(Bloomberg) -- Two Federal Reserve officials on Friday pushed back on growing expectations in financial markets for the central bank to cut interest rates as soon as March.

New York Fed President John Williams said on CNBC that it's too early for officials to begin thinking about lowering borrowing costs as they consider whether policy is restrictive enough to get inflation back to 2%.

Separately, Atlanta Fed President Raphael Bostic, who votes on monetary policy next year, told Reuters that he expects two rate cuts in 2024 but not starting until the third quarter.

“We aren't really talking about rate cuts,” Williams said on CNBC. He noted it's “premature” to be thinking about cutting interest rates in March, and said financial markets reacted “more strongly” than what policymakers showed this week in their rate projections.

Williams's message appeared to be a deliberate attempt to give the Federal Open Market Committee room to continue holding rates steady early next year if they don't see further desired progress on inflation, said Derek Tang, an economist at LH Meyer/Monetary Policy Analytics.

“The committee does want to have the option to not cut in March,” Tang said.

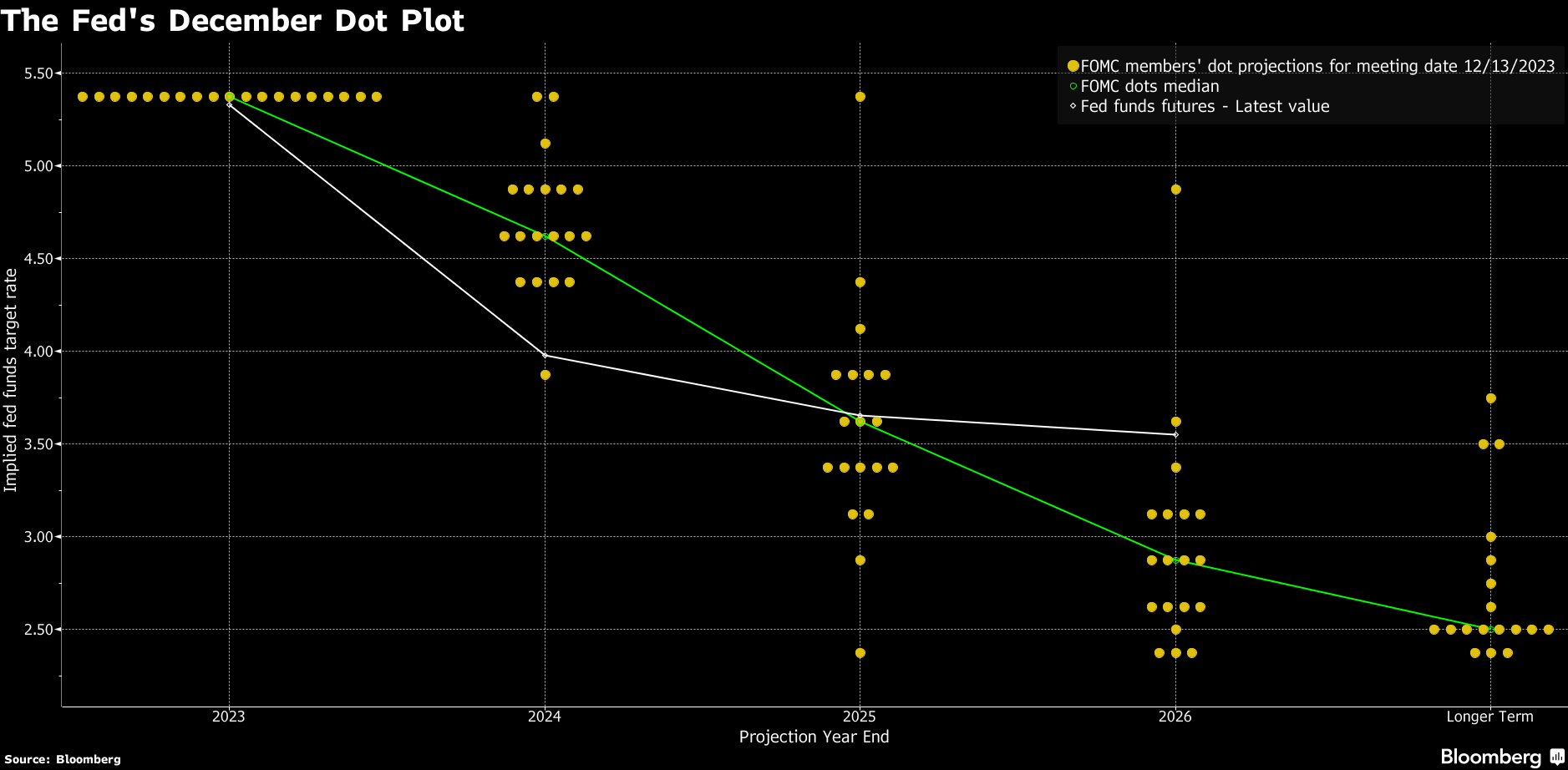

The Fed signaled a pivot earlier this week toward reversing the steepest interest-rate hikes in a generation, with officials forecasting a series of rate cuts next year. Williams noted, however, that Fed officials' quarterly rate projections suggest a more gradual path of easing than what markets expect.

Policymakers penciled in three rate cuts for 2023, according to the median forecast, while futures traders are pricing in as many as six beginning in March.

“It is just premature to be even thinking about that question,” Williams, who plays a key role in communicating central bank policy, said of a March rate cut. “That's not the question in front of us.”

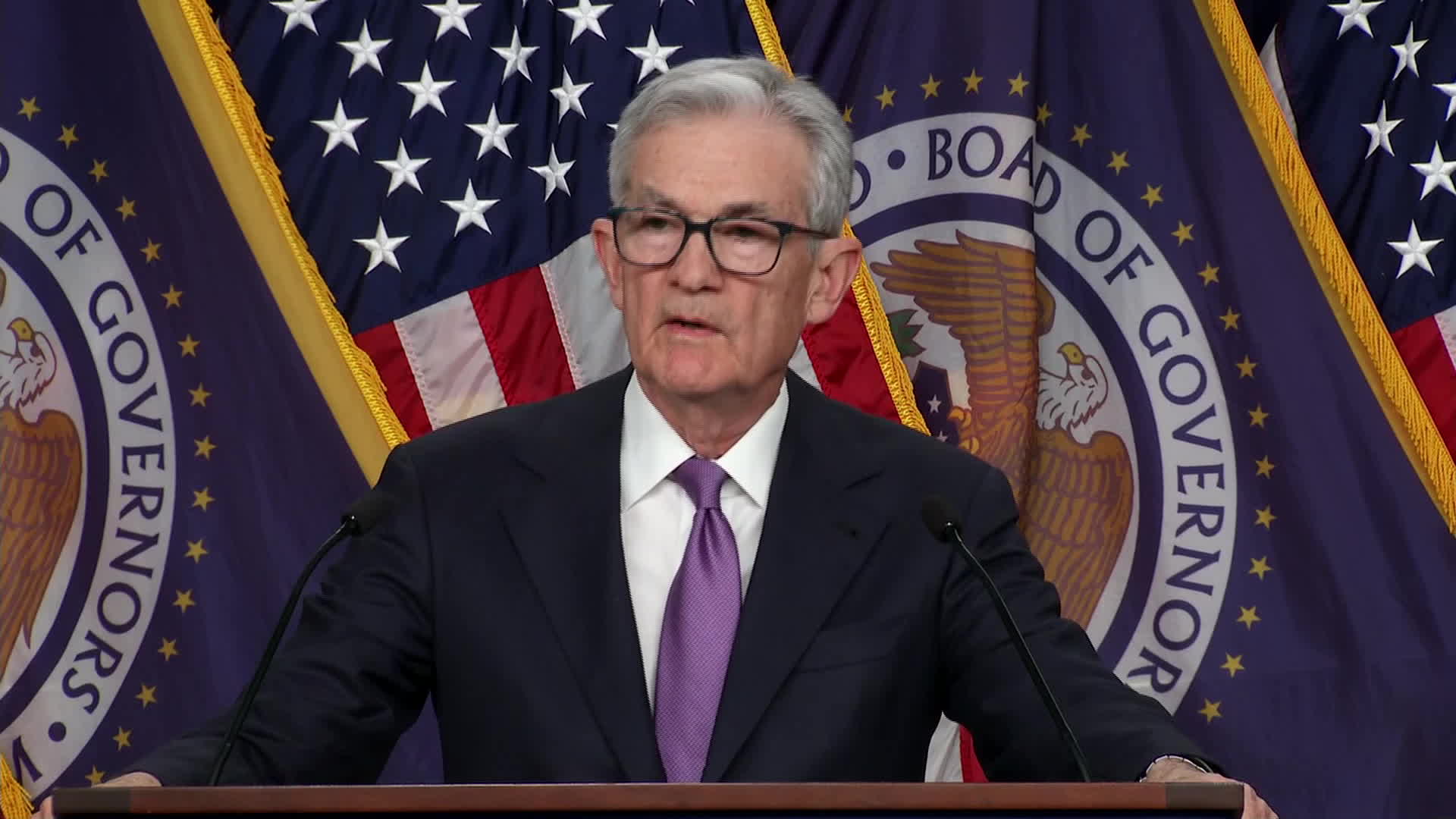

While Chair Jerome Powell said Wednesday the central bank is prepared to resume rate increases should price pressures return, he also said the topic of easing came up at their meeting this week.

Powell's lack of pushback during his press conference against growing investor expectations for 2024 rate cuts ignited one of the biggest post-meeting rallies in recent memory. It was the best Fed day across assets in almost 15 years, according to data compiled by Bloomberg.

“I'm not really feeling that this is an imminent thing,” Bostic was quoted by Reuters as saying. Policymakers still need “several months” to see enough data and gain confidence that inflation will continue to fall, Bostic said, according to Reuters.

Williams said on Friday that “the market in a way is reacting very strongly, maybe more strongly, than what we are showing in terms of our projections.”

“As Chair Powell said, the question is: Have we gotten monetary policy to a sufficiently restrictive stance in order to ensure that inflation comes back down to 2%? That's the question in front of us,” he said.

Read More: Wall Street Traders Go All-In on Great Monetary Pivot of 2024

Yields on government 2-year Treasury yields initially jumped as Williams spoke, but then moved lower as traders continue to see high chances of a March rate cut. Stocks were little changed in mid-morning trading.

As New York Fed president, Williams has a permanent seat on the Federal Open Market Committee, the Fed panel that sets interest rates.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.