(Bloomberg) -- Even if Germany's economy finally begins expanding again in 2024, it'll struggle to shake off the funk behind one of its weakest annual performances in a generation.

Beset by energy woes and creaking infrastructure, hit by a downturn in global demand, and lagging in the race for electric-vehicle dominance, the country was probably in recession as it ended 2023 with a shock court decision that undermined Berlin's whole strategy for budget financing.

With industrial data next week likely to show little improvement from a three-year low, the government strait-jacketed over ramping up investment, and the threat of train strikes looming, few economists anticipate much of a pickup. A nation long seen as the motor of the euro zone is fumbling for the ignition.

“We're pretty pessimistic for German growth this year,” said Stefan Schneider, chief economist for Germany at Deutsche Bank Research. “A combination of cyclical and structural pressures are currently crushing the hope that the country can untangle its knot and return to its previous growth rates of 1 1/2-to-2% in the foreseeable future.”

Finance minister Christian Lindner acknowledged the “sick man of Europe” trope in body and speech when he appeared at an FDP member event at Stuttgart's opera house on Saturday.

Speaking with “a bit of a fever,” Lindner acknowledged the downbeat headlines about the German economy and the country's uphill battle. “We have too little economic growth,” he said, while insisting that the economy “has enormous turnaround potential.”

While surveys have pointed to a possible bottoming out in the country's manufacturing malaise, reports in coming days may also underscore just how far it has fallen.

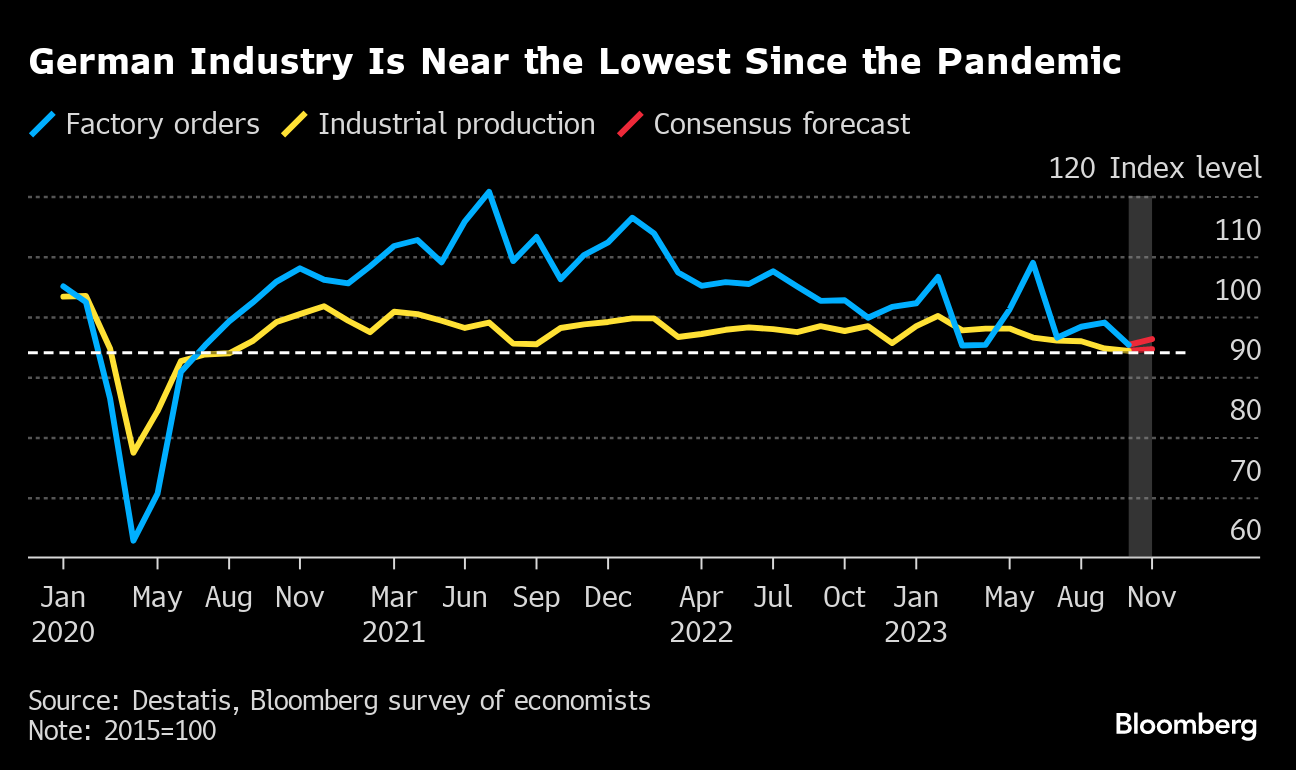

Factory orders in October were close to the lowest level since mid-2020, and economists anticipate data on Monday to reveal an increase of 1% in November, nowhere near enough to repair the damage. Exports will be released the same day.

On Tuesday, data on industrial production — also languishing at a similarly low level — will show if it too finally began recovering after five successive months of declines.

The overall impression may point to a second quarter of contraction, conventionally described as a recession. A fuller indication will be available on Jan. 15, when German officials reveal the Group of Seven's first national estimate for 2023 full-year gross domestic product.

That will probably feature a small annual decline, predicted by the Bundesbank at 0.1%, while the European Commission has projected a 0.3% drop.

The only times in the past two decades that Germany fared worse were in 2009 — as the global financial crisis raged — and then during the pandemic shock of 2020.

The country limped into 2023 just avoiding a widely predicted recession, but beset by a crisis over its gas supply after Russia's invasion of Ukraine that has yet to be sustainably resolved.

While the answer of Chancellor Olaf Scholz's coalition was to double down on the transition to climate-friendly energy, its method of doing that — off-balance sheet special funding vehicles — has just been effectively slapped down by Germany's top court.

Ministers have since cobbled together redrafted budgets for both 2023 and 2024, but the bigger question of how to retool the economy to make up for years of under-investment remains unresolved as the government struggles with a constitutionally enshrined borrowing limit that calls for near-balanced budgets.

“The transition to a climate-neutral country and the great deal of investment that must be made before income can be generated at some point are also adding to uncertainty,” said Gabriele Widmann, an economist at Dekabank. “This is something that will be a burden this year and in the coming years.”

Scholz's political challenge is compounded by the potential of more and longer train strikes, farmers angry at the removal of subsidies, and the rise of the far-right Alternative for Germany, which is likely to make gains in regional elections later this year in its strongholds in the country's east.

Germany's economic woes aren't only energy-related, as staff shortages heap pressure on its manufacturing-based business model. And at a time when China's BYD Co. has surpassed even Tesla as the world's biggest maker of electric vehicles, the country's VDA auto lobby said on Thursday that production of passenger cars last year was still 12% below the level of 2019.

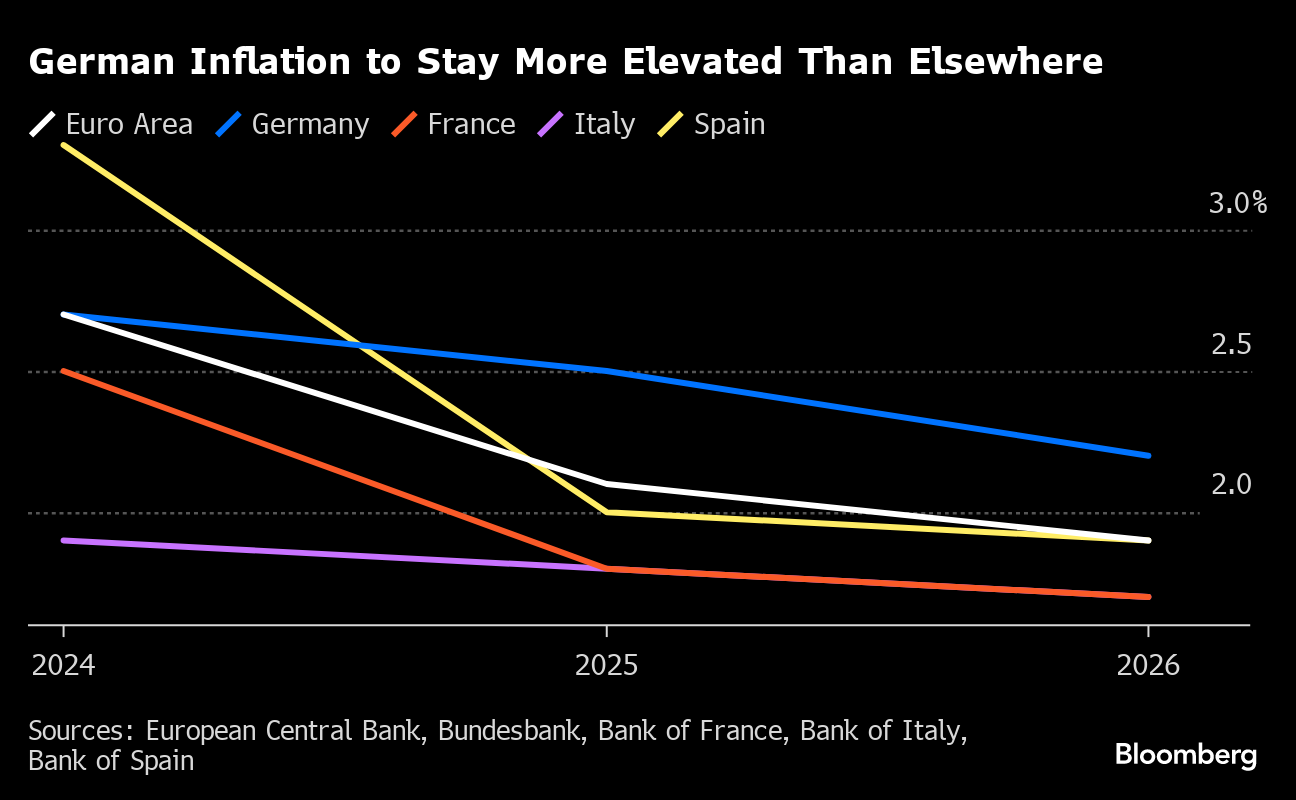

Given that backdrop, the Bundesbank anticipates overall growth of just 0.4% this year. That would be an improvement on 2023, but still one of its poorest outcomes this century, in tandem with inflation that officials reckon will linger for longer than in other major euro-zone economies.

Lindner on Saturday rejected calls for growth-seeking subsidies modeled on those offered by Inflation Reduction Act in the US, saying that Germany's strength and foundation for prosperity rested with its small businesses, startups and industry and their ability to innovate.

Schneider of Deutsche Bank says another annual contraction of 0.2% could be on the cards, though even he sees the prospect of a pickup in due course.

“The hope is that from the spring onwards, as households' real incomes in particular rise, inflation continues to fall and households' optimism perhaps also rises a little, we will be able to get out of this tailspin,” he said. “Private consumption is likely to save us from a significant economic downturn.”

One economist who's more optimistic is Stefan Muetze at Helaba, who reckons that the combination of a pickup in consumer spending, industrial demand and investment in the green transition could drive growth exceeding 1%.

“Our thesis is that things will get better in 2024, also in industry,” he said. “We assume that exports will recover somewhat over the course of the year.”

--With assistance from Joel Rinneby and Monica Raymunt.

(Updates with Lindner comments from fifth paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.