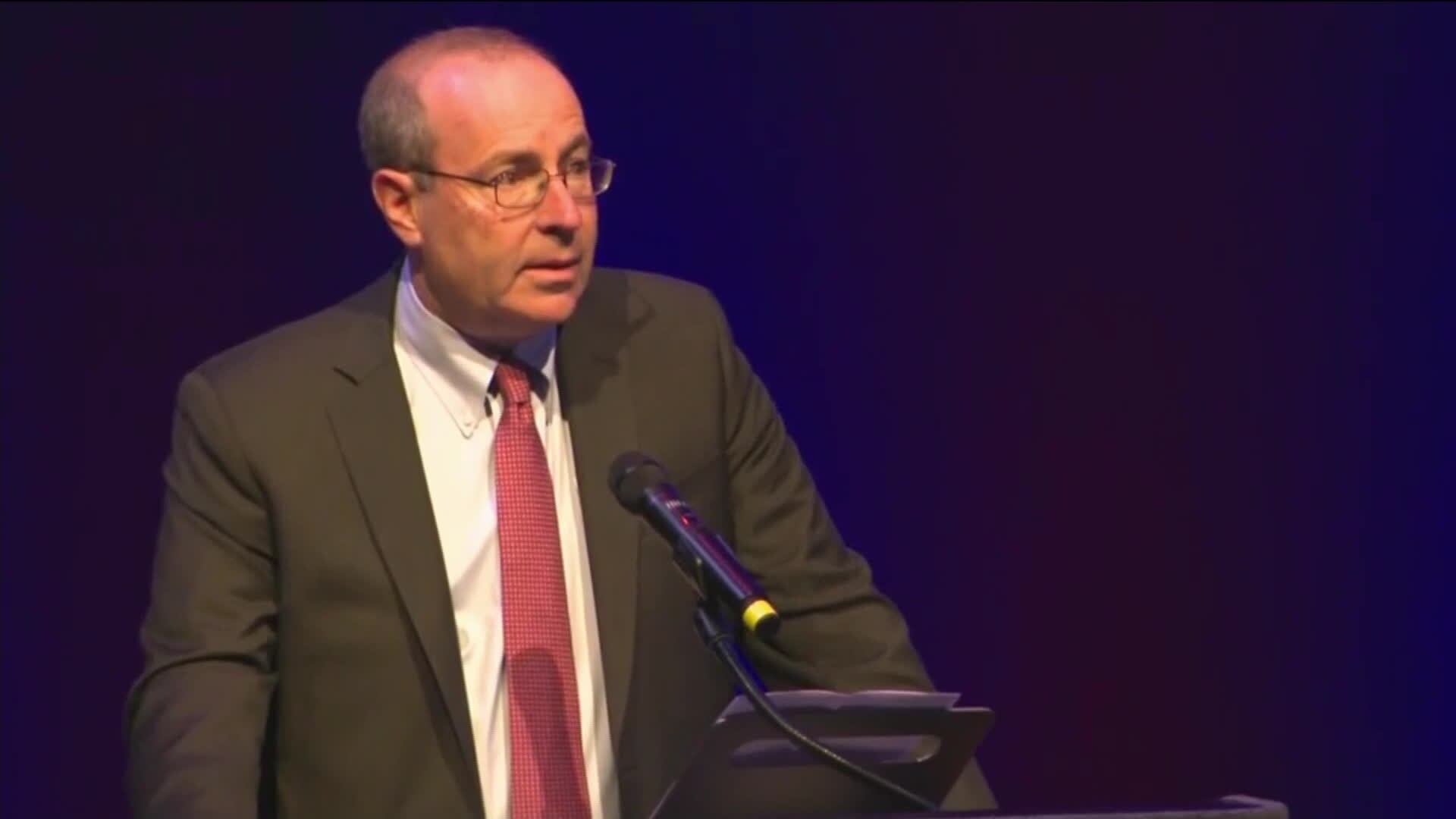

(Bloomberg) -- Federal Reserve Bank of Richmond President Thomas Barkin said a soft landing for the US economy is looking more likely but hardly certain, noting he'd need more conviction about the path of inflation before supporting a rate cut.

“A soft landing is increasingly conceivable but in no way inevitable,” Barkin, who will vote on policy decisions this year, said in a speech Wednesday. “Demand, employment and inflation all surged but now seem to be on a path back toward normal.”

While Barkin reiterated the possibility of further tightening, he didn't rule out a March interest-rate cut either. When asked about the probability of a cut in March, Barkin told reporters the policy decision is a “long way away.”

“I try not to prejudge meetings,” he said.

Officials kept rates unchanged for a third straight meeting last month and signaled they expect three quarter-point rate cuts this year, according to the median forecast released after the policy meeting.

Markets responded by moving forward their bets for rate cuts, with the first seen likely in March. Several Fed officials, including New York Fed president John Williams, have tried to tamp down expectations for steep reductions in early 2024.

While Barkin acknowledged that most officials are expecting cuts in 2024, he said that “conviction on both questions” of inflation continuing its descent and the broader economy's performance “will determine the pace and timing of any changes in rates.”

He added that the components of inflation will be important in his determination of whether the pullback in inflation is sustainable.

“When the goods deflationary cycle normalizes, what does that leave us with?” Barkin told reporters. “That's what I'm looking at there.”

Read more: Why Fed's Goal of ‘Soft Landing' Looks Closer Now:

Barkin defined a soft landing as inflation returning to normal levels while the economy stays “healthy.” He said inflation is “coming into range of our 2% target” and six-month core inflation, which excludes food and energy prices, is running slightly below the target.

2024 Risks

The Richmond Fed president laid out several risks for the economy this year in his remarks to the Raleigh Chamber in North Carolina, including how a recent plunge in long-term interest rates could stimulate too much demand and keep inflation elevated.

“While you might think this would be a first-class problem, strong demand isn't the solution to above-target inflation,” he said. “That's why the potential for additional rate hikes remains on the table.”

Barkin didn't give his expectation for interest rates with any specificity, and he said central bankers would respond to incoming data.

“Conditions are ever evolving,” he said. “So too will our approach. So, buckle up. That's the proper safety protocol even if you expect a soft landing.”

The Fed's preferred gauge of underlying inflation barely rose in November and trailed policymakers' 2% target by one measure, reinforcing the central bank's pivot toward interest-rate cuts. On a six-month annualized basis, the core metric excluding food and energy rose 1.9%, the first time in more than three years that this measure was below the Fed's goal.

(Adds comments from media Q&A following the speech.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.