(Bloomberg) --

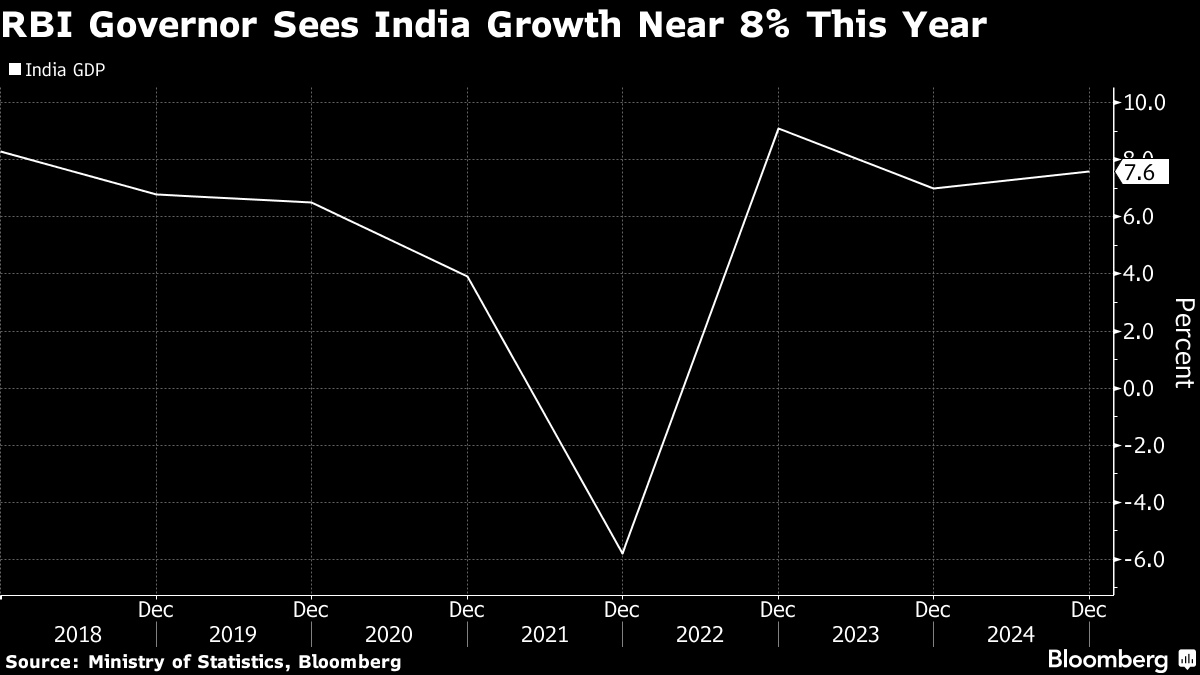

India's economy will likely grow faster than the government is predicting, reaching close to 8% in the fiscal year through March, central bank Governor Shaktikanta Das said.

“High frequency indicators suggest every possibility 7.6% growth for current year being exceeded,” Das said in an interview with ET Now television channel on Wednesday. “The growth for the current year could be very close to 8%.”

The government last week raised its full-year projection after reporting surprisingly strong growth in the final three months of 2023. The Reserve Bank of India is forecasting growth of 7% for the coming fiscal year, making the economy one of the fastest-expanding in the world.

The momentum of economic activity is robust in the current year, Das said, adding that urban demand and investment activity has been strong. He said rural demand is showing signs of revival, private investment is picking up and capacity usage is high.

Das said the rate setters won't reduce interest rates before being sure that inflation would settle durably around its 4% goal.

The RBI has kept its benchmark repurchase rate unchanged and stuck to a relatively hawkish policy stance for several months as inflation remains well above its target.

Here's more from the interview:

- Das defended RBI's recent regulatory action against Paytm Payments Bank and said it was not against the fintech industry

- “RBI is and remains fully supportive of fintechs,” he said. The central bank has given “sufficient time” till March 15 to the bank before it must close business, Das said

- The central bank is constantly monitoring non-banks that give loans for subscribing to initial public offerings

- Das said use of rupee for settlements with India's trade partners will gain more acceptance

(Updates with more details and a chart)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.