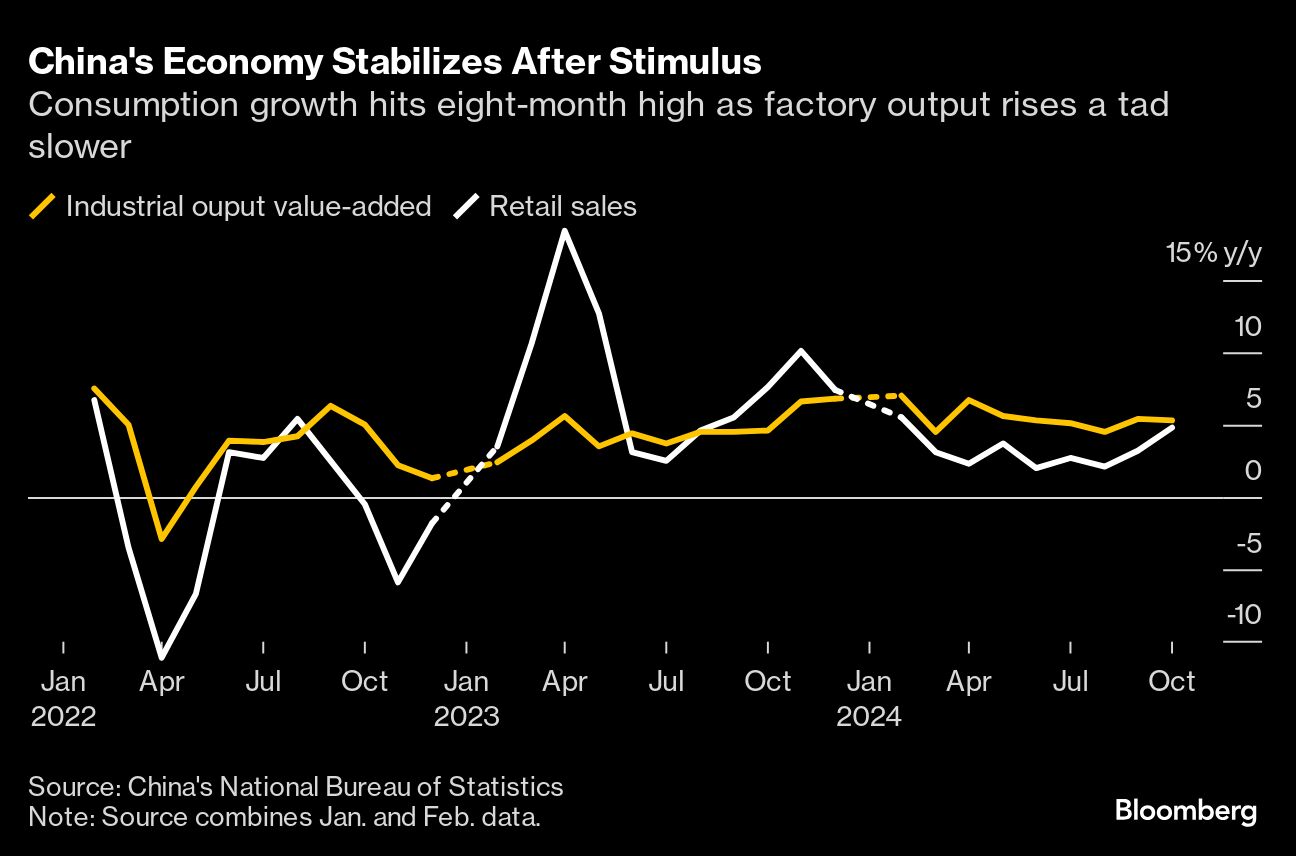

(Bloomberg) --China's economy showed encouraging signs as retail sales grew at the strongest pace in eight months, indicating Beijing's recent stimulus efforts have boosted some key sectors.

Retail sales increased 4.8% in October from a year ago, the strongest growth since February and exceeding all estimates in a Bloomberg survey. Industrial output rose 5.3%, lower than forecast.

The strength in retail spending represents improvement in a part of the economy that has struggled with sluggish sentiment and trailed growth in production, which has long benefited from Beijing's manufacturing-focused policy support.

“The policymakers will be pleased to see the rally in retail sales. They'd rather sacrifice a bit of factory activity for consumption, although it is still early to tell whether the two-speed economy has ended,” said Raymond Yeung, chief economist for Greater China at at Australia & New Zealand Banking Group Ltd.

China's benchmark CSI 300 Index of onshore stocks pared losses of as much as 0.9% after the data release. Chinese shares trading in Hong Kong were up 0.4% as of 11:55 a.m. local time after falling 0.6% earlier.

The indicators, released by the National Bureau of Statistics on Friday, captured the immediate effects of China's boldest stimulus measures since the pandemic that aimed to ensure the country reaches its annual growth target of around 5%.

Beijing has also sought to spur consumer spending by subsidizing purchases of equipment, appliances and cars in a program announced earlier this year and ramped up in the last few months. The sales of home appliances rose 39% compared to the same period last year, the fastest growth since 2010.

The question now is how far Beijing is willing to go to shore up domestic demand and tackle deflation. Boosting consumption could become even more pressing after the reelection of Donald Trump as US president, as he has threatened a 60% tariff on most Chinese imports, a move likely to hurt the Asian country's export sector.

“We should be aware that the external environment is increasingly complicated and severe, effective demands are still weak at home and the foundation for continuous economic recovery needs to be strengthened,” the NBS said in a statement.

What Bloomberg Economics Says...

The message from the activity data — the overall economy is bottoming out but not yet recovering. We see the economy picking up in coming months. To a large degree this would be thanks to an expected acceleration in fiscal spending as the government strives to disburse budgeted expenditure.Chang Shu and Eric Zhu

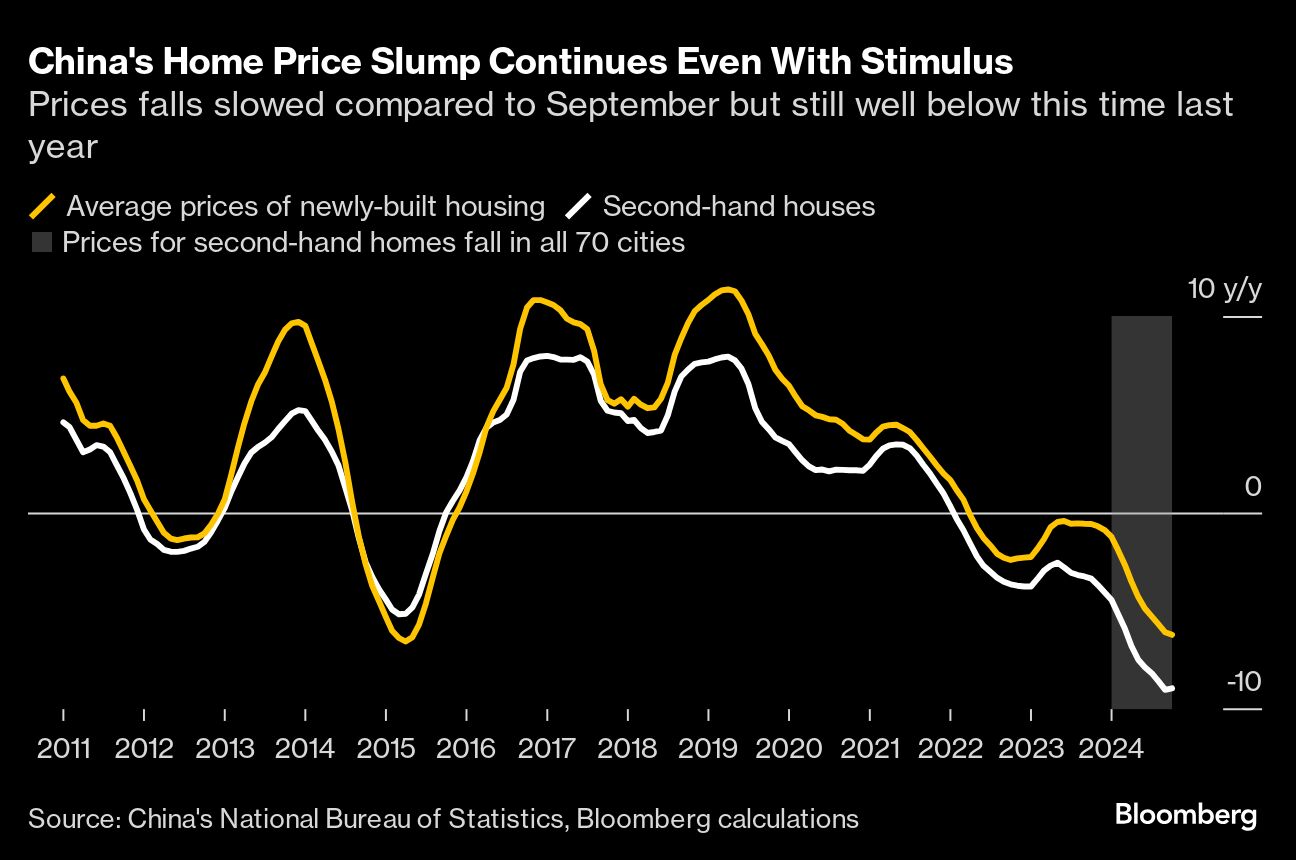

A slowdown of economic expansion in the last quarter to the weakest since early 2023 has prompted policymakers to deliver out-sized interest-rate cuts and support for the property and stock markets. Authorities also rolled out a $1.4 trillion debt swap program to curb debt risks faced by local authorities and free up fiscal room for them to promote growth.

Data released previously for October painted a mixed picture of the state of the world's second-largest economy. Sentiment among manufacturers and service providers improved and export growth hit a two-year high. However, inflation stayed near zero and credit expansion slowed more than expected, reflecting tepid domestic demand.

Finance Minister Lan Fo'an has promised “more forceful” fiscal policy next year, hinting at an increase in the budget deficit, an expansion in special local bond issuance and freer use of the funds raised. He also suggested greater support for the cash-for-clunkers program.

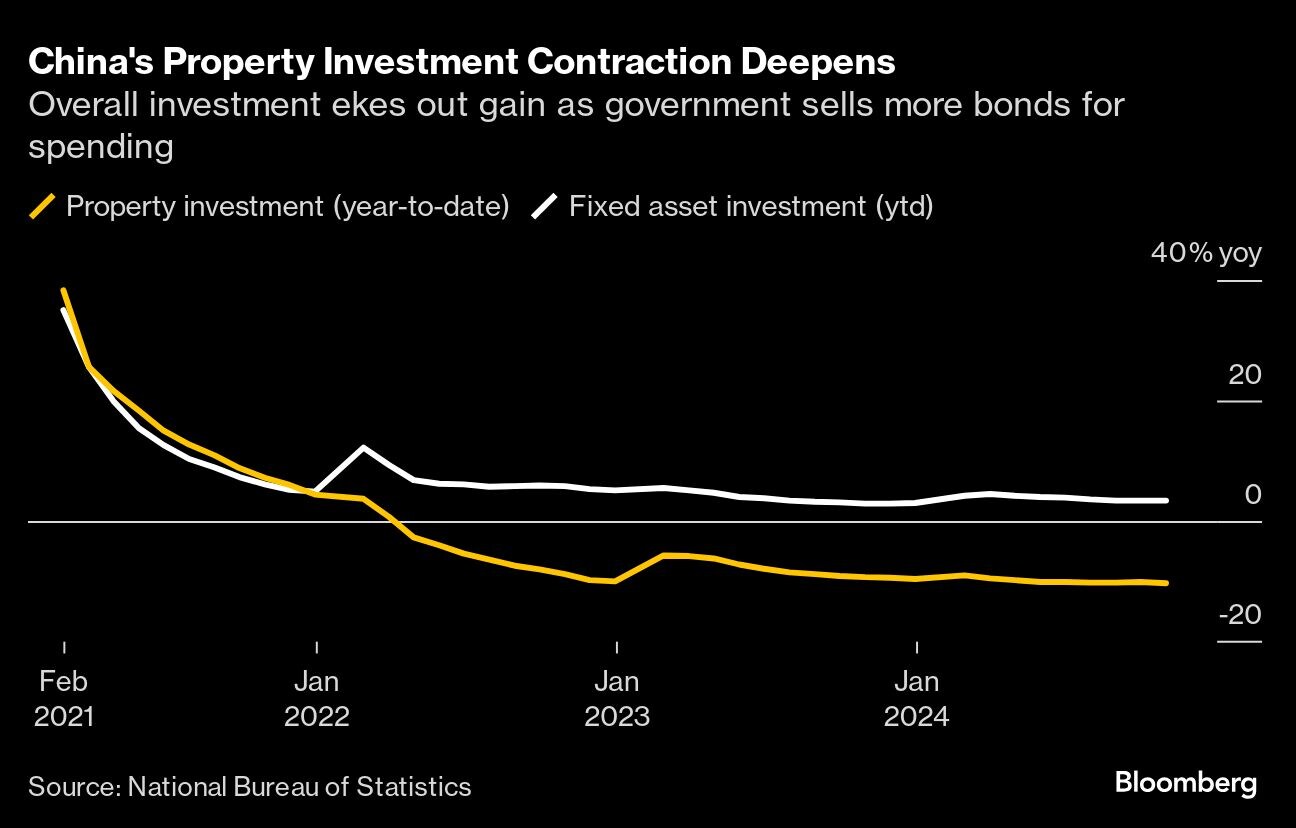

Governments at all levels accelerated bond sales in recent months, with net financing exceeding 1 trillion yuan ($138 billion) for three straight months through October.

That has yet to show an effect on investment, though. Fixed-asset investment increased 3.4% in the first 10 months of the year from the same period in 2023, maintaining the same pace in January-September.

Property investment fell 10.3% in the period, worsening from a slump of 10.1% in the first nine months, suggesting still subdued confidence among developers despite an initial recovery in housing sales.

China's home-price declines abated for a second month in October, aided by the country's recent policy support, data showed Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.