(Bloomberg) -- Indian shadow lenders are luring some of the nation's biggest fund managers as their notes offer the biggest premium in nearly four years over sovereign bonds.

Asset managers such as ICICI Prudential Life Insurance Co., Edelweiss Asset Management Ltd. and Star Health and Allied Insurance Co. are among those betting on rupee bonds of non-bank finance companies as the spreads become attractive.

“This is the right opportunity to buy bonds of some NBFCs,” said Arun Srinivasan, chief for fixed income investments at ICICI Prudential Life. The fund manager, who oversees 1.6 trillion rupees ($19.2 billion) in assets, has increased holdings in shadow lenders by about 5% this quarter and plans to add more.

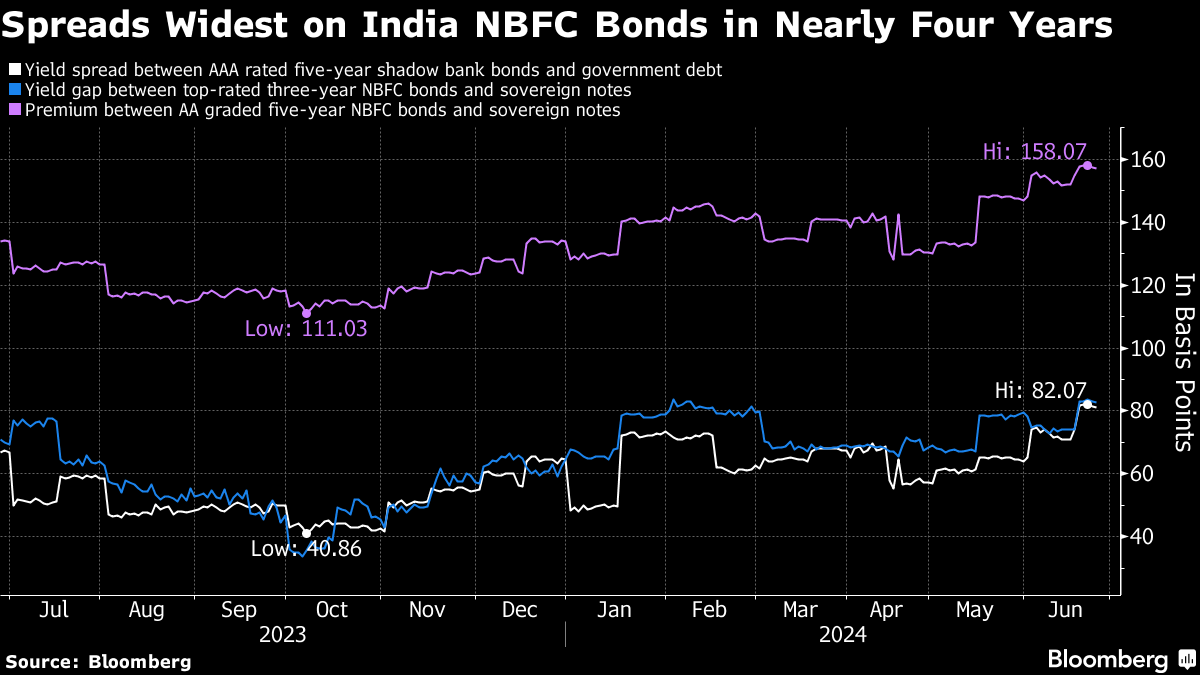

The yield spread between top-rated five-year rupee bonds of NBFCs and similar maturity government debt expanded to 82.1 basis points on Friday — the highest since October 2020 — before narrowing slightly this week, according to data compiled by Bloomberg. The premium on three-year notes was even higher at 83.6 basis points.

Shadow lenders have raised a record amount from domestic and offshore bond markets this year as banks reduced lending to the sector following tighter regulations by the central bank in November. These financiers are an integral part of the economy, lending to everyone from roadside vendors to property tycoons. Any funding strains risk hurting economic growth — one of the fastest in the world.

“Credit growth for NBFCs remains strong, and hence to meet the demand they are borrowing even at higher spreads because they can pass on the cost,” said Dhawal Dalal, president and chief investment officer for fixed income at Edelweiss Asset. “We like AAA rated two-to-three-year bonds of shadow banks and have added those in our hybrid funds.”

The spreads are still not attractive enough for everyone as there might be a scope for further widening when more suppliers tap the market.

“We are not going big on NBFC bonds,” said Murthy Nagarajan, head of fixed income at Tata Asset Management Pvt. “That's because we expect the spreads to remain elevated and widen a bit more as supply of bonds is expected to increase.”

The premium on AA graded five-year shadow bank bonds is near the highest since December 2020 at 157.1 basis points. The widening comes as bank lending to the sector grew at a slower pace of 14.6% in April, compared to 29.2% a year earlier, according to the latest Reserve Bank of India data.

“Bank funding to NBFCs has slowed and hence they have stepped up their bond borrowings, pushing the spreads higher,” said Aneesh Srivastava, chief investment officer at Star Health. “We are keeping a close watch and are buying at every opportunity available.”

--With assistance from Subhadip Sircar and Khushi Malhotra.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.