11_07_24 (1).jpg?downsize=773:435)

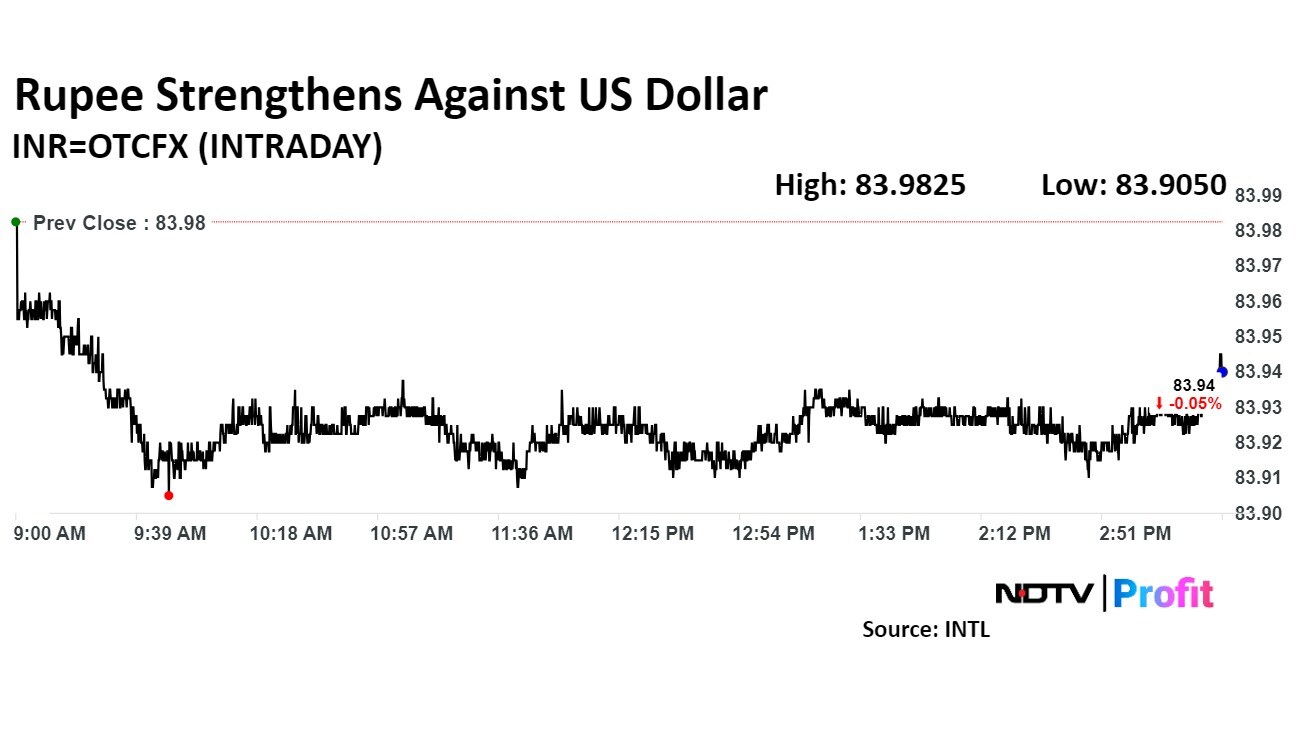

The Indian rupee closed stronger against the US dollar on Friday after nearly touching the psychologically key level of Rs 84 in the previous session. The domestic currency strengthened amid a marginal decline in the dollar index.

The rupee appreciated 3 paise to close at Rs 83.95 after opening at Rs 83.96 against the US dollar, according to Bloomberg data. The domestic currency had closed at Rs 83.98 on Thursday.

As long as the central bank maintains its firm control, capital inflows can continue to support the rupee, keeping it stable, said Amit Pabari, Managing Director of CR Forex Advisors. "However, should the RBI loosen its grip, a swift appreciation of around 30 paise could be on the horizon."

The US unemployment and nonfarm payroll data will give further direction to the overall forex market, Pabari said.

The US Dollar Index was 0.14% lower at 100.97 at 3:35 p.m. IST.

Brent Crude was trading 0.45% higher at $73.02 per barrel at 3:37 p.m. IST.

The Indian rupee, which fell to its all-time low on dollar demand, was expected to open flat, according to Anil Kumar Bhansali, Head of Treasury and Executive Director, Finrex Treasury Advisors LLP. "If RBI permits, then may cross 84.00 as dollar demand continues to hit the Indian currency."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.