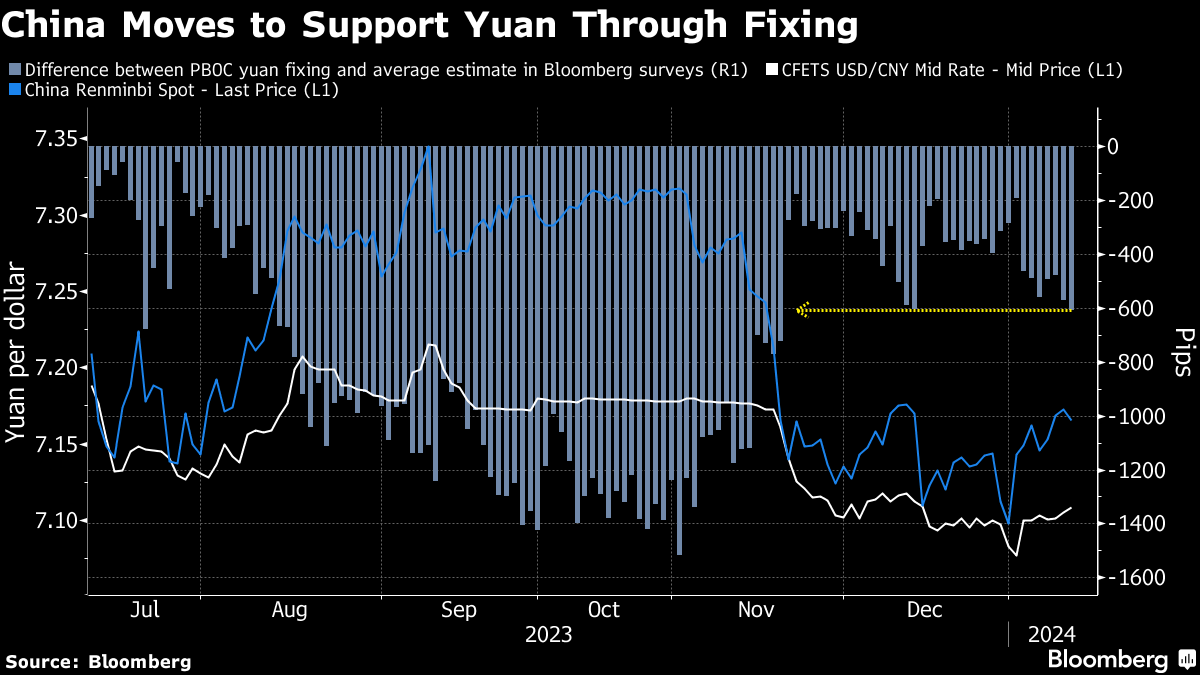

(Bloomberg) -- China's central bank pushed back against yuan weakness by setting its daily reference rate for the managed currency at the widest gap to estimates since November.

The People's Bank of China set the so-called fixing at 7.1087 per dollar on Thursday, 609 pips stronger than the average estimate in a Bloomberg survey. That's after the onshore yuan declined 1% since the end of last year.

The PBOC has been supporting the yuan through its daily fixings over the last seven months, as the wide interest-rate gap between the US and China favors the dollar, weighing on the local currency. The fixing limits the onshore yuan's allowed trading range to 2% on either side.

The added boost for the yuan comes as potential policy easing by Beijing threatens to pressure the currency weaker. While the Federal Reserve's meeting minutes last week suggested US rates will remain elevated for longer, China's bond yields slid to multi-year lows as weak economic data strengthened rate-cut bets. China's price data due Friday is also expected to show both consumer and producer price contraction.

A PBOC official told state media that the nation may lower the amount of money banks must set aside as reserves to boost lending, according to a report by Xinhua on Monday. Toward the end of last month, the PBOC said in a monetary policy committee meeting that it will keep the yuan generally stable at reasonable levels and prevent excessive one-way moves in the yuan.

The offshore yuan rose gained 0.1% to 7.1753 per dollar. The onshore unit will start trading at 9:30 am local time.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.