After a decline in bad loans seen in 2018-19, weak macroeconomic conditions are leading to fresh signs of stress, shows data released by the Reserve Bank of India on Tuesday.

Loans that are overdue between 30 to 90 days, known as special mention accounts, have inched up in the first half of the current financial year, the RBI said in its report on Trend and Progress of Banking in India.

For public sector banks, loans overdue by 30-60 days, known as SMA-1 accounts, rose to 1.6 percent of total loans as of September 2019 compared to 1.3 percent six months ago. Accounts overdue by 60-90 days, categorised as SMA-2, rose to 2.2 percent at the end of September from 0.7 percent in March.

In the case of private banks, SMA-1 accounts were largely steady at 1.9 percent as on Sept. 30, 2019. However, SMA-2 accounts accounted for 1.2 percent of total loans compared to 0.5 percent in March 2019.

Gross non performing assets, which are loans overdue by more than 90 days, remained in check for public sector banks but rose for private lenders. The gross NPA ratio for PSU banks stood at 17.3 percent as on Sept. 30, 2019 compared to 17.6 percent as on March 31, 2019. Private banks reported a gross NPA ratio of 9.5 percent at the end of the second quarter of 2019-20, as compared with 8.9 percent six months ago.

Notwithstanding the enhanced resolutions through the insolvency and bankruptcy code, the overhang of NPAs remains. The health of the banking sector hinges around a turnaround in macroeconomic conditions.RBI Report - Trends & Progress Of Banking

While stress has remained elevated, banks have seen some relief from large resolutions closed under the Insolvency and Bankruptcy Act this year.

Lenders are set to recover Rs 45,000 crore from two accounts — Essar Steel Ltd and Ruchi Soya Ltd — in the third quarter of the current financial year. Until the end of last fiscal year, total recoveries banks made through Lok Adalats, debt recovery tribunals, Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI) Act and IBC, stood at 15.5 percent of the total amount involved.

The RBI, in its report, said speedier resolution of stressed assets, corporate governance and frauds need to be addressed to ensure a robust financial sector. It added that elevated stress in other segments of the financial system — such as non-banking finance companies and co-operatives — although not large enough to have systemic implications, affects the confidence of investors.

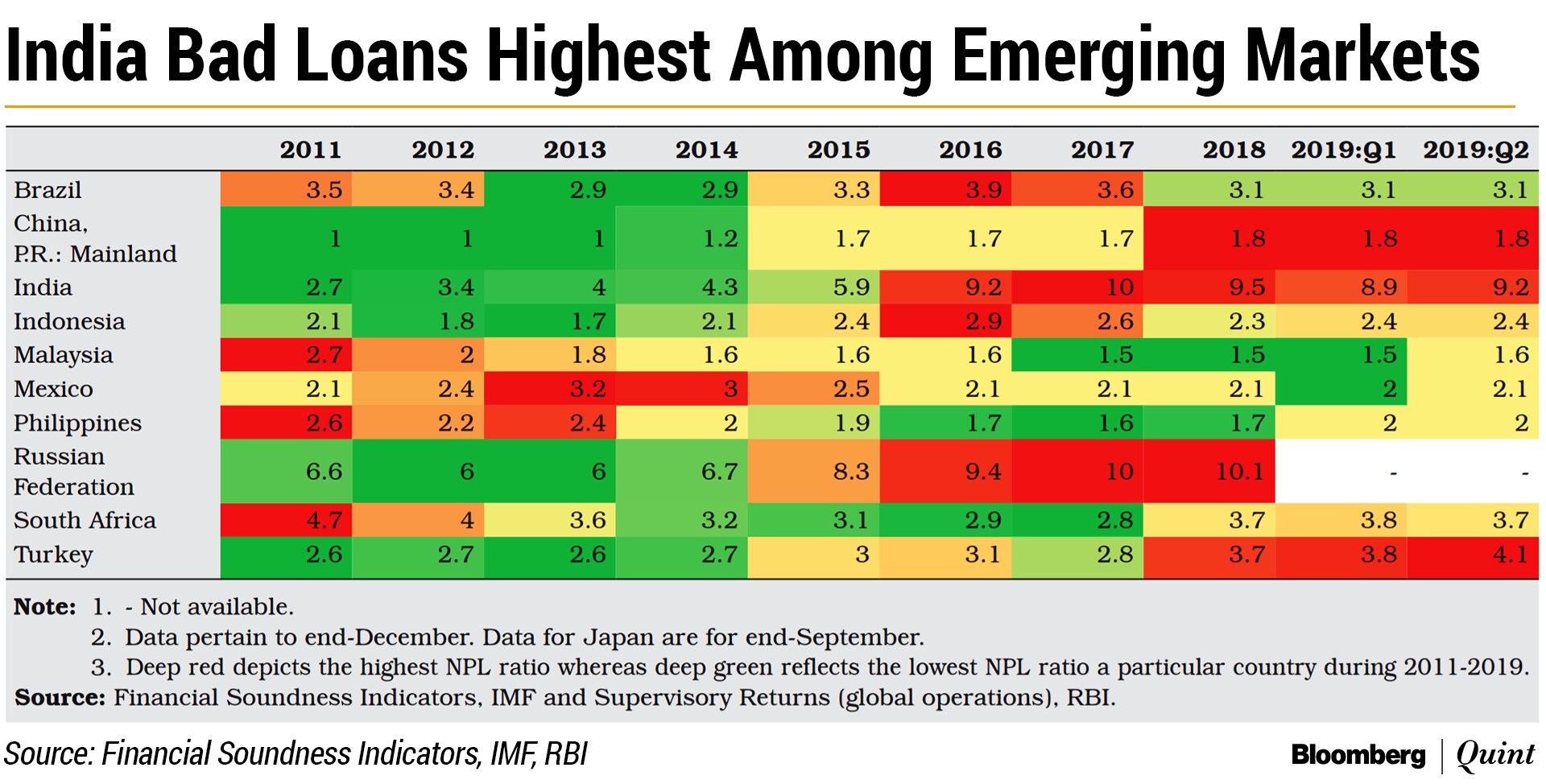

At 9.2 percent, the RBI said, India has the highest bad loan ratio among emerging markets, as on Sept. 30. The ratio stood at 8.9 percent as on March 31.

“Various sector-specific issues continued to weigh on the asset quality of banks in India. However, progress in resolution of impaired assets and various measures to clean-up balance sheets, albeit slow, is imparting a stabilising influence,” the report said.

Concerns Over Agricultural Loans

The RBI also cautioned against the rising stress in agriculture loans, owing to states offering farm loan waivers.

Total NPAs in agriculture loans, according to the RBI's assessment, rose to more than Rs 1 lakh crore for scheduled commercial banks in the financial year ended March 2019 from Rs 83,141 crore a year ago. As a share of total NPAs, gross bad loans went up to 14.6 percent from 8.6 percent a year ago.

Agricultural bad loans in public sector banks increased to Rs 95,938 crore, or 13.5 percent of total NPAs, in 2018-19. For private banks, this stood at Rs 12,679 crore, or 8.1 percent.

“The gross NPA ratio in bank lending to the agriculture sector increased in 2018-19 as well as in first half of 2019-20. In fact, analysis by the internal working group constituted by the RBI to review agricultural credit indicates that NPA levels have increased for those states that announced farm loan waivers in 2017-18 and in 2018-19,” the RBI said in its report.

Concerns Over Retail Loans

To mitigate the risk emanating from corporate loan book, Indian banks diversified their loan book and started extending more retail loans. While this strategy acted as a good risk mitigation tool, it has its own limitations, the RBI said.

“...the slowdown in consumption and overall economic growth may affect the demand for and the quality of retail loans. Moreover, household leverage and indebtedness need to be kept in focus in the context of overall financial stability,” the RBI said.

The RBI's supervisory data suggest that in the first six months of 2019-20, loan growth to services and retail sectors moderated for public sector banks, and their agricultural and industrial lending declined,” the RBI said. “For private banks, credit growth decelerated in all sectors, barring agriculture, but remained higher than that of public sector banks. Prevalence of weak consumer demand and slowdown in economic activity seem to have impinged on the overall loan growth.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.