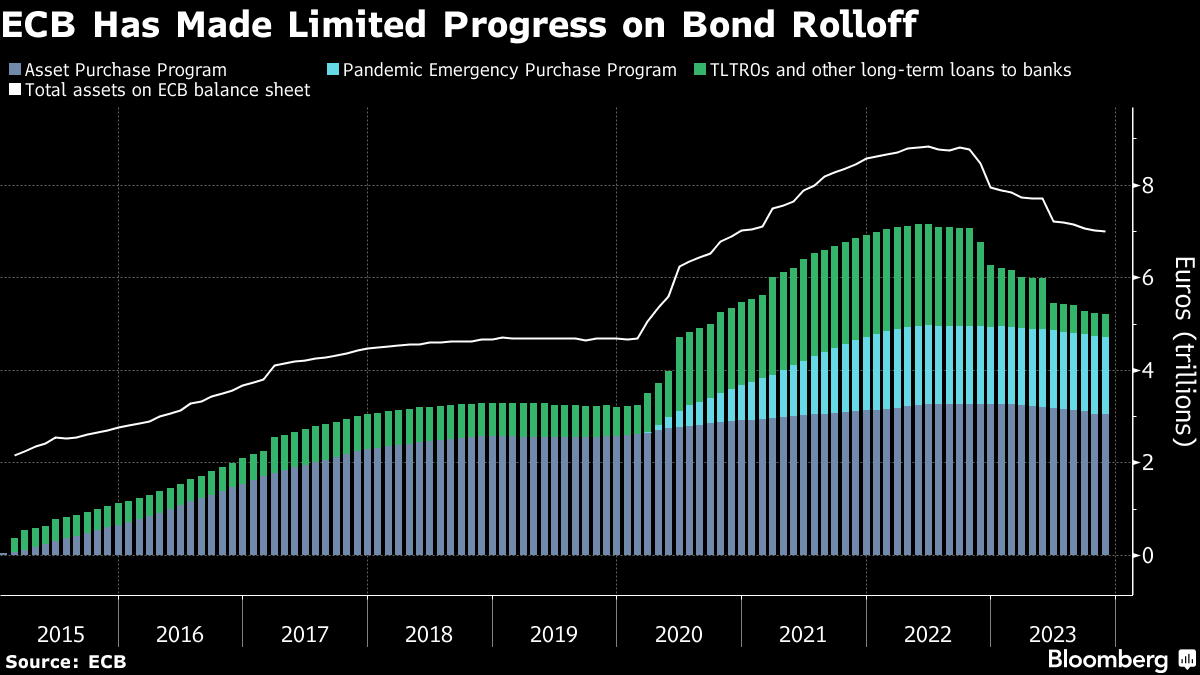

(Bloomberg) -- The European Central Bank kept interest rates on hold for a second meeting with inflation tumbling, but said it will step up its exit from €1.7 trillion ($1.8 trillion) of pandemic-era stimulus.

The deposit rate was left at a record 4% — as predicted by all 59 economists in a Bloomberg survey — with the ECB reiterating that this level will make a “substantial contribution” to returning consumer-price growth to its 2% goal.

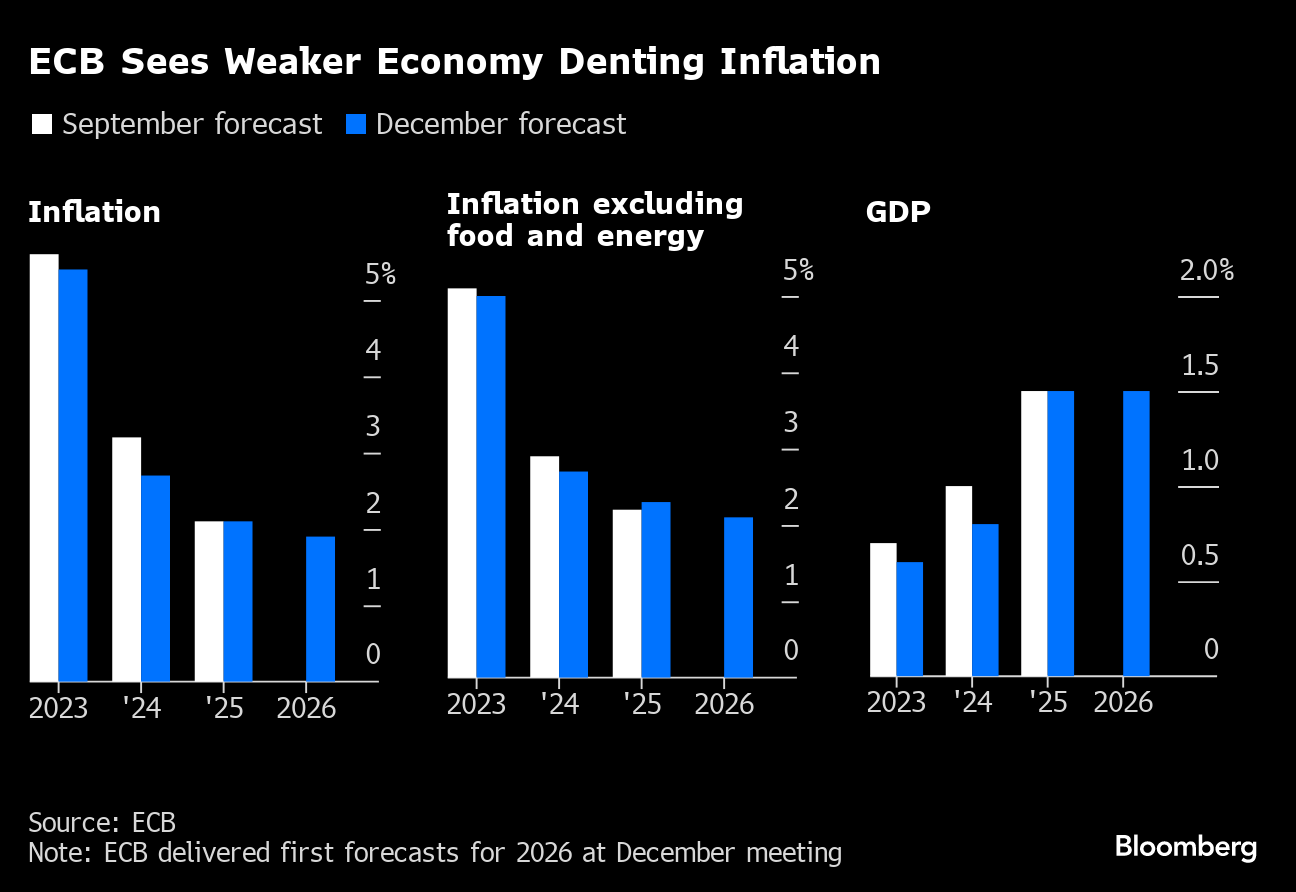

Officials, meanwhile, said they'd accelerate the end of reinvestments under the PEPP bond-buying program. That will put all policy tools into tightening mode, even as fresh projections showed a weaker economy softening the inflation outlook.

“The risks to economic growth remain tilted to the downside,” President Christine Lagarde told reporters Thursday in Frankfurt, though she suggested that dangers for prices are more balanced.

“Growth could be lower if the effects of monetary policy turn out stronger than expected,” she warned.

The euro held steady against the US dollar, while German bonds marginally pared earlier gains. The spread between Italian and German 10-year yields dropped below 170 basis points, with some investors having anticipated more radical action on PEPP.

Traders pulled back bets on ECB rate cuts next year, now seeing 155 basis points of easing compared with about 160 basis points earlier in the session.

“The Governing Council's future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary.,” the ECB said in a statement. But it dropped wording that inflation is “expected to remain too high for too long,” saying instead that it will “decline gradually over the course of next year.”

Leaving borrowing costs unchanged mirrors decisions during the past day by the Federal Reserve and the Bank of England. But while Fed Chair Jerome Powell supercharged global wagers on rate reductions by saying discussions on the topic have begun, ECB Lagarde is expected to join the BOE in pushing back against such expectations.

Markets are pricing an ECB cut as soon as March, though Lagarde has said no move should be expected “in the next couple of quarters.”

- Follow the ECB TLIV blog here

Behind the enthusiasm for wagers on easing is a steeper-than-expected plunge in inflation, to 2.4% in November. The ECB's latest quarterly forecasts offered further grounds for optimism, showing price gains at 2.7% next year and 2.1% in 2025. In 2026, they're seen at 1.9%.

Progress on inflation may also have influenced the announcement on PEPP. Several officials had expressed a preference for an earlier phase-out, before rates are lowered, to avoid sending conflicting messages to markets down the line.

The step means, however, that the ECB loses some capacity to tackle friction on European bond markets, as reinvestments can be deployed flexibly across jurisdictions.

The ECB said:

- Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion a month on average

- It intends to discontinue reinvestments under PEPP at the end of 2024

A lot will depend on the broader economy, which analysts reckon is suffering its first recession since Covid struck — albeit a far milder downturn. The ECB now sees gross domestic product only advancing by 0.6% this year and 0.8% next.

With the economy not crashing, though, wages and their capacity to reignite inflation will be a greater focus for the ECB. Negotiated pay in the euro area increased by 4.7% in the third quarter — the fastest pace in decades. Important bargaining rounds will only happen next year, meaning uncertainty over the path for prices is set to persist.

--With assistance from Sonja Wind, Craig Stirling, Christoph Rauwald, Angela Cullen, Laura Malsch, Laura Alviž, Alexey Anishchuk, William Horobin, James Regan, Daniel Hornak, Kamil Kowalcze, Ben Sills, Alessandra Migliaccio, Alice Atkins, Harumi Ichikura, Joel Rinneby, James Hirai and Naomi Tajitsu.

(Updates with Lagarde comments in fourth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

:max_bytes(150000):strip_icc():focal(722x523:724x525):format(webp)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-02-0368cb6ddb864bf09919fd100fe546b0.jpg?im=FeatureCrop,algorithm)