The Reserve Bank of India's MPC framework has worked very well amidst multiple shocks India has witnessed, Governor Das said in the media briefing, acknowledging the 51st meeting of the MPC.

The central bank does not see any evidence of higher interest rates impinging on growth, Das said. "Growth continues to remain robust, with investment intentions looking strong."

Growth has been holding steady despite rates remaining unchanged for a year and a half, he said.

Market participants must not overlook so many positives on the overall economy, because of one data point point, Das said referring to the fall in the last PMI.

"At any given point, there will be pushes and pulls in economic activity," the RBI Governor said. PMI numbers of India are probably the highest in the world, he said.

The manufacturing PMI in September eased to the lowest since January 2024, while the services PMI fell to the lowest since November 2023.

Michael Debabrata Patra, Deputy Governor said that India's own growth and inflation dynamics are quite robust. "Have been developing buffers to deal with spillovers from the rest of the world."

The Reserve Bank of India has "great confidence" that inflation is moderating, but significant risks remain, the RBI Governor said told reporters. "The fact that growth and inflation are well poised means that monetary policy framework is working."

The central bank has achieved what it wanted to achieve through a 'withdrawal of accommodation' stance, Das said. The governor added that its "not appropriate to talk about timing of a rate cut."

First-quarter growth was lower primarily because of lower spending by state, and central governments, the RBI Governor told reporters after the policy briefing on Wednesday.

The RBI is getting a sense that the state and central governments will meet their budgetary targets on spending, Das said. "The first quarter subsidy payout was high by state and central government."

If the effects of subsidies are removed, the GDP growth would have been much above 7% in the first quarter, Das said. "We don't go by statistical factors when judging economic growth..Look for action on the growth to determine economic growth projections."

Consumption and investments—drivers of growth—continue to remain stable, RBI Governor Shaktikanta Das told reporters after the policy briefing on Wednesday.

Private investments are showing signs of pick-up, Das said. "Going by all signs, private capex and government expenditure is doing well," he said adding that the services sector is continuing to do well.

Agriculture is going to provide a big boost this time as the monsoon has been very good, Das said. Urban demand has been steady, and will get support from buoyant services sector, he said.

"Inflation is expected to be high in September and October, possibly around 5%. Near-term outlook for inflation is high, but moderation is expected. The MPC changed the stance to 'neutral' because growth and inflation are well poised. It gives us gives us optionality and flexibility to take decisions," Das said.

The Governor said rate determination is based on commercial decisions by lenders and he cannot be certain if deposit and credit rates have peaked.

"Depending on overall inflation, growth outlook, MPC will decide on policy repo rate. The lending rate, deposit rate will move in tandem with policy rate decided by MPC. It takes into account several factors when determining policy direction," Das said.

While inflation is largely under control, it was prudent for the RBI to maintain caution in the current environment, according to Jaideep Iyer, head of strategy at RBL Bank. “The governor is being cautious on rates due to stable growth and macroeconomic factors, like fiscal consolidation and geopolitical risks,” Iyer said.

He also pointed out that keeping rates unchanged benefits the banking sector.

From a banking perspective, it’s better for liquidity to be easy for a while before starting a rate cut cycle.Jaideep Iyer, head of strategy, RBL Bank

High food prices is constraining the RBI from going in for a repo rate cut, according to Dharmakirti Joshi, chief economist at CRISIL.

"The outsized US Federal Reserve rate cut of 50 basis points in September marked complete and a decisive turn in monetary policy among major central banks. Yet, for emerging market peers, domestic inflation concerns are at the front and centre," he said.

The Reserve Bank of India's decision to maintain the repo rate unchanged for the tenth consecutive time "reflects a prudent and balanced approach to monetary policy", said Samantak Das, chief economist and head – research and REIS, India at JLL.

"The change of stance to neutral is early indicator of the change in the interest rate policy going forward," he said.

Although a rate cut would have positively impacted the real estate sector by boosting home buyer sentiment during the upcoming festive season and lowering borrowing costs, Das said keeping the current rate is not expected to disrupt the market's ongoing momentum.

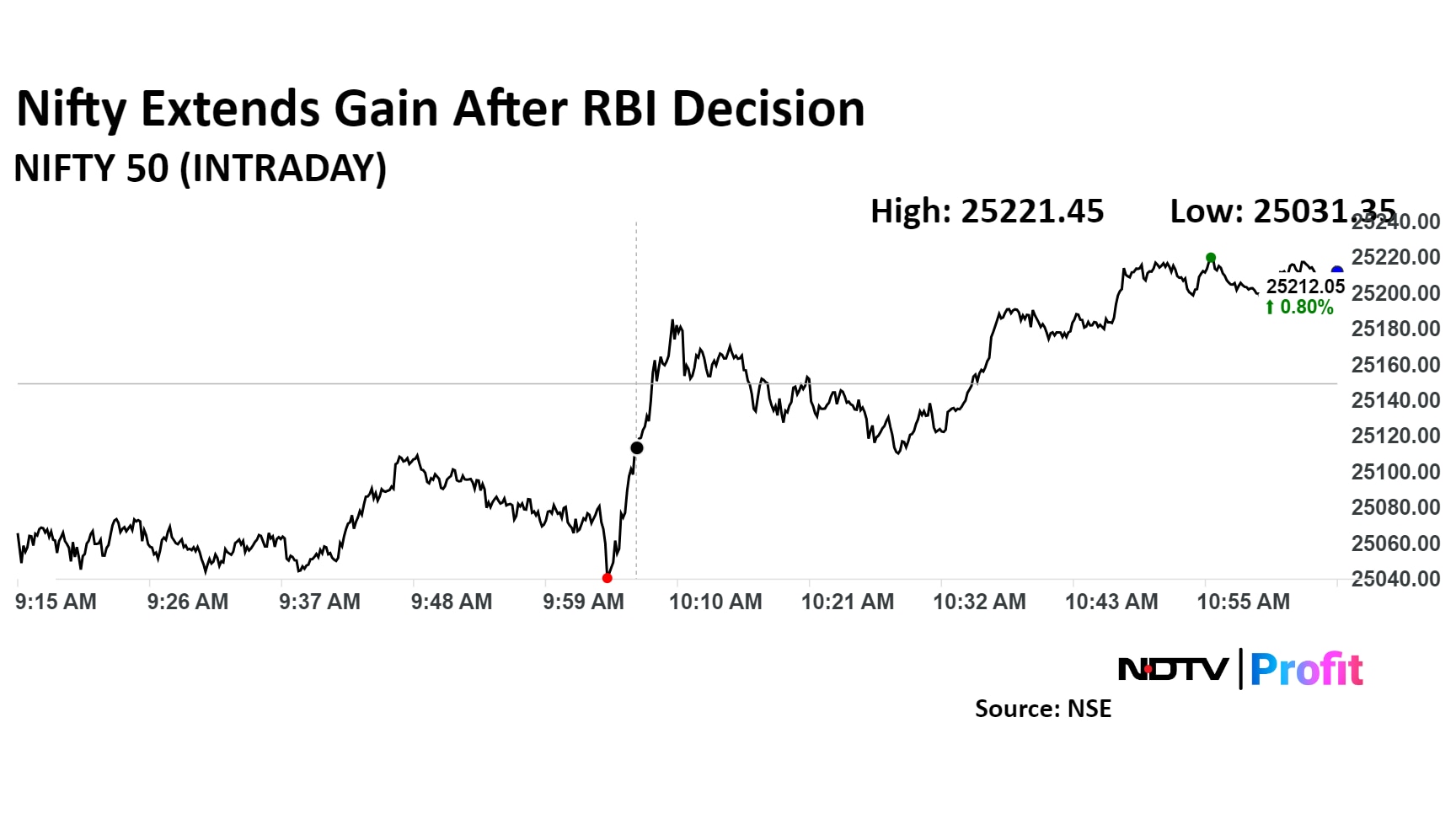

The NSE Nifty 50 and BSE Sensex extended gains after the Reserve Bank of India kept its benchmark repo rate unchanged at 6.5% in line with market expectation. The Nifty and Sensex were trading 0.8% and 0.7% higher, respectively as of 11:05 a.m.

The NSE Nifty 50 and BSE Sensex extended gains after the Reserve Bank of India kept its benchmark repo rate unchanged at 6.5% in line with market expectation. The Nifty and Sensex were trading 0.8% and 0.7% higher, respectively as of 11:05 a.m.

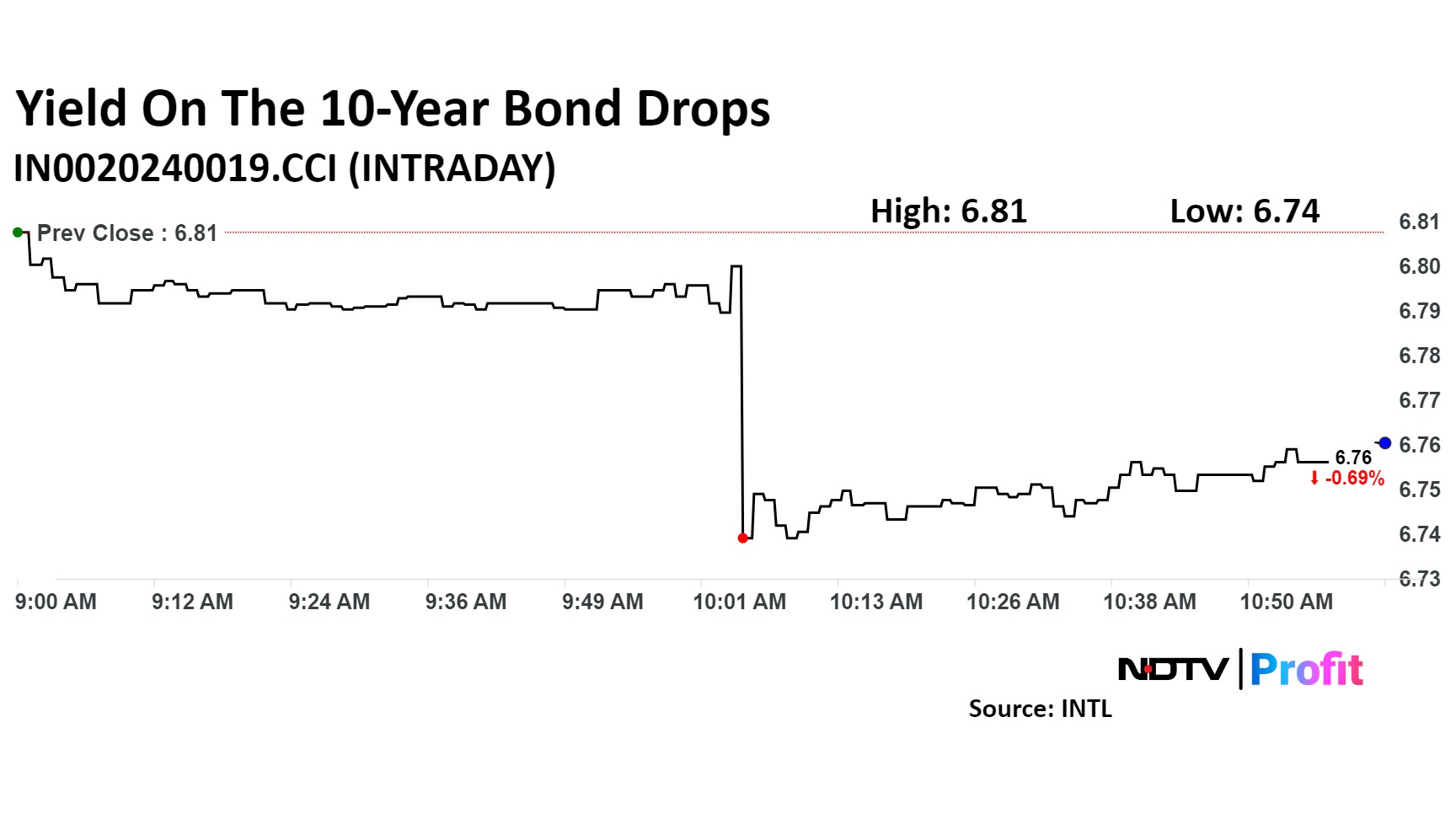

The yield on the 10-year government bond dropped five basis points to 6.76% after the RBI decided to keep repo rate unchanged but moved stance to neutral.

The yield on the 10-year government bond dropped five basis points to 6.76% after the RBI decided to keep repo rate unchanged but moved stance to neutral.

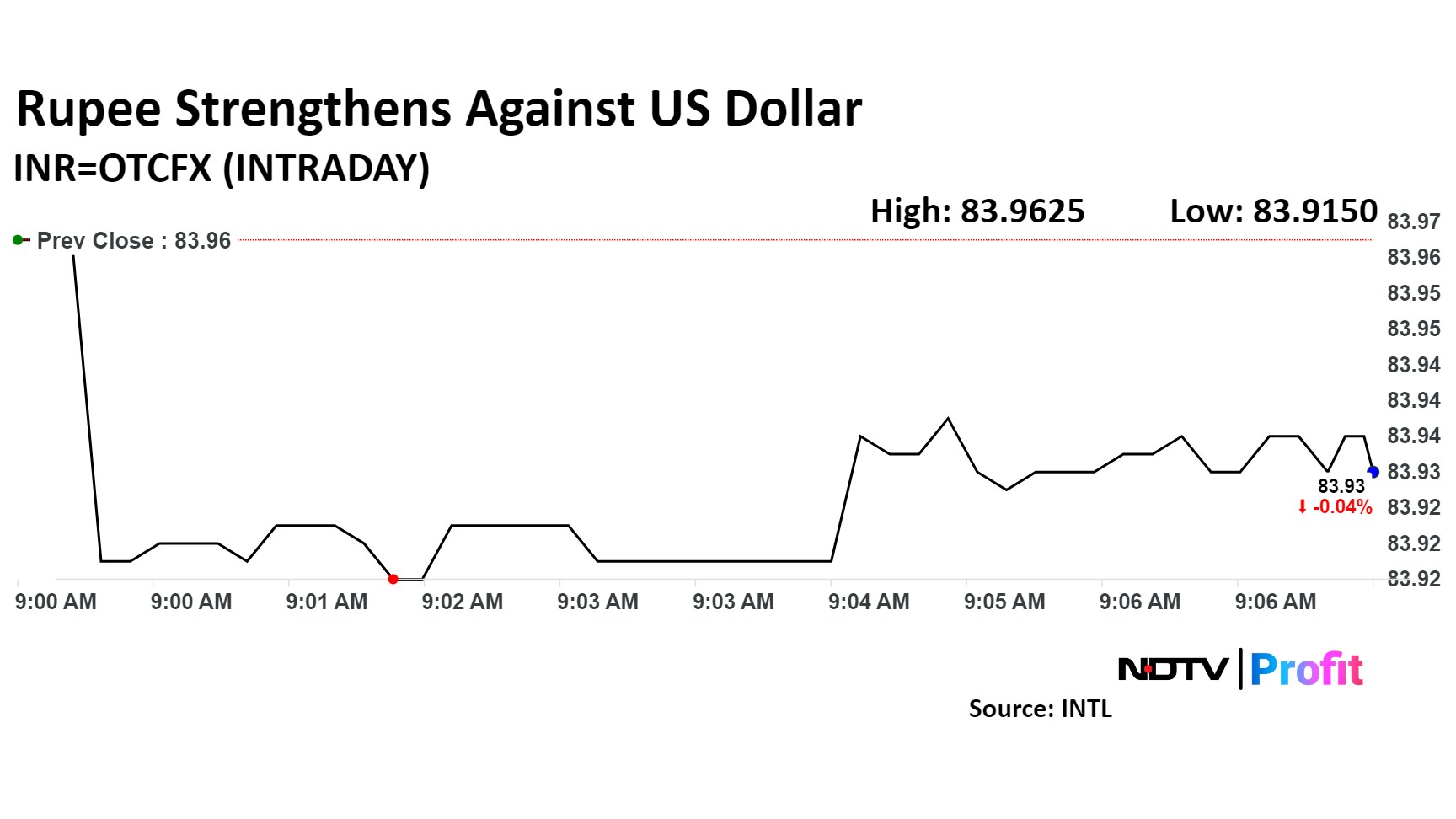

The Indian unit was trading flat at 83.95 against the US dollar as of 10:59 a.m. after the RBI held rate steady at 6.5%. The Indian unit opened 4 paise higher at 83.92 a dollar on Wednesday, according to data on Cogencis.

"It is okay to be cautious on cutting rates, given the geopolitical concerns," said Jayesh Mehta, Vice Chairman and CEO at DSP Finance. He said there is scope for rate change in December.

Katrina Ell, director of economic research at Moody’s Analytics, said the shift to neutral sets up expectations for a cut in December. "Upside risks to food inflation on weather events need to be kept in mind. India's near term inflation environment is vulnerable to oil prices. RBI has set the stage for a rate cut in December, but risks from changes in external conditions remain."

"RBI has undertaken initiatives to strengthen urban cooperative banks. Climate change is emerging as significant risk to financial sector globally. RBI proposes to create data repository 'RBI Climate Risk Information System"

"We are not complacent, especially amid rapidly evolving global conditions. Monetary Policy reflects MPC's view that it is appropriate to have greater flexibility and optionality to act in sync with emerging conditions. Stand unambigously committed to ensure durable alignment of inflation to target, while supporting growth."

"India's current account deficit widened to 1.1% of GDP in Q1. Buoyancy in services exports, strong receipts are expected to keep CAD manageable. FDI flows remain strong in the current financial year. External commercial borrowings moderated, but non-resident deposits recorded higher net inflows vs last year," Shaktikanta Das said.

"Some NBFCs, including microfinance companies and housing finance companies are chasing excessive returns on equity. Concerns arise when interest rates charged by NBFCs become usurious. Engaged with some NBFCs bilaterally on business practices. NBFCs may review compensation practices, which seem to be purely target driven in some cases. Important for NBFCs to follow sustainable business goals, compliance-based culture."

"NBFCs in particular have registered impressive growth over last few years. While the overall NBFC sector remains healthy, have messages for a few outliers. Observed that some NBFCs are pursuing growth without appropriate risk management framework. Growth at any cost approach would be counter productive to NBFCs," he said.

"RBI proactively conducted two-way operations to manage liquidity over last two months. Yields on three-month T-bills and commercial papers have eased. 10-year G-Sec yields have softened on global cues. Term premium has remained stable in the recent few months. Transmission of rates to the credit market has been satisfactory," said the Governor.

"Prevailing and expected inflation growth balance have created congenial conditions for change in stance to "neutral". Significant risks to inflation from adverse weather events, geopolitics, increase in commodity prices continue to stare at us. It is with a lot of effort that the inflation horse has been brought to the stable

CPI inflation seen at 4.1% in Q2, 4.8% in Q3, 4.2% in Q4, 4.3% in Q1 FY26.

"CPI print in September expected to see big jump due to unfavourable base, food prices. Headline inflation trajectory is projected to sequentially moderate in Q4. Unexpected weather events, geopolitics continue to pose major upside risks to inflation. Recent uptick in food, metal prices if sustained can add to upside risks to CPI inflation," said RBI Governor Shaktikanta Das.

Real GDP growth in Q2 seen at 7%, Q3 at 7.4%, Q4 at 7.4%, Q1 FY26 at 7.3%.

"Domestic growth has sustained momentum. Global economy has remained resilient since last meeting. Downside risks from geopolitical conflicts, financial market volatility, elevated public debt continue to play out. World trade is exhibiting improvement," said Shaktikanta Das.

"Food inflation pressures could see some easier on back of kharif sowing, good soil moisture. Core inflation appears to have bottomed out", said Governor Das.

MPC voted to remain unambiguously focused on durable alignment of inflation to target while supporting growth.

The RBI has kept repo rate unchanged at 6.5%.

Flexible inflation targeting has served us well over the years, proved its mettle, says Das.

The Reserve Bank of India's MPC will decide on interest rate today. Banks and financial institutions, NBFCs, auto companies and housing and real estate stocks will be in focus.

Watch RBI Governor Shaktikanta Das address the press conference in Mumbai where he will announce the decision of the MPC on interest rate.

The RBI MPC committee had first raised rates by 40 basis points at an unscheduled meeting in May last year, followed by 50 basis points each in June, August and September. It raised rates by a further 35 basis points in December last year, followed by a hike of 25 basis points in February this year.

Only three of the 13 economists polled by Bloomberg expect the MPC to cut the repo rate by 25 basis points, with the remaining expecting a status quo for the tenth straight meeting. The benchmark lending rate is at 6.5%.

The first cut and change in stance is likely in December 2024 or February 2025, according to Soumya Kanti Ghosh, chief economic advisor at the State Bank of India. "We, however, believe a possibility of growth slowing down incrementally with the leading indicators showing a declining momentum and increasing geopolitical risk might prompt a rewording of communication from RBI highlighting the need to have a balanced growth inflation balance," he added.

The NSE Nifty 50 and BSE Sensex opened higher on Wednesday ahead of the Reserve Bank of India's monetary policy announcement. Infosys Ltd. and State Bank of India led the gains in the indices.

As of 9:17 a.m., the Nifty 50 was up 0.19% at 25,058.45, while the Sensex rose 0.21% to 81,82.39.

Follow live market action here.

The NSE Nifty 50 and BSE Sensex opened higher on Wednesday ahead of the Reserve Bank of India's monetary policy announcement. Infosys Ltd. and State Bank of India led the gains in the indices.

As of 9:17 a.m., the Nifty 50 was up 0.19% at 25,058.45, while the Sensex rose 0.21% to 81,82.39.

Follow live market action here.

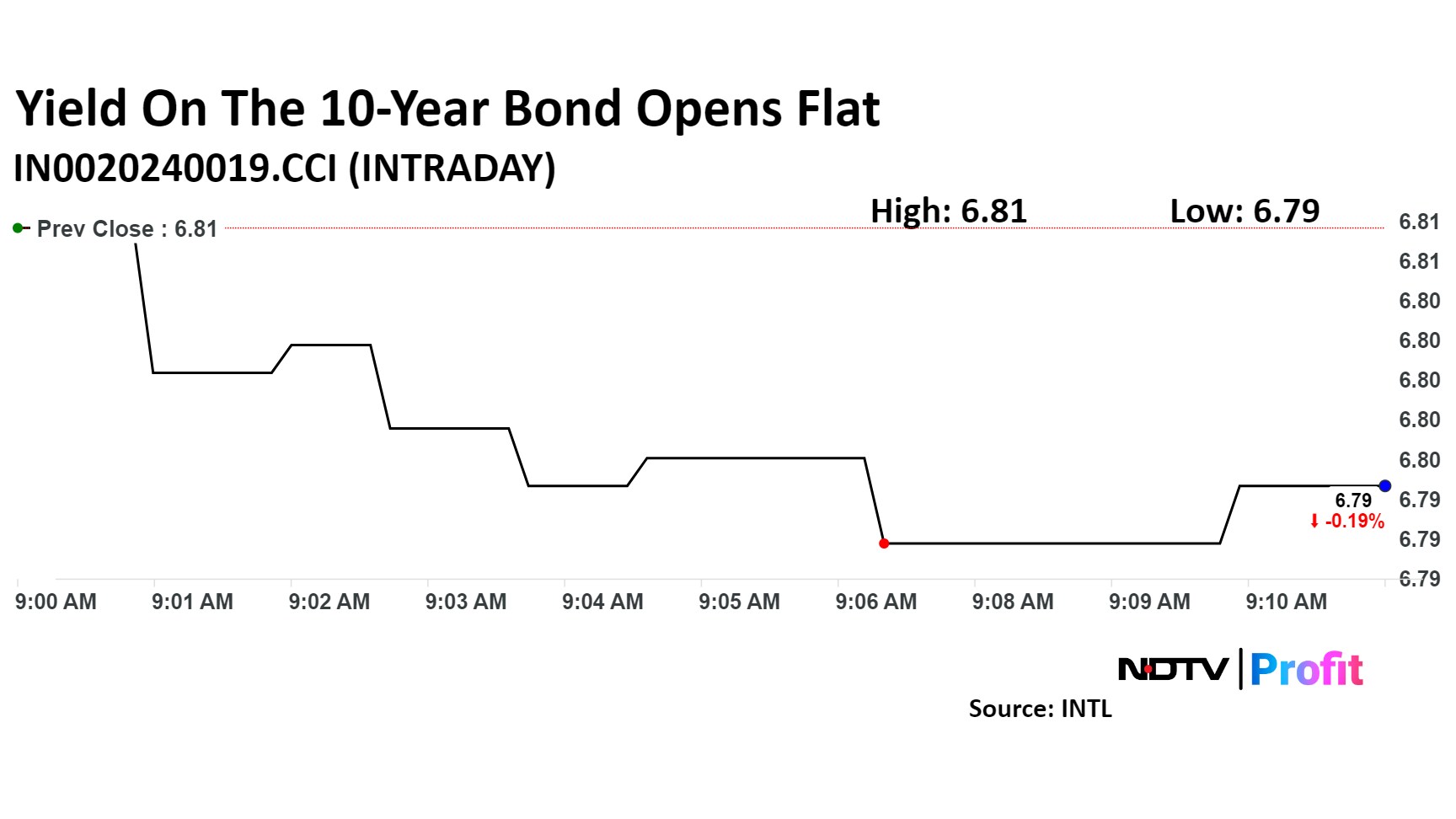

The yield yield on the 10-year bond opened flat at 6.80%, ahead of the RBI Monetary Policy Committee decision on the repo rate. It closed at 6.79% on Tuesday.

Source: Bloomberg

The yield yield on the 10-year bond opened flat at 6.80%, ahead of the RBI Monetary Policy Committee decision on the repo rate. It closed at 6.79% on Tuesday.

Source: Bloomberg

The Indian rupee strengthened by 4 paise to open 83.92 against the US dollar. It closed at 83.96 on Tuesday.

Source: Bloomberg

The Indian rupee strengthened by 4 paise to open 83.92 against the US dollar. It closed at 83.96 on Tuesday.

Source: Bloomberg

According to RBI's money market data, the banking system currently has a liquidity surplus of approximately Rs 1.57 lakh crore. After experiencing a prolonged deficit, liquidity has remained in surplus for the past two to three months, leading the RBI to employ variable rate reverse repo (VRRR) auctions to manage the excess.

India's benchmark equity indices snapped their six-session losing streak to end higher on Tuesday, led by heavyweights HDFC Bank Ltd., Infosys Ltd., and Reliance Industries Ltd. They ended higher even as most global markets fell, and investors now await the outcome of the monetary policy committee meeting due on Wednesday.

The Nifty 50 closed 0.88%, or 217.40 points, higher at 25013.15, and the Sensex gained 0.72%, or 584.81 points, to end at 81634.81. Intraday, both the indices gained 1% and 0.88%, respectively.

RBI Governor Shaktikanta Das is set to announce the decision of the six-member Monetary Policy Committee on Wednesday, October 9, at 10:00 a.m.

Retail inflation rose to 3.65% in August, compared to 3.54% in July. In July, the inflation was the lowest in nearly five-years. Despite the uptick in August, it remains within the central bank's target of 4% aided by the base effect.

Food inflation is likely to remain elevated. Prices of key vegetables, such as onions and tomatoes, climbed in September, according to high frequency data by the Department of Consumer Affairs, as several parts of the country saw crop damages amid excessive rains.

CPI is expected to remain below 5% in the remaining months, except for September because of unfavourable base effect, Ghosh said. "However, for the full year FY25, CPI inflation is likely to average to 4.5%-4.6% and will remain In the RBI’s targeted range of 4-6%."

The next RBI Monetary Policy Committee meetings for financial year 2024-25 will be held on the following dates:

Dec. 4-6, 2024

Feb. 5-7, 2025

The central bank holds six bi-monthly meetings annually. Previous meetings in this financial year took place in April, June, and August.

India's Monetary Policy Committee in its August meeting decided to keep the benchmark repo rate unchanged but was ready to act as and when needed, amid sticky inflation at home and banking crisis elsewhere.

Key takeaways from RBI Governor Shaktikanta Das' speech:

The decision to keep the repo rate unchanged at 6.5% was unanimous.

The standing deposit facility rate pegged 25 bps below the repo rate, is at 6.25%.

The marginal standing facility rate, which is 25 bps above the repo rate, is at 6.75%.

The committee had first raised rates by 40 basis points at an unscheduled meeting in May last year, followed by 50 basis points each in June, August and September. It raised rates by a further 35 basis points in December last year, followed by a hike of 25 basis points in February this year.

The MPC decided with 5:1 majority to remain focused on the withdrawal of accommodation, Das said.

On Oct. 1, the government appointed three new external members, including Ram Singh, Saugata Bhattacharya, and Nagesh Kumar, to the Reserve Bank of India’s monetary policy committee. These new members are replacing Mumbai professor Ashima Goyal, IIM-Ahmedabad professor Jayanth Varma, and New Delhi senior adviser Shashanka Bhide, whose tenure ends on Friday. The other members of the committee include Governor Shaktikanta Das, Deputy Governor Michael Patra, and Executive Director Rajiv Ranjan.

Also Read: All You Need To Know About The New External Members of RBI MPC

The Reserve Bank of India is expected to maintain the current benchmark interest rate during this Monetary Policy Committee meeting.

Only three of the 13 economists polled by Bloomberg expect the MPC to cut the repo rate by 25 basis points, with the remaining expecting a status quo for the tenth straight meeting. The benchmark lending rate is at 6.5%.

According to Soumya Kanti Ghosh, chief economic advisor at the State Bank of India, the first cut and change in stance is likely in December 2024 or February 2025,

However, Nomura stated that it expects the October meeting to mark the start of monetary policy inflection.

The last hike in the repo rate happened in February 2023 when it was increased to 6.5%, and since then, it has remained unchanged in the subsequent nine bi-monthly monetary policy reviews.

Read full story here.

The Monetary Policy Committee or MPC of the Reserve Bank of India chaired by Governor Shaktikanta Das began its 3-day MPC meeting on Monday, Oct. 7, to discuss the fourth bi-monthly monetary policy for the fiscal year 2024-25. Key areas of the decision making process included interest rates, inflation, growth outlook and oil prices.

Das will announce the decision of the six-member MPC at 10:00 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.