(Bloomberg) -- A wave of euphoria swept across Asia's markets after the Federal Reserve signaled it's likely to cut interest rates next year, with analysts almost unanimously calling for extended gains across asset classes.

The MSCI Asia Pacific Index surged as much as 2.7% in intraday trading Thursday to the highest level in more than three months, led by stocks in Australia, South Korea and China. Bonds and currencies joined the party as rate differentials between America and Asia are expected to narrow further amid lower US yields.

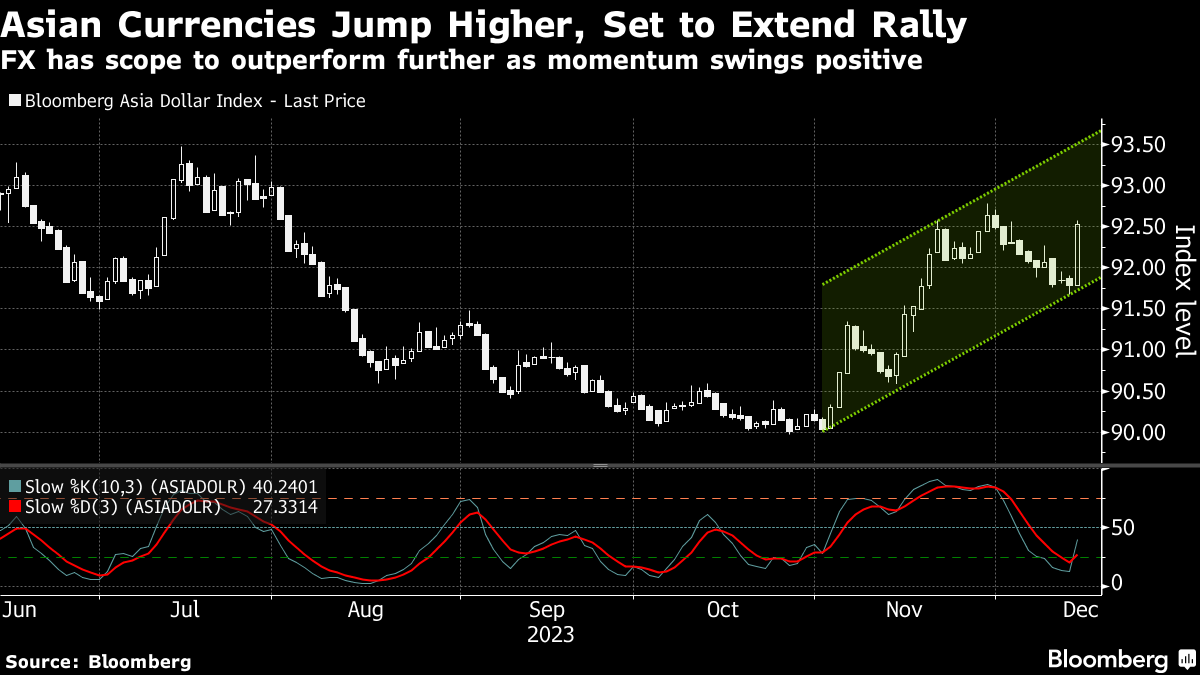

The risk-on rush bodes well for a broader rally as the drop in short-term rates will likely keep the US dollar under pressure, putting Asian markets in a sweet spot. While the Fed's dot plot showed 75 basis points of reductions in 2024, traders are betting on cuts of twice that size.

“This should encourage more cash deployment into bonds and equities,” said Ray Sharma-Ong, investment director of multi-asset at abrdn. “We also expect Asia equity markets to improve as US growth moderates while Asia growth remains resilient,” he said.

Bonds and currencies strengthened across Asia. Japan's 10-year yield fell three basis points, extending the decline into a third day, while the yen surged as much as 1.3% to 140.97 per dollar, passing the four-month high of 141.71 reached last week. In Indonesia, the yield on the five-year note declined by the most in one month.

“To EM Asia, this is good news” after a year in which global central banks raised rates fairly aggressively, Ken Cheung, chief Asian FX strategist at Mizuho Bank, said on Bloomberg Television. “These headwinds are likely to become tailwinds for next year and this will pave the way for EM Asia currencies rally for the next year.”

Traders are now awaiting the Bank of England and European Central Bank meetings to determine whether developed-market peers are at the cusp of a global easing cycle.

Here's what other analysts and strategists had to say:

Steve Englander, head of global G-10 FX research and North America macro strategy at Standard Chartered Bank:

“We see the Fed stance as positive for risk appetite and a plus for higher-beta currencies. For high-yielding currencies, the yield premium may now be seen as a real yield premium rather than as a risk premium, making them far more attractive. We continue to see USD/JPY downside as attractive given the likelihood of a narrowing of the large divergence in policy rates”

Amy Xie Patrick, head of income strategies at Pendal Group in Sydney:

Australian bonds to benefit from the rally in Treasuries, though “to talk about cuts for the RBA now is premature given that we are still waiting for confirmation that wage pressures here have peaked. But being pulled along for some of the ride in the US — I don't mind that.”

Brendan McKenna, emerging market strategist at Wells Fargo in New York:

“Most of EM Asia can perform well, but I think the outperformers can be currencies like Philippine peso, Korean won and Indonesian rupiah. Currencies that are associated with economies integrated into the global economy and where rates are unlikely to come down in the near future”

Brad Bechtel, global head of foreign exchange at Jefferies in New York:

Aussie, Norwegian krone and kiwi, to some extent, look interesting as those central banks are still holding a hawkish stance. “Owning Aussie against the dollar, pound and euro may turn out to be a great trade over coming weeks,” he said

Winson Phoon, head of fixed income research at Malayan Banking Bhd in Singapore:

“A positive spillover from the overnight rally in US Treasuries is likely following the Fed pivot benefiting both EM Asia FX and bonds.”

“Higher yielder IndoGB may outperform today. IndoGb look well positioned to receive increased foreign inflows, at least from a tactical standpoint given the prevailing risk-on mode on Fed pivot. Bank Indonesia has plenty of room to roll back previous hikes, including the knee-jerk hike in October which happened at the height of US dollar strength and US Treasury selloff. I'm not ruling out a cut as early as the next BI meeting”

Chetan Seth, Asia ex-Japan equity strategist at Nomura:

“For now, positive momentum in stocks may sustain in the near term.”

“We maintain our view that 2024 should be a better year for Asia ex-Japan stocks. Our MSCI Asia ex-Japan target by end-2024 is 673. The three pillars of our constructive view are: strong earnings growth recovery in 2024 driven by recovery in semi or chip sector or China, stabilization in valuations or softer US dollar on peak Fed rates, and now the prospects of insurance rate cuts in the US, which should significantly reduce the risk of a hard landing in the US, and better fund flow environment.”

--With assistance from Garfield Reynolds.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.