A series of inter-linkages are exacerbating the demand slowdown in the Indian economy, according to Pranjul Bhandari, chief India economist at HSBC.

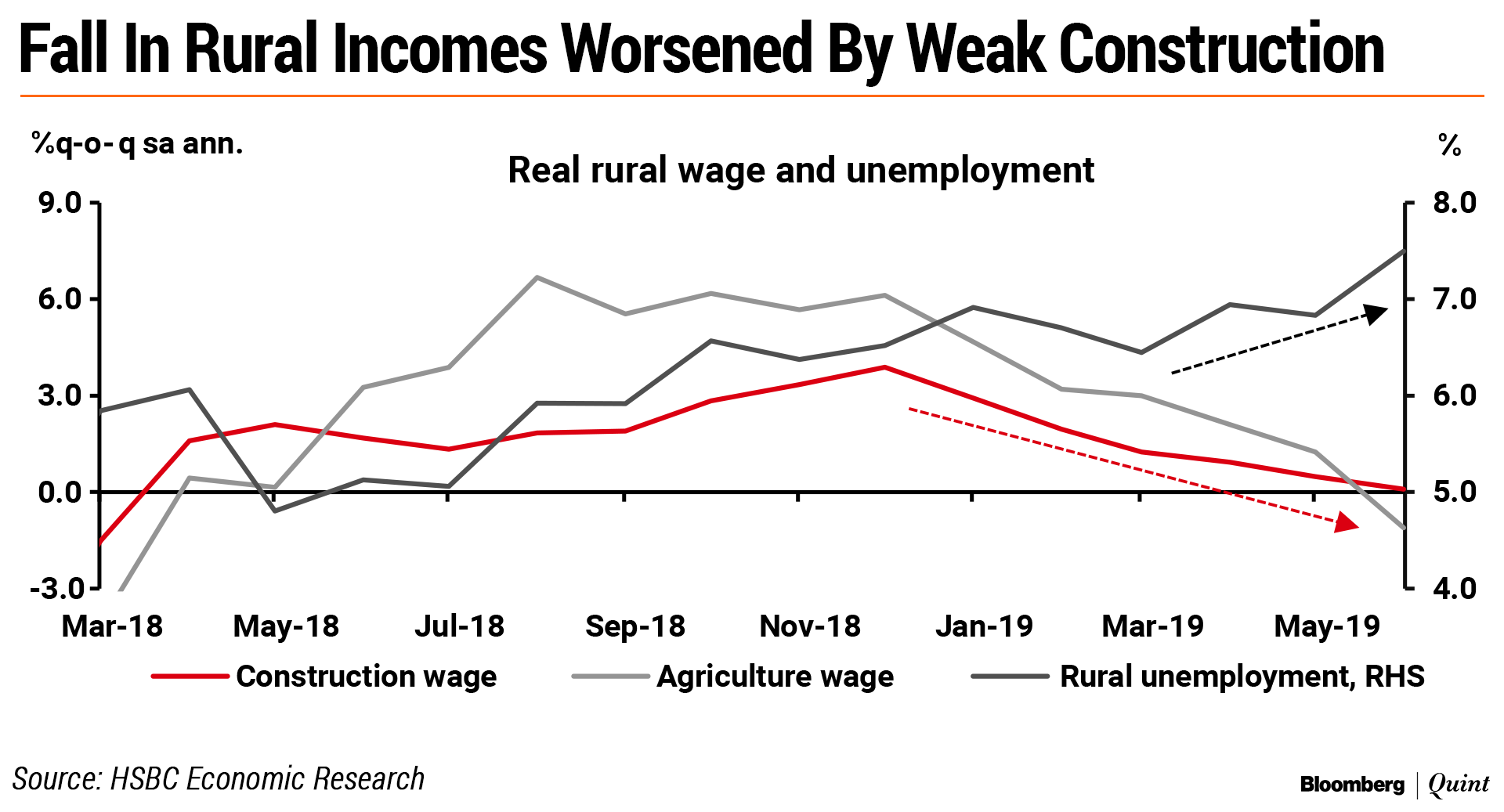

While the economy was already facing weak rural demand due to low wage growth in the farm sector, problems have been compounded by the crisis faced by non-bank lenders, which has led to a slowdown in construction activity. This, in turn, is hurting wage growth in the construction segment of the rural economy, shows Bhandari's research.

According to an Aug. 22 HSBC report, construction wages started falling again from January 2019, after a modest pick-up between July and December 2018. This, Bhandari believes, coincides with a worsening of the liquidity crunch being faced by non-bank lenders.

About a decade ago, the main driver of rural income was agriculture: about 70 percent. Now, it has fallen from 70 percent to about 50 percent. In the meantime, the role of construction in rural wages has really gone up. If you look at construction, you find that about 70 percent is from real estate and if you narrow down to real estate, you find that it is very dependent on shadow banks.Pranjul Bhandari, Chief India Economist, HSBC

Given these inter-linkages, until funding to real estate improves, rural incomes may not bounce back up in a big way, she added.

Along with the continued slowdown in the rural economy, urban income growth, too, has not been particularly strong and is weighing on consumption. While the dip in growth of private final consumption expenditure to 3 percent in the first quarter of FY20 may be one-off, the broader trend of moderating consumption growth remains a worry, said Bhandari.

Private consumption has been falling and I think the main reason is incomes. Rural incomes in real terms have just been growing by 1 to 2 percent, urban income growth is not very much higher. A lot of the growth was coming from leverage, which has slowed. So, all of this has made consumption weak in this slowdown period.Pranjul Bhandari, Chief India Economist, HSBC

According to Bhandari, incoming data remains weak and it is difficult to say that GDP growth bottomed out at 5 percent in the April-June 2019. She advocates continued monetary easing, together with steps to push up exports and investments. Bhandari, however, cautions against the temptation to loosen fiscal policy via large spending.

Large fiscal spending could steepen the yield curve by pushing up long term-bond yields and hurt investment. “It will spook the bond markets, so you will get negative effect, but you don't get positive effect because implementation on ground takes time.”

Watch the full interview here.

Edited excerpts of the interview:

Post the Q1 GDP data, have any of the high frequency indicators improved?

Well, we have a lot of data for July and August, but I am afraid to say that things aren't looking very much better. You see some areas of improvement, for example the PMI services has gone up, some credit for personal loans has gone up. But on the other hand, PMI manufacturing is down, credit to industry is down so can't really say we've bottomed out yet.

Has the pace of deterioration in the economy surprised you?

Yes, for instance, the April-May-June quarter, we were not expecting growth to be as low as 5 percent. A lot of people ask, what is it that really surprised you?

I have a hypothesis here. It was manufacturing where most of the surprise came and if you break down manufacturing into organised and unorganised, the unorganized sector is proxied by the organised data. Here I want to argue that some of the other unorganised sector indicators, for example, currency in circulation and rural wages are low but they didn't deteriorate between the March and June quarters. So, I don't think unorganised sector was much worse-off but organised sector fell a lot and to the extent you proxy the unorganised with organised, you have actually underestimated growth a little bit. So, I think a little bit of that happened.

But even if you correct for that, there is definitely a big slowdown out there.

Where was the organized manufacturing slowdown coming from? Is this a financing issue? Is it more than that?

Well it's across the board, right? It is a demand issue; people are not really demanding very much, incomes are low so if there is no demand, you don't produce. Then there is a funding issue and there are pockets of stress in which people are finding it hard to get cheap funding. So, it's a mix of everything at this point,demand side and supply side.

How steep to your mind is the consumption slowdown. Some have pointed out that the consumption data on the expenditure side of GDP is not very reliable.

The quarterly GDP data is not very good. Especially private consumption. It is actually just a balancing datapoint on the GDP expenditure side so you can't really go by it quarter by quarter. But if you take a more smoothened average, yes, private consumption growth has been falling and I think the main reason is incomes.

Rural incomes in real terms have just been growing by 1 to 2 percent, urban consumption is not very much higher. A lot of the growth was coming from leverage, given by the NBFC sector. That has slowed.

So, all of this has made consumption weak in this slowdown period.

As far as the rural economy is concerned, you pointed out in a recent report that it is important to focus beyond just agricultural wages.

A lot of people talk about the current slowdown in terms of the cyclical versus the structural elements. Or they say that it is a very unfortunate year, lots of things piled up from NBFC crisis to volatile markets to trade wars. But there is a third lens which I think has gone quite unnoticed. It is the inter-linkages between the sectors of the economy.

Some of these inter-linkages have strengthened more than people imagined in the last decade. Believe it or not, my analysis suggests that rural incomes depend a lot on shadow banks and I will tell you how. Earlier, about a decade ago, the main driver of rural income was agriculture at about 70 percent. Now, it has fallen from 70 percent to about 50 percent. In the meantime, the role of construction in rural wages has really gone up. So,if you look at construction, you find that about 70 percent is from real estate and if you narrow down to real estate, you find that it is very dependent on shadow banks. In FY18, 100 percent of incremental credit real estate developers raised came from shadow banks and not from commercial banks.

So, to cut a very long story short, until funding to real estate improves, I don't think rural incomes will really bounce back up in a big way.

From what you see in the data so far, what should be the policy focus right now?

According to me, these are the dos and donts.

I would say that, keep your monetary policy stance accommodative. I think rate cuts should be gradual. Even for the last policy meeting, my forecast was a 25 basis point cut,for the next policy meeting too my forecast is a 25 basis point cut. I think it should be gradual. Keep the bond market wanting for more. I think that's the best way to have transmission continue. You really want to see it continue.

One of the problems we had with the 35 basis point rate cut was a lot of people, mistakenly I think, believed that there won't be any more rate cuts.

So, I would say that, keep it low and keep it coming and keep the bond market wanting more. So, transmission will hasten. So that's one.

The second is investment. You can't escape investment. Consumption driven growth is what we are going to see in the next year, but it is going to be very soft because incomes are low, and I don't think it is very sustainable. It comes at the cost of savings. I don't see that being India's sustainable growth driver. You have to revive investment at some point because that's how you increase capacity, capacity for jobs, capacity for wages, for employment and everything. How do you do it? the private sector is not very keen right now so the government has to do it, but in a fiscally responsible way.

I can't stress enough the importance of asset recycling. A lot of other assets that the government already owns like roads, airports, they should sell them, use the money to build new roads and new airports. I think that can kick-off a lot other investments that we need coming at this point.

And the third is exports. Trade wars in the other countries throw a lot of other opportunities. India should be out there, looking for these opportunities raising its hand and taking as many orders as it can from around the world. Instead, I think what we have done is that we have imposed a lot of tariffs, which gives a sense that India is not open for trade. So, I think our external trade policy needs to be far more open. So, these are the big dos that I have.

In terms of the donts, please don't run a higher fiscal policy right now. You will just announce a big package and you'll spook the bond market; the transmission will stop and perhaps the implementation of that fiscal policy won't even be there because implementation in India takes time. It's a complicated large country.

The other don't is, don't expect growth to go back up meaningfully at this point. I think the world has changed; global growth is likely to be weak in the next two years. Never in the past has India's growth soared when the global economy is weak. So, keep your expectations muted.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.