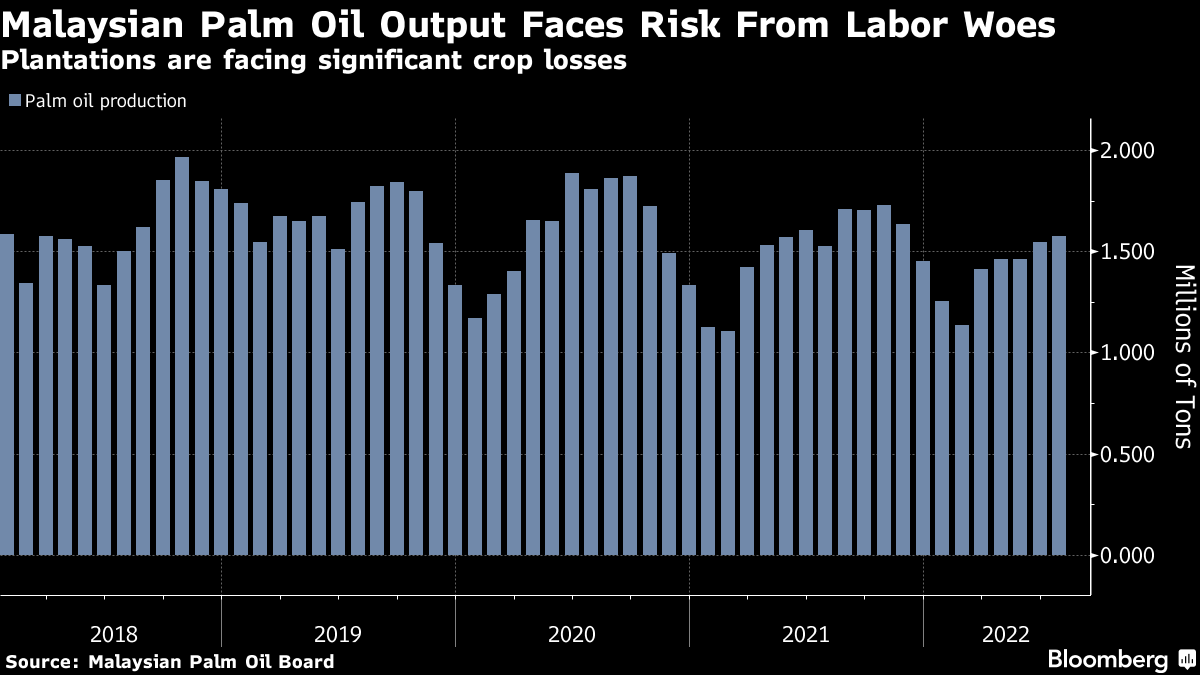

(Bloomberg) -- Malaysian palm oil production is set to decline for a third year as a worker shortage in plantations continues to hamper harvesting, according to the nation's largest group of growers.

Total crude palm oil output for 2022 from the world's second-largest grower will be 18 million tons, said Joseph Tek, the new chief executive of the Malaysian Palm Oil Association, which represents 40% of planted palm by area in the country.

Malaysia's palm oil industry is reliant on overseas workers and authorities are struggling to bring in people fast enough since pandemic restrictions eased. Without enough boots on the ground, many planters are having to cut harvesting and leave ripened fruit rotting on trees.

Under its previous leadership, the association had forecast production of 18.5 million to 18.7 million tons for 2022. Output was 18.1 million tons last year, and 19.1 million in 2020. There are crop losses ranging from 15% to 25% or even higher due to the labor crunch, according to Tek.

“The above scenario is set against the backdrop of the snail pace return of foreign workers,” he said. It's now the peak cropping time of the year with “the ugly monsoon season just around the corner,” said Tek, who became chief executive in mid-August.

The ubiquitous tropical oil has seen wild swings this year. Futures surged to a record in late April on global vegetable oil supply shortages following Russia's invasion of Ukraine, but have since plummeted as Indonesia, the biggest grower, ramped up exports and on expectations for increased production from Malaysia.

Benchmark prices for November delivery rose as much as 1.6% to 3,749 ringgit ($833) a ton on Thursday, after hitting a six-week low in the previous session. Palm oil is bottoming out on expectations of strong Indian demand in September, as well as the labor shortage that may curb production growth, said Paramalingam Supramaniam, a director at Selangor-based broker Pelindung Bestari Bhd.

The association is forecasting 1.70 million tons of output in August, which is higher than July but flat compared with a year earlier, Tek said. Production for the first eight months of the year is estimated at 11.54 million tons compared with 11.60 million tons for the same period in 2021.

The labor shortage has worsened to around 120,000 workers, Tek said. Although some applications for foreign worker quotas have been approved by the government, there are still administrative and procedural glitches, which means any incoming workers may miss the peak production season, he said. August through October is generally the busiest harvest period.

Palm oil prices look very attractive, before the arrival of monsoon rains that could damage the crop and its oil quality, Paramalingam said. Any abrupt change in the supply and demand equation in the fourth quarter could see physical crude palm oil prices bottoming out to trade between 3,600 ringgit and 3,700 ringgit, he said.

(Updates to add prices and trader comments in seventh paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.