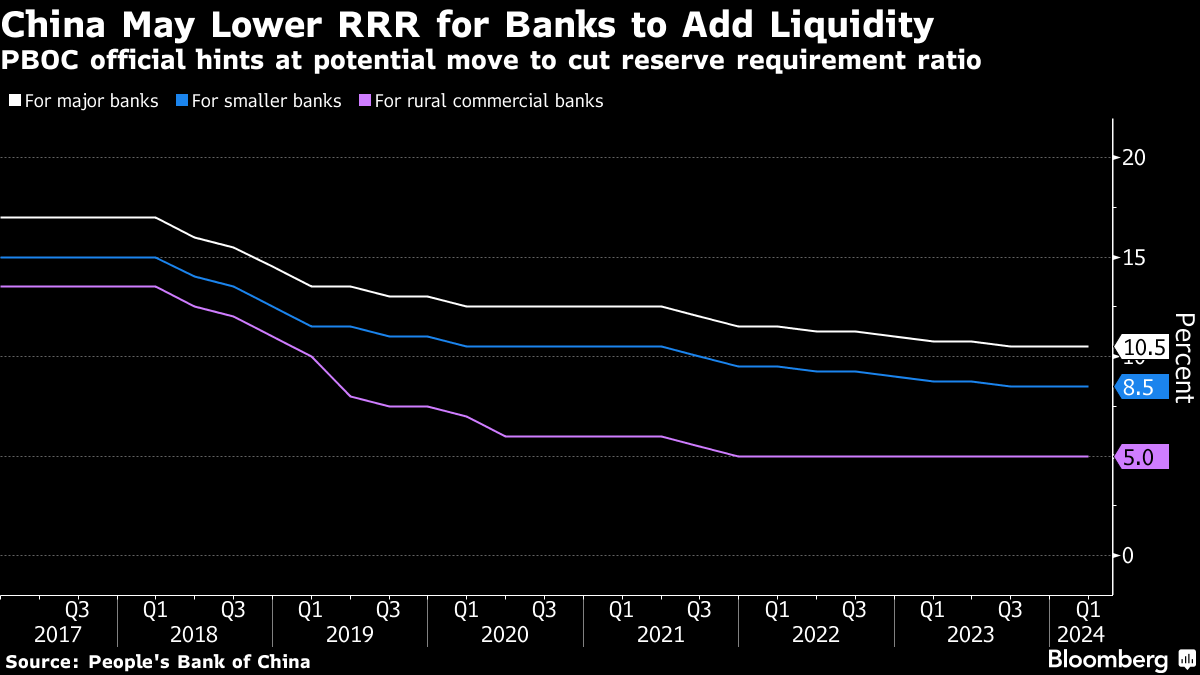

(Bloomberg) -- China's central bank signaled that it's prepared to keep policy loose by lowering the amount of money banks must keep in reserve, reinforcing expectations among investors of more easing to come.

The People's Bank of China will use a variety of tools to provide “strong support” for a reasonable growth in credit, said Zou Lan, head of the central bank's monetary policy department, in an interview with Xinhua News Agency late Monday. He highlighted “reserve requirements” as one option, suggesting policymakers have considered trims to that ratio as a way to boost lending capacity and bolster credit.

“The official comments may reinforce expectations of PBOC easing, as the central bank mentioned the RRR tool and signaled a willingness to guide interest rates lower,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd. He added, though, that a lot of easing hopes have “already been priced in.”

The central bank will also strengthen its counter-cyclical and cross-cycle policy adjustments to create favorable financial conditions for the country's economic growth, Zou told the newspaper. He added that the PBOC will guide financial institutions to strengthen their liquidity risk management for stable money market operations.

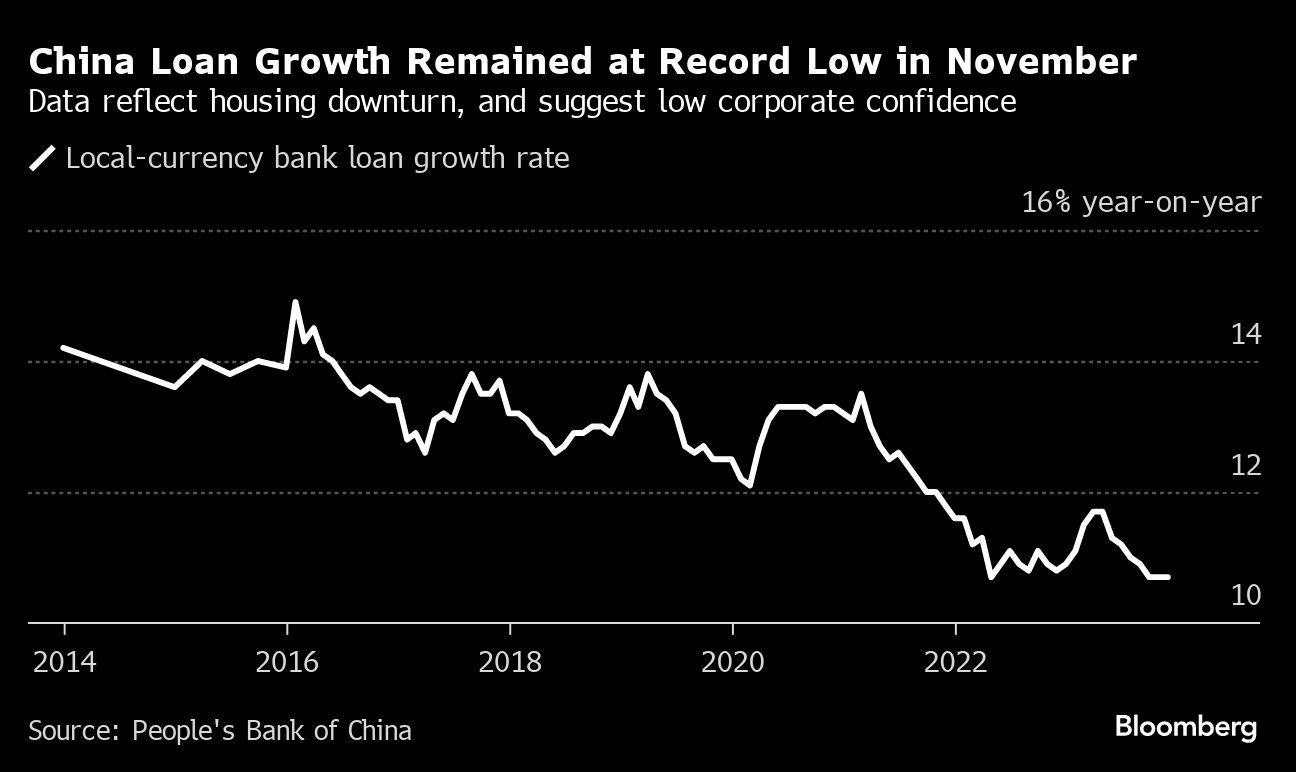

Investors and analysts have been betting on loose monetary policy this year as the economy continues to show signs of weakness and confidence has yet to rebound. Upcoming data is expected to give more clues on the progress of the recovery, including the state of borrowing activity last month and how severe the nation's deflationary pressures still are.

Zou's remarks don't necessarily signal an imminent cut to the so-called reserve requirement ratio, or RRR — though they may suggest such action is on the table in the coming months. He made similar public comments last July before the central bank reduced the RRR for major banks in September.

Even so, there are signs the environment is ripe for further easing. Chinese government bond yields are at the lowest in nearly four years, while banks have been able to raise short-term debt more cheaply in money markets than from the central bank. The PBOC has also been softening its grip on the yuan, while major commercial lenders just recently reduced their deposit rates.

Any action in the near term would come on the heels of an already-aggressive series of moves by policymakers to pump more cash into the banking system.

Last month, the central bank doled out an unprecedented 800 billion yuan ($111 billion) of one-year loans to commercial lenders, and injected even more short-term cash through open market operations. The combined effect was equivalent to at least a 50-basis point reserve-ratio cut that's set to bring the central bank's balance sheet to another record.

In addition, the PBOC also provided nearly $50 billion worth of low-cost funds into policy-oriented banks to finance housing and infrastructure projects last month.

“The PBOC still owes the market a RRR cut despite record-high liquidity injection,” said Neo Wang, managing director for China research at Evercore ISI in New York. He projects a 25-basis point cut to the RRR “soon,” along with potential reductions to policy and benchmark rates.

The equity market is “in urgent need of good news,” Wang said.

Markets are clamoring for some kind of action from Chinese authorities that may inject more momentum into the recovery.

The CSI 300 Index — a benchmark of onshore Chinese shares — was up 0.4% mid-morning Tuesday, trailing the advance in a broader gauge of Asian equities. It slumped to the lowest in nearly five years during the previous session as concerns about the economy and policy uncertainty persist.

The yuan has advanced nearly 3% against the dollar after hitting the weakest level since 2007 in September, opening up the room for the PBOC to ease policy without triggering significant capital outflows. China's 10-year government yield inched toward the lowest level in more than two decades.

Some analysts cautioned that an RRR cut will likely not be enough on its own to spark a meaningful turnaround. The central bank twice reduced that ratio last year — along with other measures including policy rate cuts — in efforts that failed to move the needle much.

“This is a low-hanging reflex — not an adequate, much less resounding, resolution to China's deep-seated confidence deficit,” wrote Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd, in Singapore, in a research note about a potential RRR reduction.

Sentiment among businesses in China remains low amid an uncertain regulatory environment. Consumers, meanwhile, have been hammered by a gloomy job market and the nation's property slump, which is now entering its fourth year.

“Merely increasing the capacity for credit supply, which RRR cuts will do, will not guarantee a restoration of unimpeded cash-flow,” Varathan wrote.

He cited the close relationships between China's real estate and shadow banking industries, along with debt woes among local governments, as issues that “cannot simply be waved off with RRR cuts.” Case in point: The failure of shadow banking giant Zhongzhi Enterprise Group Co., which last week filed for bankruptcy.

“Monetary policy easing is helpful on the margin, but fiscal policy easing would be more effective,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Co.

Chinese authorities have pledged to strengthen fiscal support for the economy via measures including more government spending in 2024, as Beijing is expected to set an ambitious growth target for the year of around 5% or so. Fiscal stimulus was weak last year as authorities struggled to pull revenue from selling land, a consequence of the property crisis.

--With assistance from Foster Wong, Iris Ouyang, Wenjin Lv, Zhu Lin and John Cheng.

(Updates with additional comments, details throughout.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.