(Bloomberg) -- In normal times, Chancellor of the Exchequer Jeremy Hunt's decision to pump more than £20 billion a year into the UK economy might tip the Bank of England toward raising interest rates again.

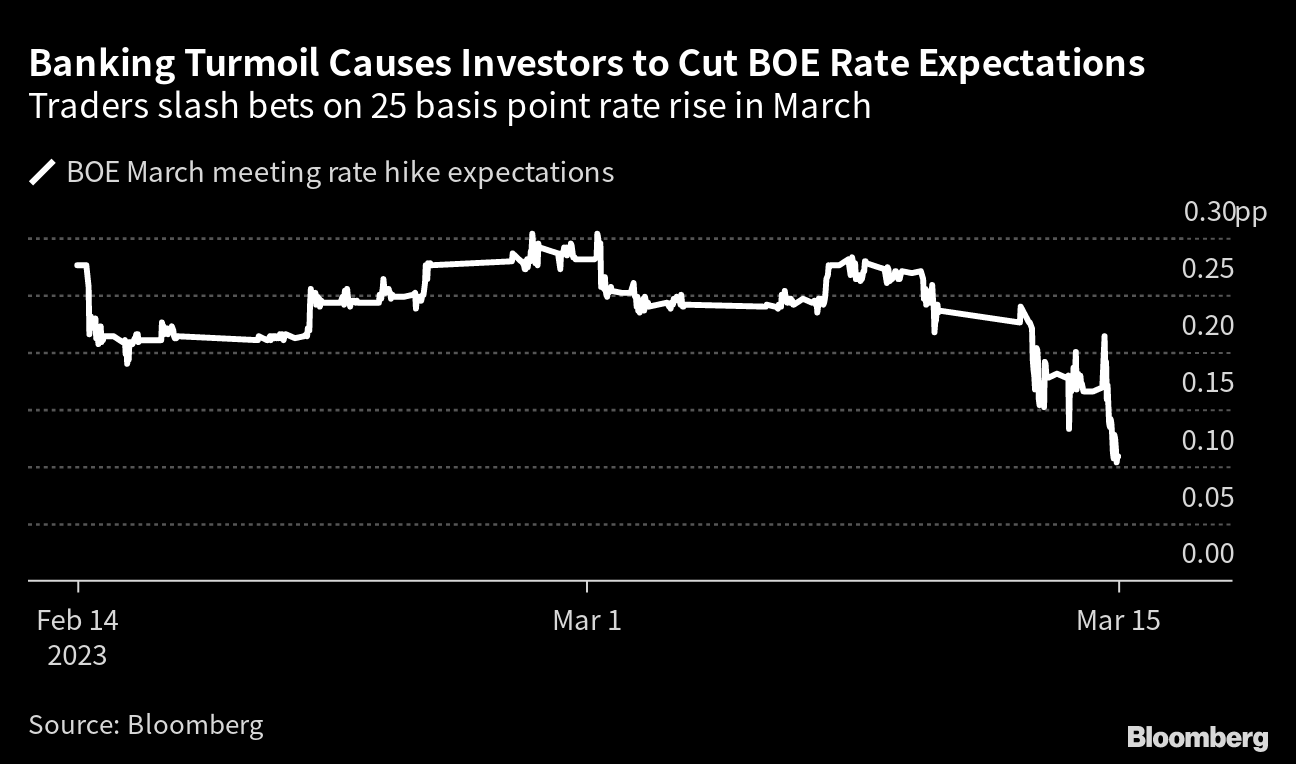

But growing turmoil in financial markets may well overshadow next week's rate decision from the central bank. Investors rapidly pared back bets on another quarter-point increase in the BOE's key lending rate after concerns about the health of Credit Suisse led to a selloff of bank shares on Wednesday.

Concerns about inflation lingering near a four-decade high are rapidly giving way to worries about the confidence in the banking system, which has been unsettled since the collapse of SVB Financial Group in the US last week. The result may be that BOE policy makers led by Governor Andrew Bailey put more weight on markets than the Treasury's fiscal stimulus.

“Today's budget argues for a little bit more tightening by the Bank of England,” said Thomas Pugh, an economist at RSM UK who had seen a 50% chance of a rate hike next week. “But the flare up of risks around Credit Suisse today and associated moves in financial markets makes that probability even smaller.”

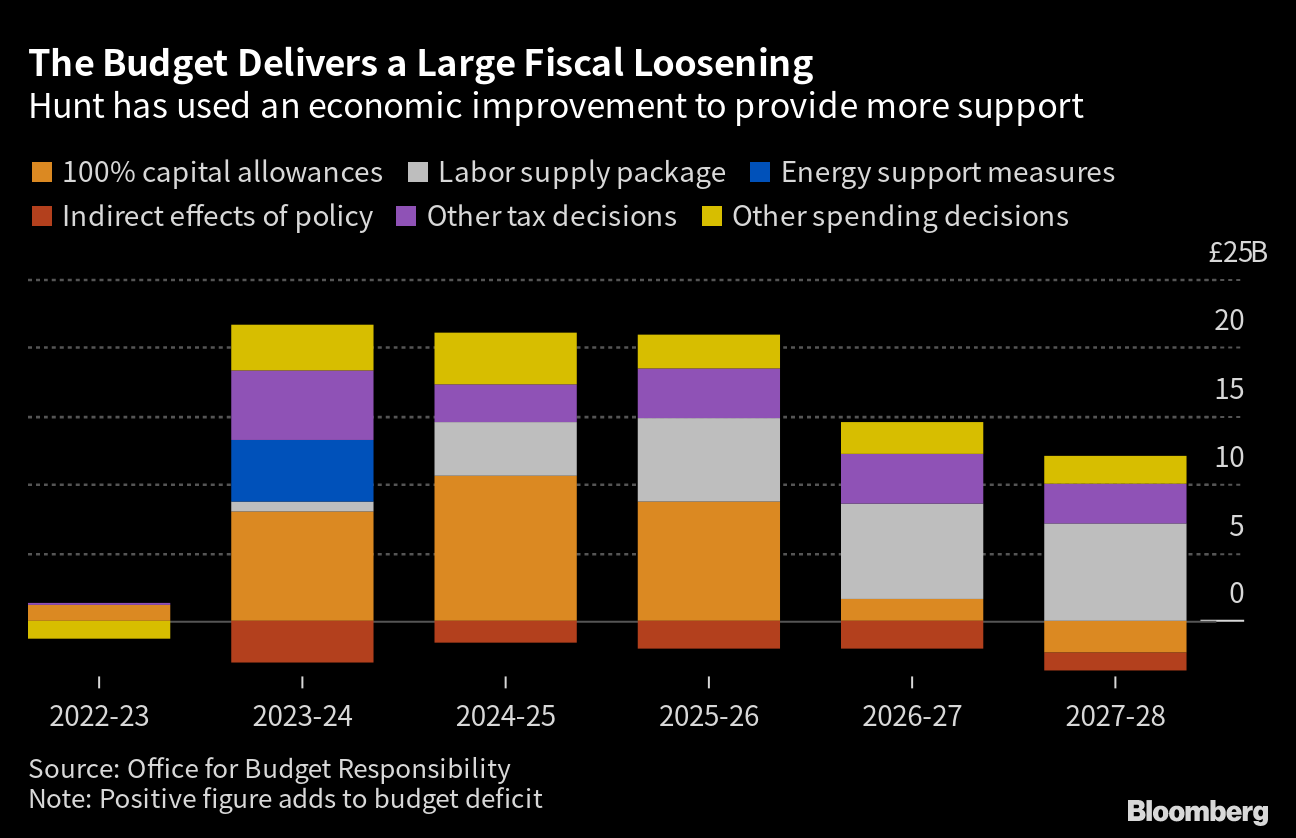

Hunt's budget set aside money to cushion households against soaring energy and child care costs. It also gave companies a tax break for investing and allowed savers to shelter more of their income in pensions. The result is a £91 billion fiscal stimulus through 2028.

George Buckley, chief UK economist at Nomura, said the stimulus “is not peanuts” and “was rather larger than we had been expecting.”

“That will not be something that will pass the Bank of England by,” Buckley said. “These numbers will feed into the Bank's models and its policy discussions.”

Just a few weeks ago, investors were certain the BOE would raise the benchmark lending rate a quarter point to 4.25% on March 23, continuing the quickest tightening cycle in three decades. Policy makers were looking at signs that inflation was proving more persistent than it expected, threatening a wage-price spiral.

Now, that decision is on a knife-edge and markets have priced in only one more hike by this summer. Markets quickly shifted after the SVB collapse on Friday and have moved more sharply on Wednesday.

Dan Hanson, UK economist at Bloomberg Economics, expects a quarter-point hike but cautioned that it's “far from a done deal.”

“Relative to what the BOE knew at its February meeting, today's policy announcements constitute a loosening of near-term fiscal policy that will do more to lift demand than supply over the BOE's forecast horizon – that's modestly inflationary,” Hanson said. “The big risk is that financial stability concerns dominate.”

What Bloomberg Economics Says ...

“Chancellor of the Exchequer Jeremy Hunt offered up a larger near-term giveaway in his Budget than we had been expecting. The policies will lift demand in the near term, a likely ploy to get the economy growing meaningfully again before the next election due early 2025. Tackling the UK's long-run growth woes was always going to be a harder task and while he took steps in the right direction, we're far from convinced he's found the silver bullet.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the INSIGHT.

Should worries over the stability of the banking sector begin to fade, the BOE may again consider the broader economic impact of Hunt's stimulus.

The Office for Budget Responsibility said the near-term fiscal loosening will lift demand relative to supply in the coming years, threatening to stoke inflation. Analysts said it represented a fiscal policy boost close to 1% of GDP per year over the next three years.

However, more generous energy support will weigh on the headline inflation rate in the short-term and measures to lure back workers could boost the supply side of the economy in the long run.

The extension to a £2,500 cap on annual gas and electricity bills for a typical household will lower the headline inflation rate by around 1.5 percentage points at the end of the year, according to James Smith, economist at ING.

“When we had the original EPG announced, (the BOE) said the focus for them was much more about it lowering headline inflation as opposed to the stimulative impact,” Smith said.

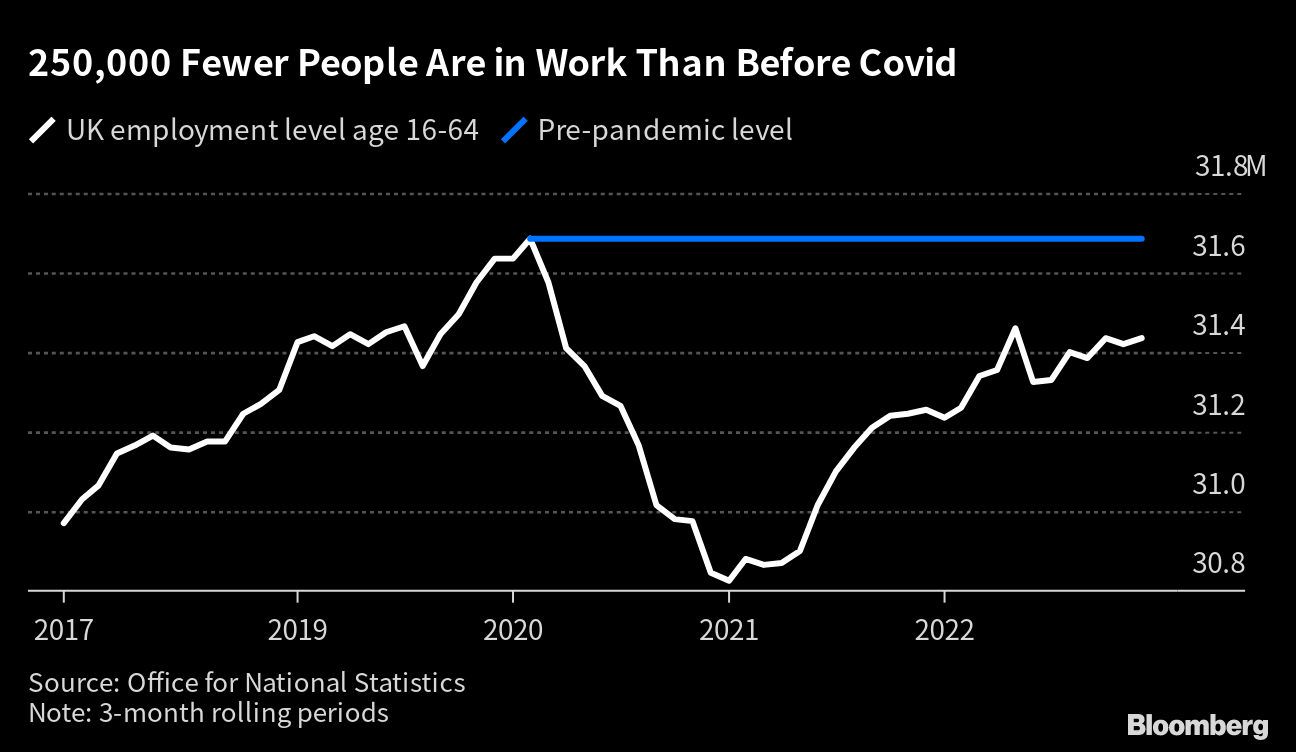

The measures to lure back workers into jobs, such as a major extension to free childcare, could also help prompt the BOE to become more upbeat on the economy's supply.

“In the medium term, the measures announced today should boost the supply side of the economy,” said Pugh.

“Getting more inactive people back into work will be crucial to bringing down wage growth, and by association, services inflation, reducing the need for further rate hikes. Any boost to business investment should improve productivity and reduce inflationary pressures.”

The BOE itself could be a drag on the scale of any future fiscal stimulus in the coming years as the Treasury is left on the hook for losses from the quantitative easing program.

The OBR said the losses from BOE's bond portfolio will total £108 billion over the next five years, almost completely reversing the previous profits made from the bond-buying stimulus.

The BOE bought government and corporate debt to pull down market interest rates and boost the economy but any gains or losses are transfered to the Treasury. The Treasury is now being left on the hook for the losses as interest rates rise and bond valuations sink.

Read more:

- Credit Suisse Ignites Global Market Rout as Banking Fears Return

- UK Plans Sweeping Changes to Tax and Benefits to Lift Growth

(Updates with comment.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.