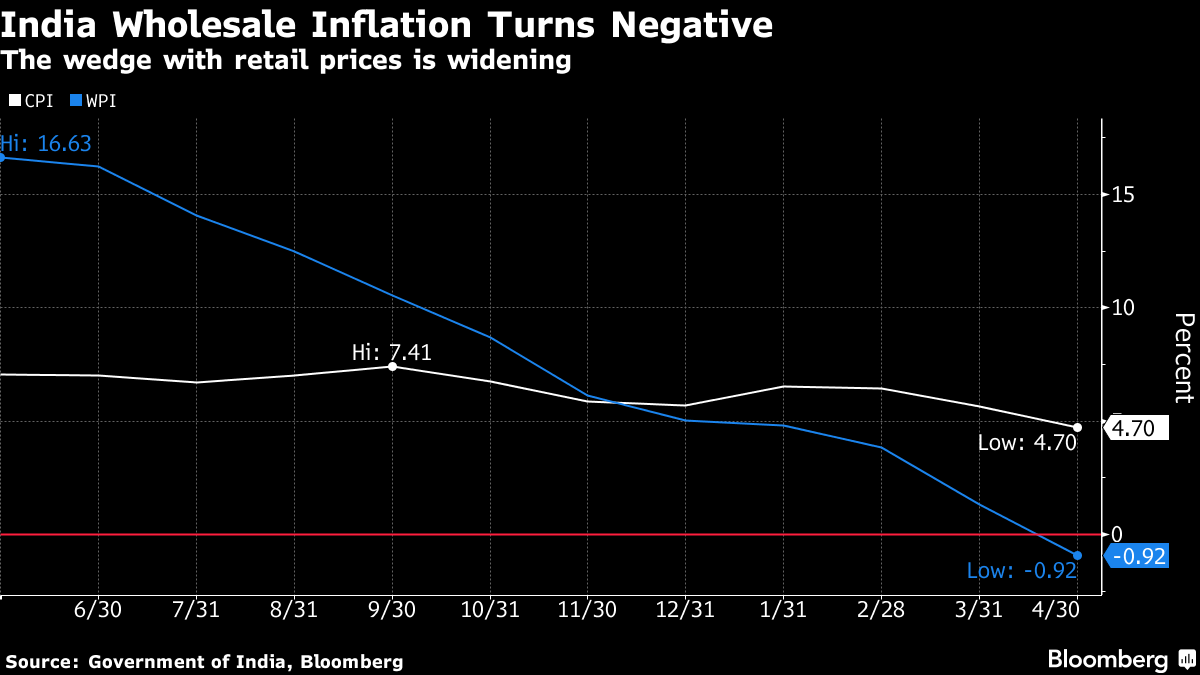

(Bloomberg) -- India's wholesale prices contracted for the first time in almost three years after global commodity prices softened, bringing down input costs for producers.

Wholesale price index declined 0.92% in April from a year earlier, the Commerce Ministry said in a statement Monday. That compares with a 1.34% rise in March and the median estimate of a 0.40% drop in a Bloomberg survey. The decline is primarily contributed by fall in prices of basic metals, food products, mineral oils and textiles, among others, the ministry said.

Indian bonds held Friday's gains spurred by expectations that easing inflation would prompt the central bank to extend a rate pause as retail inflation — the key metric targeted by the monetary authority — fell within its target band, while economic growth slowed following an aggressive tightening cycle.

WPI was in negative zone last in July 2020 when the world's biggest lockdown to prevent the spread of coronavirus killed demand. The latest contraction marks a wild swing in input cost pressures for India's manufacturers who saw wholesale inflation soaring to a a three-decade-high last year following Russia's invasion of Ukraine.

“The negative WPI will help growth more than inflation because input price pressures are easing for producers,” said Gaurav Kapur, chief economist with Indusind Bank Ltd. “Eventually this should help bring down output prices as well.”

Data released Friday showed retail inflation slowed to 4.70% — the weakest in 18 months. The wedge between the two gauges reflects reluctance of manufacturers to pass on input cost benefits to customers. Several of them had absorbed costs when commodity prices were rising last year, affecting their margins.

Prices of manufactured products fell 2.42% from a year ago, while prices of food articles rose 3.54%, followed by an increase of 0.93% in fuel and power prices, according to Monday's release.

The fall in both consumer and wholesale inflation comes amid economic growth concerns and would likely allow the Reserve Bank of India's rate setting panel to pause for an extended period before it starts lowering rates. The panel kept the benchmark repurchase rate unchanged at 6.50% in April, after raising it cumulatively by 250 basis points since May last year. RBI's next rate decision is due June 8.

--With assistance from Tomoko Sato.

(Updates with details throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.