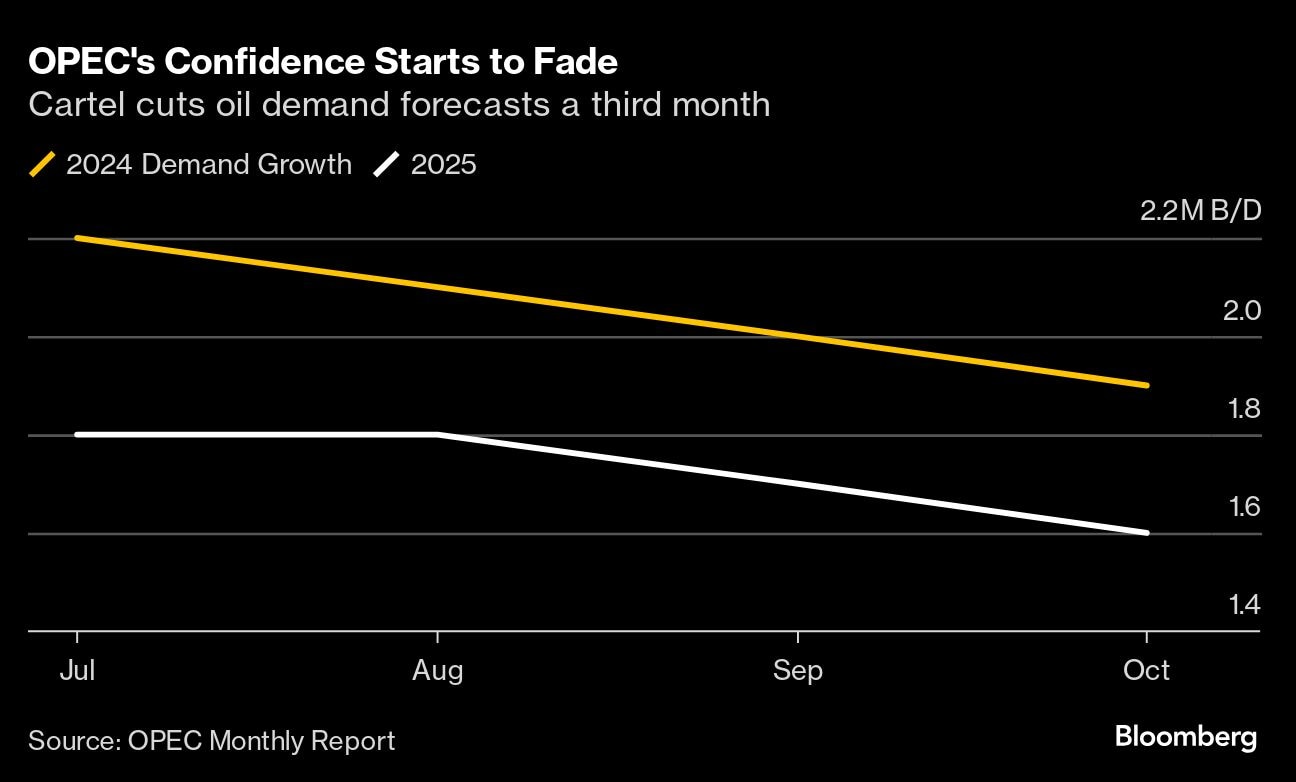

OPEC has reduced its oil demand growth forecast for the third consecutive month as the group belatedly recognises a slowdown in global fuel consumption.

Global oil demand will increase by 1.9 million barrels a day—roughly 2%—in 2024, or 106,000 barrels a day less than previously forecast, the Organization of Petroleum Exporting Countries (OPEC) said in its monthly report. The revision was “largely due to actual data received combined with slightly lower expectations” for some regions, it said.

With the three successive downgrades, OPEC is starting to retreat from the strongly bullish projections it has held throughout this year. Even after the reductions, its oil demand growth estimates remain an outlier—above Wall Street banks and trading houses, and at the top end of the range expected by Saudi Arabia's oil company, Aramco. It's roughly double the rate seen by the International Energy Agency.

The actions of OPEC members themselves suggest a lack of confidence in the outlook of its Vienna-based secretariat, delaying their plans to restore halted crude oil production even as the cartel's forecasts point to a major supply deficit.

Led by Saudi Arabia, OPEC and its allies are due to begin gradually restoring 2.2 million barrels a day in monthly tranches from December—two months later than originally planned. Market-watchers such as JPMorgan Chase & Co. and Citigroup Inc. remain sceptical that they'll proceed amid slowing growth in top consumer China and swelling oil supplies from the Americas.

While crude oil prices have been boosted by the Middle East conflict, at $77 a barrel they're too low for some OPEC nations. The coalition's efforts to shore up prices have been undermined by countries that have failed to deliver their cutbacks—notably Iraq, Kazakhstan, and Russia.

The report also showed Iraq belatedly making progress in implementing its share of oil production cuts due since the start of the year, while still pumping above its agreed quota.

Baghdad curtailed production by 155,000 barrels a day in September to 4.112 million per day, getting closer to its target of 4 million while staying above it—and still making no progress in the extra cuts it promised to compensate for overproduction. An Iraqi official said at the weekend that output is below the quota.

Kazakhstan increased production by 75,000 barrels a day to 1.545 million, flouting its pledge to perform better. Russia reduced by 28,000 per day but also remained above its ceiling, at approximately 9 million a day.

OPEC+ is expected to make a decision on its scheduled December output hike in the coming weeks. The alliance is due to meet on Dec. 1 to consider output policy for 2025.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.