(Bloomberg) -- “Whether it's rye flour, or bird flu that impacts eggs,” said Ken Jarosch, the owner of Jarosch Bakery, “when it makes national news, just running a business, it's an opportunity to increase the prices without getting a whole bunch of complaining from the customers.”It's not the kind of thing you typically hear a business owner express publicly but Jarosch was simply stating late last year his philosophy about when it's safe for a business such as his — a midsized bakery in the Chicago suburbs — to hike prices for cookies, cakes and other carbs. He had the idea long before Covid upended supply chains, realizing he could quickly push through price increases when news hits of some big shock to the economy because there'll be less pushback from customers right then.

Now, a growing body of analysts and researchers see this pattern playing out across Corporate America, with companies using unusual disruptions as an excuse to raise prices for their goods and services, thereby allowing them to expand profit margins.

And over the last few years, businesses have been able to point to a smorgasbord of “once-in-a-lifetime” emergencies stemming from the pandemic and Russia's invasion of Ukraine, which together have effectively roiled everything from semiconductor production to commodities markets and shipping.

The key question is, in an economy where the consumer continues to spend freely, how sticky this ‘excuseflation' proves to be and how high the Federal Reserve will have to drive up interest rates to prompt businesses to lower prices, or at least stop raising them. At 6.4%, annual inflation is down from its peak last year but still well above the Fed's 2% target.

“A lot of companies had these one-off or very, very rare excuses to raise prices and begin to find how much the consumer would take,” Samuel Rines, a managing director at Corbu LLC, says in the latest episode of the podcast. “Once you get that price push, once you figure out that the consumer's willing to pay it, that is margin expansive over time, as you begin to have a normalization in your input cost.”

He cites a plethora of companies that are taking price over volume, or the ‘POV' strategy, as he's dubbed it. These include all-American favorites like PepsiCo Inc. and Home Depot Inc. and even two retailers long known for their discounted prices: Walmart Inc. and Dollar Tree Inc.

And while any company would naturally like to always be able to raise prices without taking a major hit to market share, in this environment of sub-3.5% unemployment and average hourly earnings growth running over 4% annually, consumers are by and large stomaching these price hikes. They've typically only sparked modest hits to customer demand. That explains why the Fed is so focused on cooling off the labor market — and wage growth, in particular — to get inflation back under control.

In the meantime, a defining factor of this excuseflation — and one potential reason it's proving difficult to stamp out — is that it gives companies a cover to raise prices together, limiting in the process customers' ability to vote with their feet by shopping elsewhere.

Pepsi Pricing Power

“We call it the new PPP,” says Rines, short for “Pepsi Pricing Power.”

It effectively allowed the soft drink giant to raise prices, he says, to make up for volume sales losses in Russia following the invasion of Ukraine. This is very different than the conventional narrative that the war was inflationary because it rocked key commodity markets — particularly oil, gas, and wheat.

As Rines sees it, Pepsico all around the world started paying more in order to compensate Pepsico for losing the Russian consumer market. And while traditional economics would argue that consumers eventually turn to lower-priced alternatives or to Coca-Cola Co., that hasn't really been the case so far.

“You shouldn't have Pepsi being able to push price, in theory, right? It should be Pepsi and Coca-Cola battle it out and you have very minimal price increases and they don't have the ability to really play catch up with inflation,” Rines says. “And that's simply not the case right now.”

Asked recently on a call with analysts if Pepsi might consider rolling back price increases if demand weakens, CEO Ramon Laguarta argued that the company was “trying to create brands that can stand for higher value to consumers and consumers are willing to pay more for our brands.”

So, basically, no. (Pepsi didn't respond to a request for comment).Once companies enact higher prices, there isn't a lot of motivation to reverse them.

The result is a surge in profit margins at both Pepsi and Coca-Cola — and across major companies in general.

Listen to Odd Lots on Apple podcastsListen to Odd Lots on SpotifySubscribe to the newsletter

It's a point picked up by UMass Amherst economists (and frequent guest) Isabella Weber and Evan Wasner,. They cite an explosion in corporate profit margins to a record 13.5% in the second quarter of 2021 as evidence that companies are going beyond simply passing on higher input costs to customers.

In new research published last week they named the phenomenon “sellers' inflation,” noting that a series of “overlapping emergencies” in recent years had effectively given companies the peg they need to collectively raise prices.

“Bottlenecks can create temporary monopoly power which can even render it safe to hike prices not only to protect but to increase profits,” Weber says. “This implies that market power is not constant but can change dynamically in a changing supply environment. Publicly reported supply chain bottlenecks and cost shocks can also serve to create legitimacy for price hikes and create acceptance on the part of consumers to pay higher prices, thus rendering demand less elastic.”

Because these disruptions and shocks have tended to affect entire industries, firms can hike prices without fear of losing market share, even for two notorious competitors like Pepsi and Coca-Cola.

“Firms do not lower prices, as doing so may spark a price war,” Weber writes. “Firms compete over market shares, but if they lower prices to gain territory from other firms, they must expect their competitors to respond by lowering their prices in turn. This can result in a race to the bottom which destroys profitability in the industry.” That means there's little motivation to roll them back once enacted.“When these cost increases are not unique to individual firms but experienced by all competitors, firms can safely increase prices since they have a mutual expectation that all market players will do the same,” she notes.

Wings won't stop

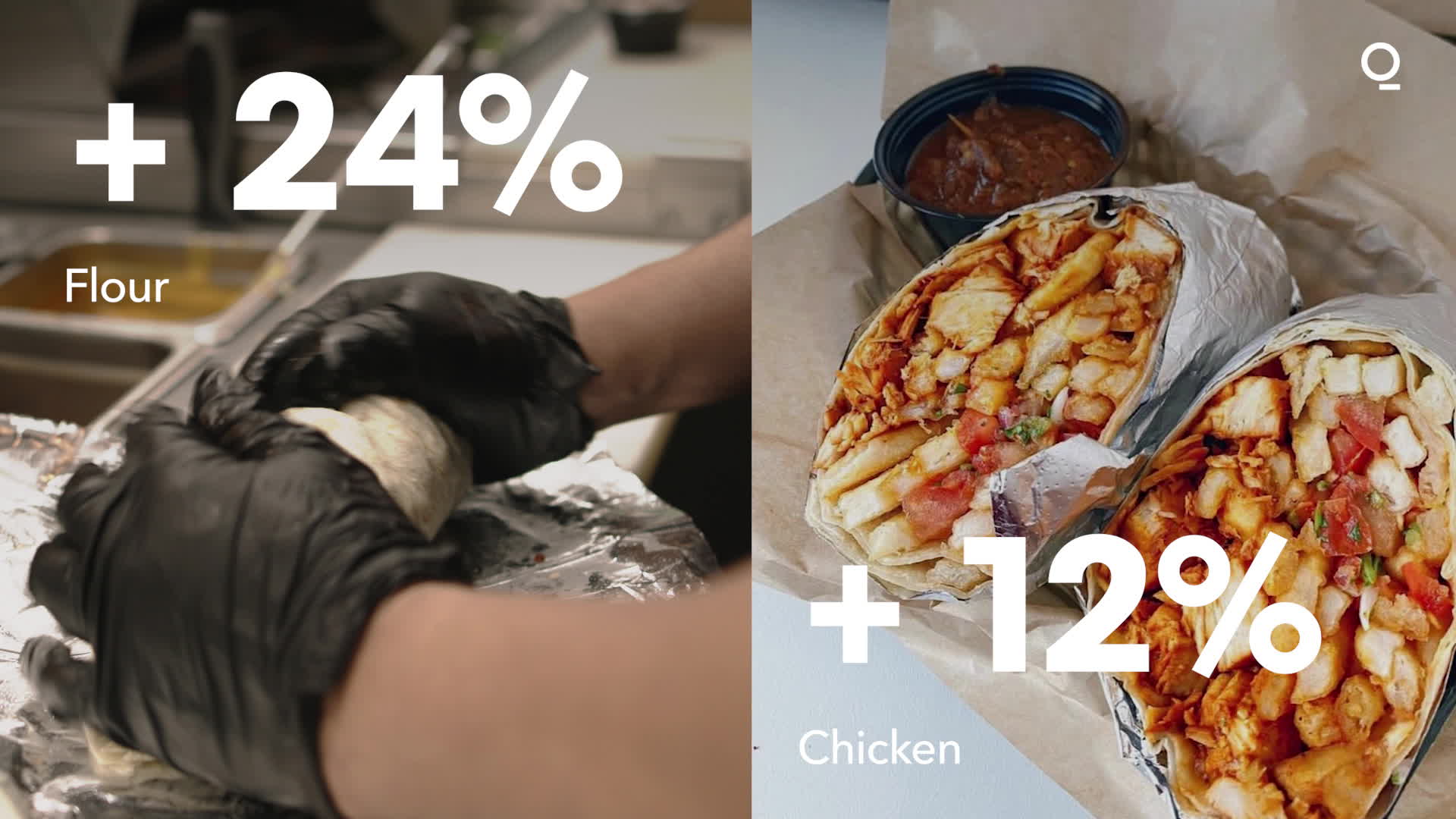

Rines loves to talk about a chicken-wings restaurant chain named Wingstop as one example of corporate actions helping inflation take off.

When the wholesale cost of wings was soaring back in 2021 — it jumped 125% over one 12-month period — Wingstop “began to push price, push price, push price and they had zero pushback from the consumer,” he says. “The consumer just continued to buy chicken wings, and it's not as though there are a limited number of places to go buy a spicy chicken wing.”

When wholesale wings prices started to fall from their recent peak, Wingstop didn't reverse course. The cost is down about 50%, Rines says, but “Wingstop is not exactly stopping pushing their price. In fact, they're saying and guiding towards a typical 2% to 3% type price increase.” (Wingstop didn't respond to a request for comment.)The chain's profit margins are up, and its stock has soared almost 250% from the low it hit during the depths of the Covid-sparked market rout in early 2020.

“Yeah, over the course of the year, we've been taking price. We have another opportunity in front of us where we are actively working with our franchisees and they are going to put in somewhere between 4 to 5 points of additional price, hopefully during this quarter, certainly over the next few months, that will culminate in a total of a targeted 10% overall increase, which we believe is in line with where inflation is and aligned with consumer demand as well. So, like other brands, we're making sure that we're taking our price in this environment to offset some of the near-term headwinds.”

- Charlie Morrison, former Chairman and Chief Executive Officer, Wingstop Q3 2021 conference call.

The mismatch between declining wholesale prices and stubborn retail ones may help explain why inflation has proven so tough to stamp out even as many of the one-off shocks — such as the pandemic fiscal stimulus or the initial commodity effect of the war — fade into the past. It also poses a challenge to economists who might assume that margins should dissipate through competitive pressures.

“Most economists have considered the return of inflation from the perspectives of the dominant interpretations of the 1970s: Inflation originates from macro dynamics, with the (New) Keynesian interpretation positing a matter of excess aggregate demand in relation to capacity on the one hand, and the classic Monetarist postulation of too much money chasing too few goods on the other,” Weber writes. “In so far as costs are considered to play any role from either perspective, it is purely a matter of inflated wages.”

There are some signs that policy makers are starting to pay more attention to corporate behavior as a driver of prices, with Lael Brainard, the former vice chair at the Fed who now runs President Joe Biden's National Economic Council, arguing in January that: “Retail markups in a number of sectors have seen material increases in what could be described as a price–price spiral, whereby final prices have risen by more than the increases in input prices.”

And while higher profit margins on the surface would seem to be a benefit for investors, when every company is in a position to raise prices, that's the behavior that keeps prompting members of the Fed's Federal Open Market Committee to ratchet up interest rates again and again, putting a lid on stock prices.

It's going to be tough for policy makers to stop hiking rates “until they begin to actually see corporations decelerate pricing,” Rines says. “And when Smuckers says for 2023 it's 8%, that is not good for the FOMC. When Cracker Barrel's saying wage increases are 5% to 6%, that's not good for the FOMC. You know, one is a consumer good and one is middle America getting a pay raise. When Walmart's raising their minimum wage, again, that's a pretty big deal when it comes to consumption on the lower end.”

“It's going to be easy” to get fooled by CPI prints pointing to slower inflation in coming months, Rines says, “and then all of a sudden get caught a little off guard when corporations continue to push pricing, trying to find the elasticity on their margin.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.