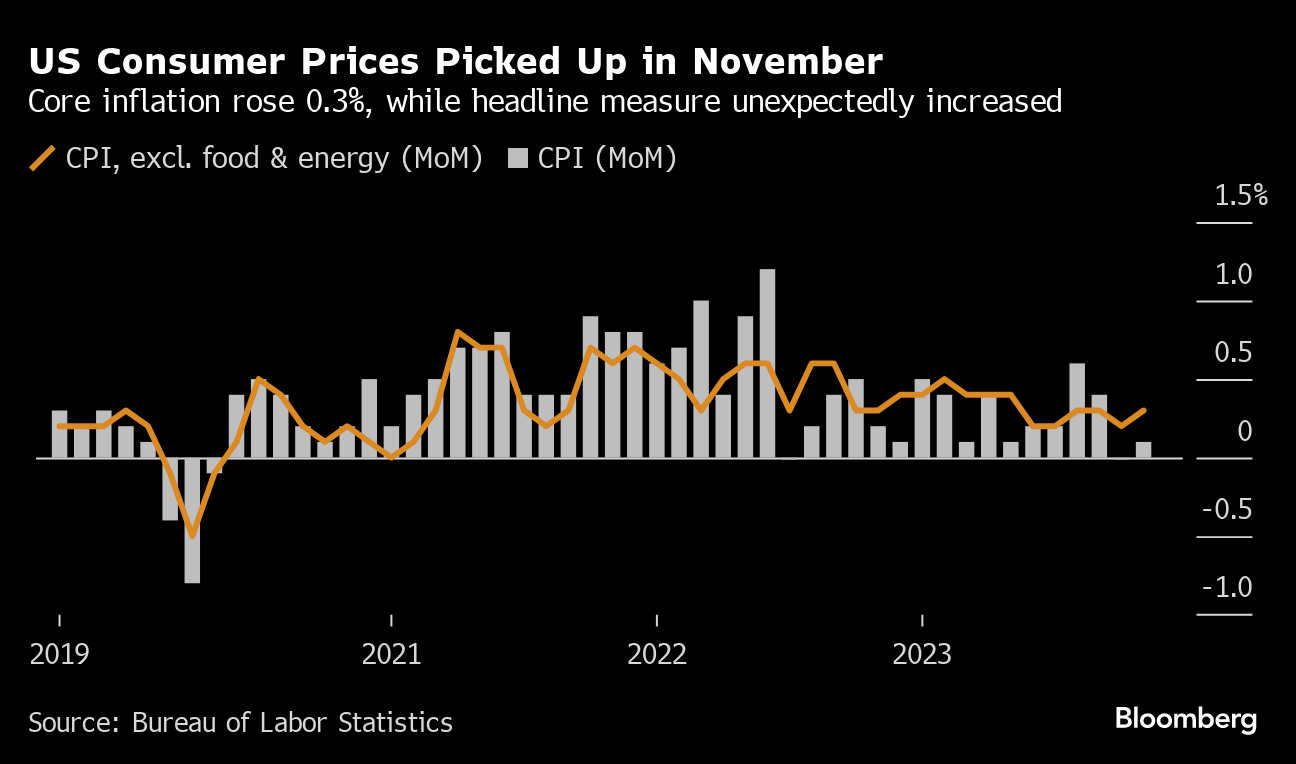

(Bloomberg) -- US consumer prices picked up in November on increases in housing and other service-sector costs, keeping inflation stubborn enough to thwart any Federal Reserve interest-rate cuts soon.

The consumer price index ticked up after being little changed in October, and when stripping out food and energy costs, the so-called core CPI accelerated on a monthly basis as well, according to government figures. Economists favor the core metric as a better gauge of the trend in inflation than the overall CPI.

Follow the reaction in real time on Bloomberg's TOPLive blog

Tuesday's data underscore the choppy nature of getting inflation back in line — particular in the service sector, which the Fed has zoned in on as the last mile in its inflation fight. While price pressures have largely retreated from multi-decade highs, a still-strong labor market continues to power consumer spending and the broader economy.

Fed officials begin a two-day meeting Tuesday that is expected to culminate with them holding interest rates steady again. Chair Jerome Powell will likely reiterate he and his colleagues want to see a more sustainable pullback in price growth toward their target before easing policy.

Consumer prices were up 3.1% in November from a year earlier, about a third of what the rate was at its peak in the middle of 2022.

“It's better than where we were a year ago, but if that's truly the underlying trend of inflation, then I don't think we're on the cusp of Fed easing at this point because that's still pretty far from 2%,” said Stephen Stanley, chief US economist at Santander US Capital Markets LLC. “I view the market optimism around early rate cuts as premature at this point.”

Treasuries erased gains, the S&P 500 fluctuated and the dollar pared losses after the release. Traders scaled back bets on how aggressively the Fed will cut interest rates next year.

The Bureau of Labor Statistics figures reflected increases in rents, medical care and motor-vehicle insurance. Used-car prices rose for the first time since May. On the other hand, apparel and furniture costs declined.

Despite the pickup in price pressures, inflation is still broadly on a downward path. A measure cited by Powell and other Fed officials — six-month annualized core inflation — fell below 3% for the first time since early 2021.

What Bloomberg Economics Says...

“Even as November's core inflation ticked up to a pace more consistent with 3% annual inflation, long-term measures suggest the Fed has made significant progress on disinflation over the past six months. There are also signs that China's deflation is giving another disinflationary boost to core goods.”

— Anna Wong and Stuart Paul

To read the full note, click here

Shelter prices, which make up about a third of the overall CPI index, rose 0.4%, offsetting a decline in gasoline prices. Economists see a sustained moderation in the shelter category as key to bringing core inflation down to the Fed's target.

Excluding housing and energy, services prices climbed 0.4% from October, picking up from the prior month, according to Bloomberg calculations. While Powell and his colleagues have stressed the importance of looking at such a metric when assessing the nation's inflation trajectory, they compute it based on a separate index.

Unlike services, a sustained decline in the price of goods has been providing some relief to consumers in recent months. So-called core goods prices, which exclude food and energy commodities, fell for a sixth month, matching the longest streak since 2003.

“This report paired some serious deflation in core goods with strength in core services,” Omair Sharif, founder of Inflation Insights LLC, said in a note. “As such, I don't think this is a great number for Fed officials, or market participants, hoping to change the conversation to rate cuts.”

The Fed is looking for softer labor-market conditions to rein in demand across the economy, especially after last week's strong jobs report. A separate report Tuesday showed real earnings advanced 0.8% in November from a year earlier, extending a months-long streak in which wage growth has outpaced inflation.

Consumers are growing more optimistic on the trajectory inflation is headed. Separate reports this month showed near-term inflation expectations are now at the lowest levels since early 2021, aided by lower gas prices.

Looking ahead, the key question for policymakers isn't so much when they'll cut interest rates, but why. In a Bloomberg survey of economists this month, nearly three-quarters said cuts would be in response to cooling inflation, while 28% said they'd be due to the start of a recession.

--With assistance from Kristy Scheuble, Reade Pickert and Michael Mackenzie.

(Adds economists' comments)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.