(Bloomberg) --

Tightening enforcement of US sanctions is denting India's oil trade with Russia, forcing processors to consider other supplies, according to refinery executives familiar with the matter.

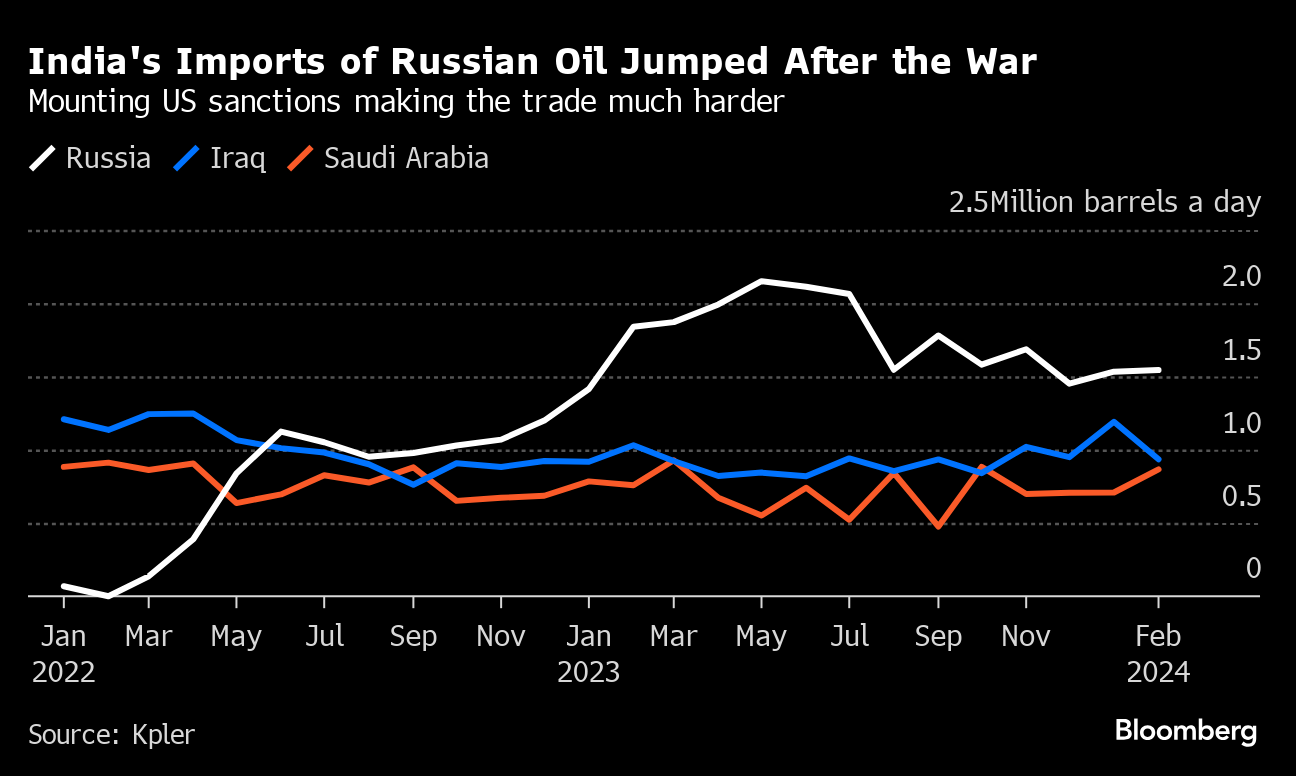

Russia is still the dominant supplier to India, but there are signs refiners are buying more from elsewhere. Overall imports from Saudi Arabia are 22% higher this month than January, with the biggest private refiner — Reliance Industries Ltd. — taking its highest volume since May 2020, according to Kpler.

India's refiners are keen to take more Russian oil, but there would need to be US approval for buying to ramp up again, the executives said, asking not to be identified because the information is private.

Russian oil is now only $2-$4 a barrel cheaper than other supplies and double-digit discounts are unlikely to return due to competition for barrels from China, the executives said. The discount blew out to more than $30 after the war.

India's imports of Russian oil surged after the war as refiners took advantage of cheaper barrels that other buyers shunned. At its peak last year, crude from the OPEC+ producer accounted for almost half of the nation's purchases, but fresh US sanctions has recently stranded some cargoes.

Moscow is also seeking payment in yuan due to increased scrutiny by some banks over using dirhams to settle the trade in the past few months, said a refinery executive and a government official.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.