The alarm from economists has been clear for months: Brace yourself. If he delivers on his campaign promises for an aggressive package of new US tariffs, they've warned, a re-elected Donald Trump will set the stage for a historic period of turmoil in the global economy.

And yet there's a reason CEOs, bankers, investors and even Trump advisers have largely shrugged off warnings about the damage a 10%-to-20% universal tariff and even higher import duties on China would do, or the resurgence in US inflation they might bring.

From the incoming president's own track record, many see evidence Trump is unlikely to deliver on all he has threatened, and express confidence they can adapt to whatever he delivers this time around.

Even as economists decried his plans as a terrible miscalculation, Trump ratcheted up protectionist threats on the campaign trail because they were a key part of an agenda popular with voters. After his win, he claimed a license to deliver on those promises.

“America has given us an unprecedented and powerful mandate,” Trump told supporters. “Success is going to bring us together, and we are going to start by all putting America first.”

His former trade czar, Robert Lighthizer, who is expected to have a prominent post in a new administration, has warned that the rest of the world should be ready for new US tariffs and that any country with a trade surplus should be willing to address Trump's grievances.

“Countries that run consistently large surpluses are the protectionists in the global economy,” Lighthizer wrote in the Financial Times last week. “We would be merely responding to the harm they have caused.”

But hanging over those threats are big questions: Is Trump bluffing, and even if he isn't, how will the world respond? His first term in office was renowned for chaotic economic policymaking and bitter internal battles between rival aides on trade.

Trump also built a reputation as a transactional president, who was open to lobbying from CEOs like Apple Inc.'s Tim Cook on tariffs and flattery from foreign counterparts who learned trade threats could be defused with a promise to buy more Iowa soybeans, or even a peck on the cheek.

The world has also changed. Companies have worked hard on adapting to tariffs — avoiding them where possible and realigning supply chains. These are core skills now, honed through the chaos of the Covid pandemic and the advent of an era in which geopolitics drives trade and investment more than the sole pursuit of cost efficiencies.

In earnings calls Wednesday, executives at automakers including BMW AG and Honda Motor Co. signaled they were prepared to weather any Trump tariff storm thanks in large part to the large manufacturing operations they have already in the US.

“There is some natural cover-up against possible tariffs or whatever, but let's not speculate whether there are tariffs. It might also only be that this is a verbal issue,” Oliver Zipse, BMW's CEO and chairman, told analysts, pointing to growing sales in the US where it already manufactures cars. “In the United States, I would think we almost have a perfect setup for the time to come.”

Stanley Black & Decker Inc. CEO Donald Allan Jr. told analysts recently the company had been planning for a Trump victory and a new tariff regime since the spring. The plan calls for price increases on its machine tools to offset any new duties and shifting production out of China to other Asian countries or Mexico as necessary.

“We have a playbook on the shelf ready to go,” Allan said. But that doesn't include doing what Trump wants companies to do. It's “unlikely that we're moving a lot back to the US because it's just not cost effective to do,” Allan said.

Williams-Sonoma Inc., the home-furnishing chain, is ready for changes, too. Back in 2018, half of the San Francisco-based retailer's imports came from China. Now, that reliance is 25%, Jeff Howie explained to analysts recently. “If this does come up and tariffs are expanded, we're prepared to reduce it further.”

Such planning reflects an acknowledgment of a new business reality. But it also illustrates a growing acceptance among both policymakers and executives that tariffs can be a useful tool for governments facing international competition.

Everett Eissenstat, who served as Trump's representative to the Group of Seven and G-20 in his first administration and is now a partner at law firm Squire Patton Boggs, said there was little to stop Trump from carrying out his tariff threats.

“This is really a huge shift,” he said. “I think we're entering into a period of a recalibration of the global trading system.”

Even true believers in protectionism admit broad tariffs have some negative side effects. Trump's victory sent the dollar sharply higher against Chinese, European and emerging market currencies. That raises the specter of not only less competitive US exports, but also potential economic turmoil outside the US that would reduce demand.

Read more: Trump Resurgence Sinks Emerging Markets From Mexico to China

Trump's stated goal for his trade strategy has always been to export more and import less. It's why he sees the US's persistent trade deficits as a profit-and-loss statement deeply in the red. A strong dollar that leads to US companies selling less overseas might anger Trump and only cause him to double down on protectionism.

Still, senior bankers say privately that companies and policymakers around the world are confident they learned how to deal with Trump and his trade wars during his first term.

Some of that has been fueled by other Trump advisers who quietly have been circulating on Wall Street and beyond for months, insisting that the now-incoming president's tariff threats will be used as negotiating leverage against countries including China — not to spark all-out trade warfare.

The economic risk, of course, is that this is America's frog-enjoying-the-warm-water-before-it-boils moment, where inflationary worries are ignored. One senior banker recently expressed concern that the clients he met with on his travels were in fact too sanguine about the turmoil ahead.

Aside From Tariffs

Tariffs aren't the only ways Trump can upend global trade.

The next few years will likely bring a renegotiation of the US-Mexico-Canada Agreement — the rebranded North American Free Trade Agreement that was a signature trade achievement of his first term. Trump has signaled anger at Chinese investments in Mexican factories to produce electric vehicles and other products and avoid his original tariffs. He's also linked immigration to tariffs by threatening harsh levies on imports from Mexico if the new government there doesn't block migrants from crossing to the US.

Delivering on much of what Trump promised on the campaign trail may depend on who controls Congress, something that hung in the balance on Wednesday with the Senate in Republican hands and House races still being counted. That's not necessarily the case with trade policy, in which US presidents have expansive authority to act unilaterally, particularly if national security can be invoked.

Any restraint will have to come from within a new administration, from financial markets or from domestic constituencies hurt by US tariffs or their inevitable flipside: retaliation.

‘Super Genius'

Elon Musk's investments in both China, via Tesla, and Trump's campaign could wield more influence on what the new president chooses to do than the hawks in his national security team. “He's a super genius,” Trump told supporters on Wednesday. “We have to protect our super geniuses.”

Though Trump repeatedly shrugged off economists' warnings about his tariffs, the scale of the potential impact may also eventually end up giving him and his advisers pause.

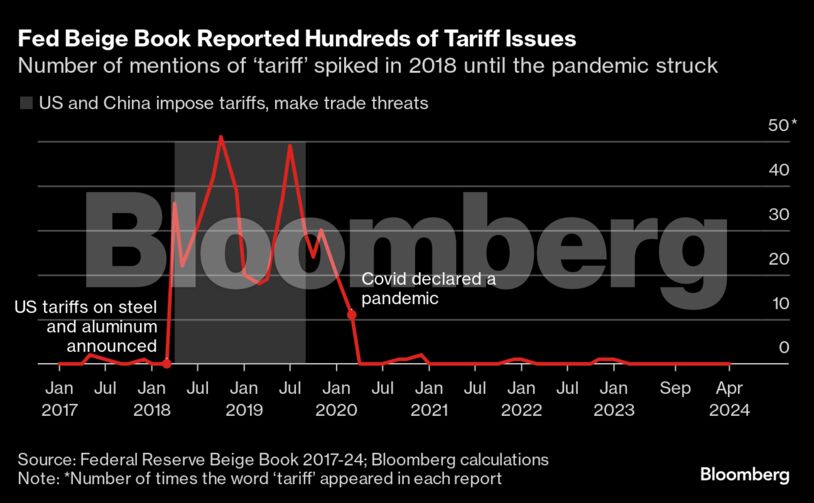

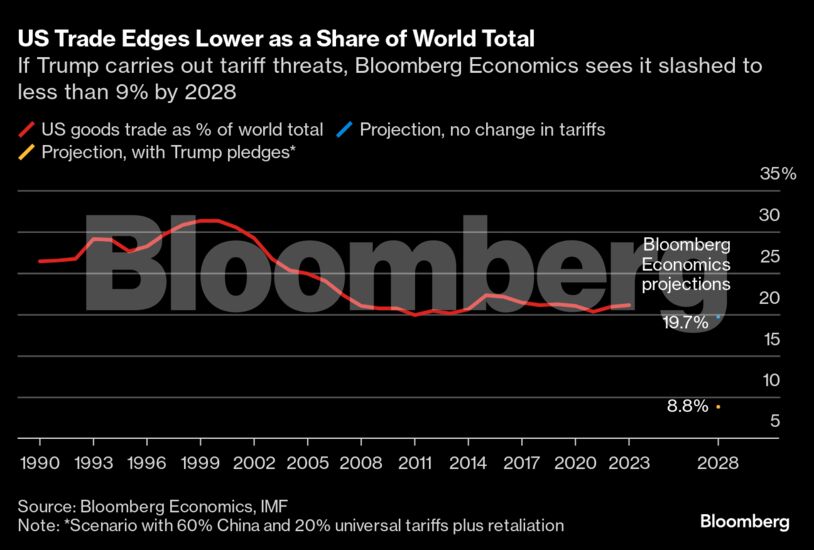

According to calculations by economists Maeva Cousin and Eleonora Mavroeidi of Bloomberg Economics, raising tariffs on Chinese imports to 60% and those from all other countries to 20% would lead to a bigger shock than even the Smoot-Hawley Tariff Act of 1930 delivered.

That legislation, widely credited with setting off trade wars that deepened the Great Depression globally, saw average US tariff rates go from 14% to close to 20%. Trump's proposals would send the average from 3% currently to more than 20%, a far steeper jump.

Combined with retaliation from China and other countries, by the 2028 election the tariffs would lead to US economic output being 1.3% lower than otherwise, the Bloomberg Economics pair calculated.

Given the scope of the potential fallout, Anna Wong, Bloomberg Economics' chief US economist, says the most plausible scenario is that while Trump will increase some bilateral tariffs, he won't impose universal tariffs.

“We think procedural requirements, as well as the response from the economy, will limit the scope of trade actions,” Wong wrote in a research note this week. “We also assume US trade partners would retaliate in kind.”

In a recent report, Goldman Sachs economists said the most likely scenario would feature higher duties on imports from China, delivered quickly. The top rates would likely be reserved for strategic products, with consumer goods facing lower levies. That would lead to an average tariff hike on China of around 20 percentage points, they calculated — a level lower than the 60% Trump has threatened.

Trust Issue

There are those who also worry about a broader erosion in global trust in the US even if Trump is slow to deploy his economic weapons.

Emily Blanchard, who until last year served as chief economist at the US State Department and is now at Dartmouth College, said there is little doubt that a second Trump term will bring a further deterioration in the US standing in the world and its economic alliances.

“If the US takes actions demonstrating that we're no longer committed to openness and fairness, rules and transparency and predictability, then the whole game changes,” Blanchard said. “Firms, investors and governments are going to try to protect themselves and build out contingency plans.”

For those who believe that they can adapt to another Trump term or even charm their way through a trade standoff, there are examples to follow. Musk's rise in Trump's inner circle, for one, has proved that a politician once full of vitriol for electric cars can be won over by a man who made his fortune selling them.

Cook's Approach

Then there was Apple's Cook, who managed to avoid most of the company's China-assembled products from being subjected to Trump's tariffs in August 2018 by flying in to dine with the president at his golf club in Bedminster, New Jersey. Cook's argument was simple: How could Apple compete against South Korean rival Samsung if the government was going to make his products more expensive?

“I thought he made a very compelling argument,” Trump told reporters the next day. Most of Apple's products have avoided the 25% tariffs that other imports have faced.

Some national leaders similarly courted Trump, and seem to be preparing to do the same in a second term. Mindful of the risk their trade surplus with the US presents, South Korean officials have for months been drafting a plan to boost energy imports from the US if Trump is elected, Bloomberg reported this week.

European officials now girding themselves for a new rise in transatlantic tensions have their own examples to draw on.

Read more: ECB's Guindos Warns of ‘Huge' Implications of Trump Tariff Plans

In July 2018, facing a potentially devastating Trump threat of tariffs on European cars, Jean-Claude Juncker, who was then president of the European Commission, flew to Washington to try to work out a deal.

The night before a scheduled Oval Office meeting, two senior aides to the respective presidents hashed out a compromise under which the EU would buy American soybeans and natural gas. But whether Trump would embrace the deal was unclear, people close to the talks said.

Until the next day: Juncker marched into Trump's office for the meeting and planted a healthy kiss on Trump as a greeting that not only charmed Trump but caused him to order up a Rose Garden press conference to quickly unveil the unfinished deal. “Obviously the European Union,” as represented by Juncker, “and the United States, as represented by yours truly, love each other!” Trump later tweeted, attaching a photo of the kiss.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.