(Bloomberg) -- A stronger-than-expected pivot to stimulus in the world's two biggest economies has brightened the market outlook. For economists, the jury is still out.

China's barrage of monetary, fiscal and regulatory easing to boost the ailing property market, alongside expectations for deeper interest-rate cuts from the Federal Reserve and peers, sent stocks soaring worldwide last week. The bullish mood continued Monday after three of China's biggest cities eased home-buying curbs, sending shares and iron ore spiking higher.

“This is one of the turning points of the year,” David Kruk, head of trading at La Financiere de L'Echiquier, said of the US and Chinese policy moves. “I have the feeling now that everyone is going to go with the flow.”

Chinese stocks extended one of their most remarkable turnarounds in history, soaring for a ninth day on Monday and pushing the benchmark CSI 300 Index's gains to 27% from a mid-September low. A Societe Generale SA index tracking cross-asset momentum jumped to the highest in more than a year.

In the bond market, traders are increasingly moving to price in a second 50-basis point rate cut from the Fed in November as well as another reduction in rates from the European Central Bank in October, shifts that were previously not base cases just a few weeks ago.

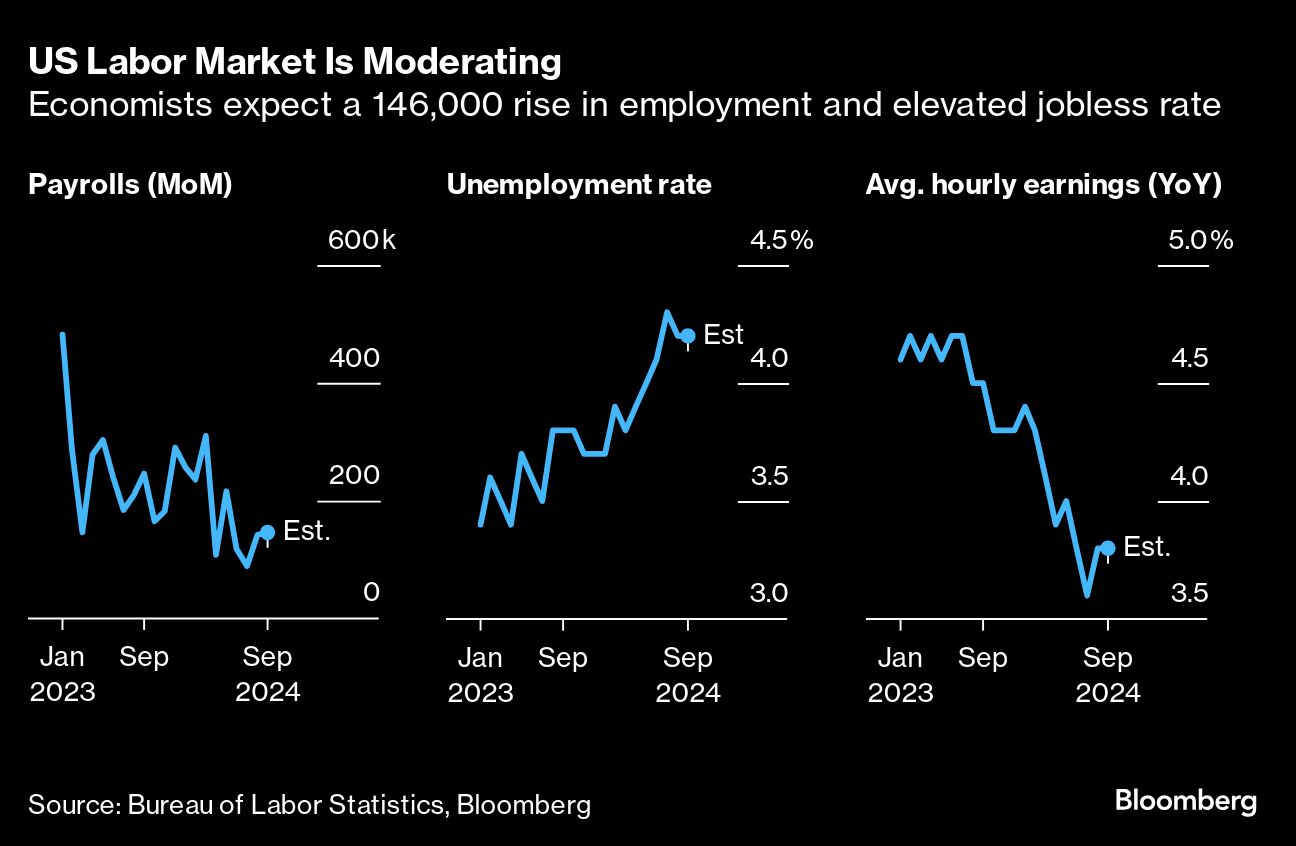

The bulls could still come unstuck by sudden slumps in demand or hiring, with Friday's US jobs report a near-term test of their will. A disruptive presidential election that's now just five weeks away looms as a bigger potential hurdle, while tensions in the Middle East remain a risk to the rosy outlook.

“Markets versus economics could be quite different right now,” said Rob Subbaraman, head of global markets research at Nomura Holdings Inc. While the market outlook has clearly improved over the past two weeks “for the economic outlook, it's less clear cut. Of course, markets are meant to preempt, but for economists the jury is still out.”

For the US, risks include a deteriorating labor market, potential for labor disputes to widen, a revival in inflation, and an election that could result in expansionary fiscal policies that limit the Fed's scope to cut rates as much as markets are anticipating. It could also result in stagflation if a victory by Donald Trump leads to steep tariffs on Chinese and other imports, Subbaraman said.

As for China, while the stimulus is clearly buoying the stock market, more fiscal measures will be needed to shift the economic narrative.

Morgan Stanley's China economist Robin Xing says even after the recent stimulus blitz, “a return to benign inflation and sustainable growth is likely to be a long, drawn-out battle.”

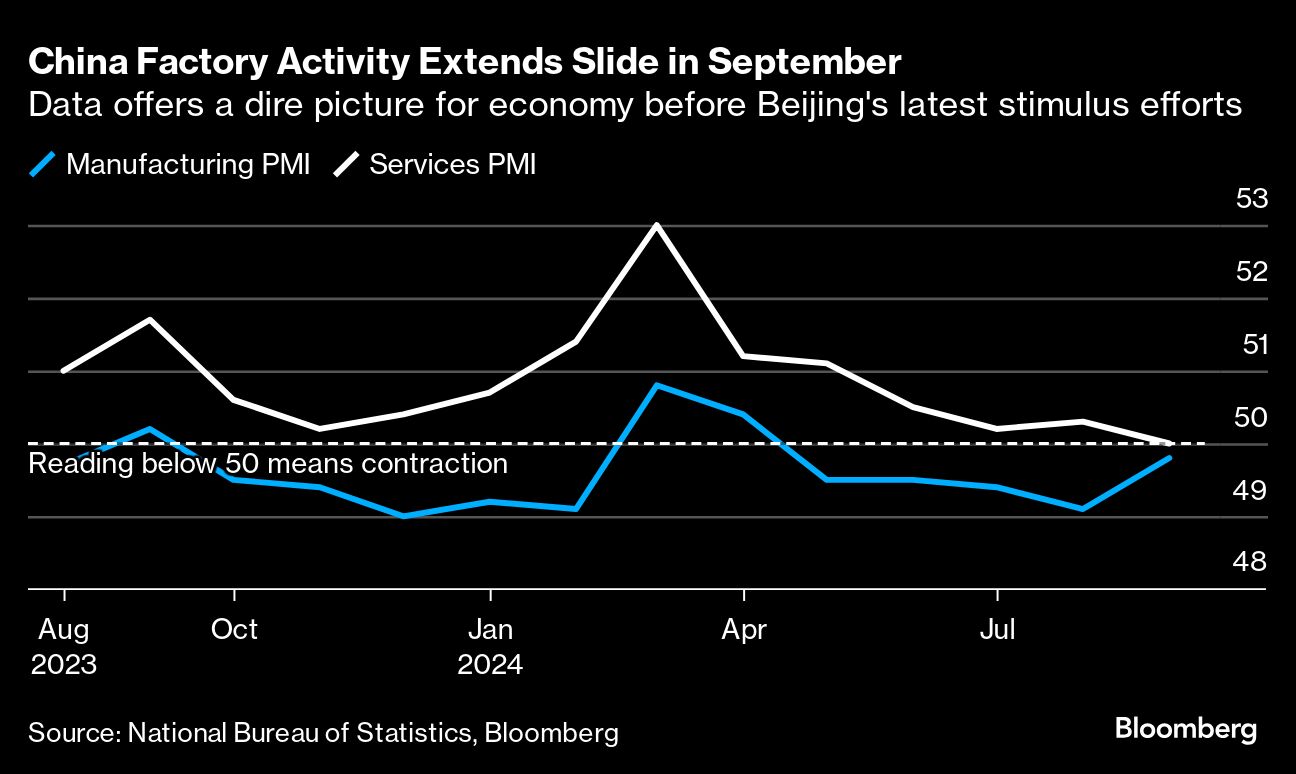

China's official manufacturing PMI remaining in contraction territory for a fifth month and a private measure deteriorating.

Monday's purchasing managers indexes underscored the challenge, with China's official manufacturing PMI remaining in contraction territory for a fifth month and a private measure deteriorating.

Looking ahead, Bloomberg Economics' Chang Shu sees an increasing chance for growth to gear up to a faster path on the back of the recent policy stimulus. Monetary easing could raise growth by as much as 1-1.1 percentage points over four quarters, she said.

In the US, meantime, recent data has been resilient. Friday's September jobs report is expected to show a healthy, yet moderating, labor market.

While a soft landing aided by Fed rate cuts would be welcomed by markets and economists alike, there's also the risk that such an outcome forces chair Jerome Powell to change course again — as he did last December when a pivot signal reignited activity in the first quarter.

“Current economic conditions can be best described as ‘Goldilocks,'” said Torsten Slok, chief economist at Apollo Management. “Not too hot, and not too cold. But the story doesn't end here. The risk with cutting interest rates too much too quickly is that the economy becomes too hot again.”

For investors, equity valuations may come into play even if the Goldilocks conditions do continue. After a powerful two-year rally, stocks on the S&P 500 are trading at around 25 times earnings, versus 15 times on China's benchmark CSI-300 index, according to data compiled by Bloomberg.

“The Fed's larger-than-expected rate cut can buy more time for high-quality stocks to remain expensive and even help lower-quality cyclical stocks stabilize in the near term, especially after China's recent actions,” said Michael Wilson, chief US equity strategist at Morgan Stanley. “However, I believe labor data and other growth indicators need to improve to justify these conditions continuing into year-end and beyond.”

That may mean there's more upside for China's beaten down stocks, especially if policymakers there keep rolling out stimulus measures.

“Investors are so underweight everything Chinese and Chinese equities are extremely undervalued that a serious rally is entirely possible,” said Stephen Jen, chief executive officer at Eurizon SLJ Capital. “In general, risk assets ought to do very well, with the Fed cutting rates, China embarking on monetary and fiscal stimulus, and oil prices being low. After the US election, I expect global equities to rally powerfully into year-end.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.