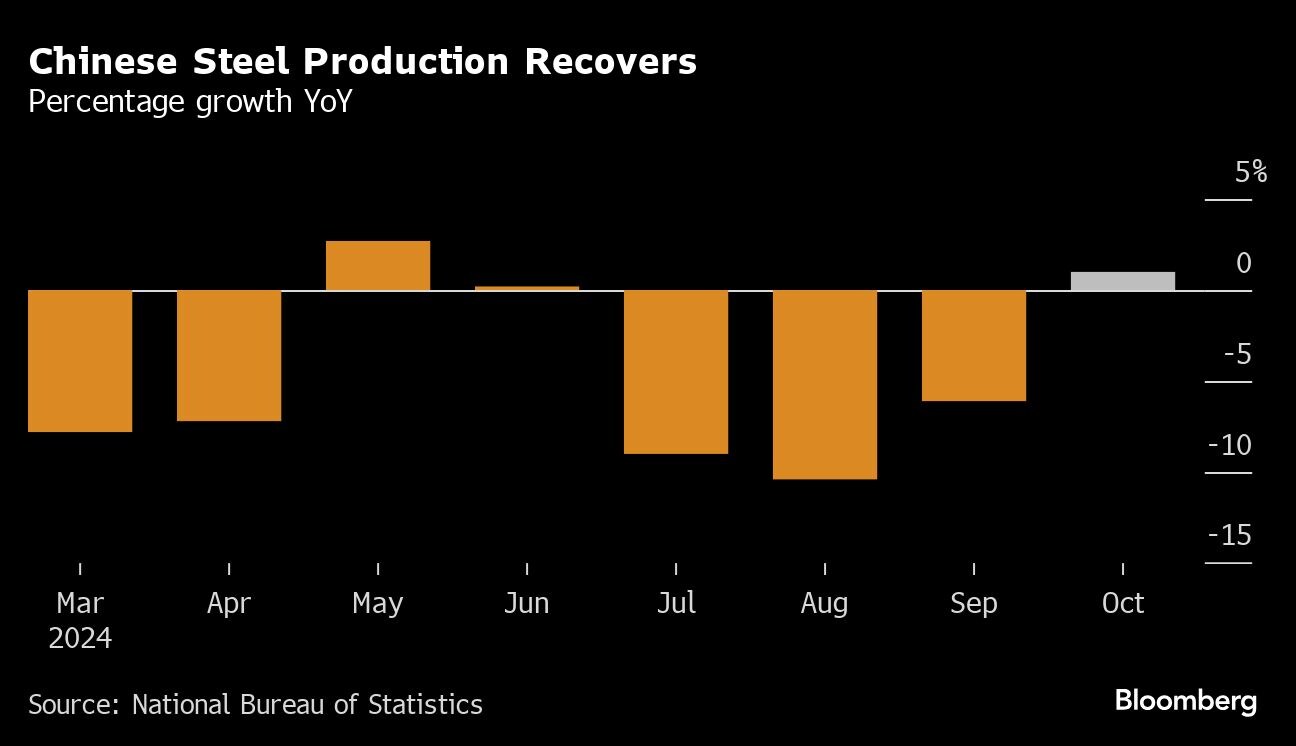

(Bloomberg) --Chinese steel output recovered in October, snapping four months of declines, as sentiment brightens following Beijing's efforts to rekindle economic growth.

Healthier margins allowed steelmakers to churn out more metal on a monthly basis for the first time since May, with production rising to 81.88 million tons, an increase of 6.2% on September and 2.9% higher than last year, according to the statistics bureau on Friday.

The increase means that the cumulative drop in output over the first 10 months compared to 2023 has now narrowed to 3%, suggesting the industry is still on track to surpass 1 billion tons for a fifth consecutive year at current operating rates.

Although a lot of mills are still losing money and the property sector continues to drag on demand, analysts cited a pick-up in orders from manufacturing and state-backed construction activity as well as a spike in exports. However, the industry's long-term prospects remain gloomy.

The main steel association called on mills last month to maintain their production discipline after the rebound in prices, warning that conditions haven't really changed. While the government has indicated it has the headroom for more stimulus next year, future measures are unlikely to revive the market's traditional wellsprings of demand — new housing starts and scaled-up, steel-intensive infrastructure.

Among other materials, aluminum output rose 1.6% on year to 3.72 million tons, close to the record set in August, as seasonal consumption of the lightweight metal increased. Smelters have restored some idled capacity while new plants have also come online to meet the extra demand, according to Shanghai Metals Market.

Output of power fuels also rose — coal by 4.6% and natural gas by 8.4% — as China kept supplies elevated ahead of peak winter demand. But feeble margins saw crude oil refiners cut runs, with production dropping 4.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.