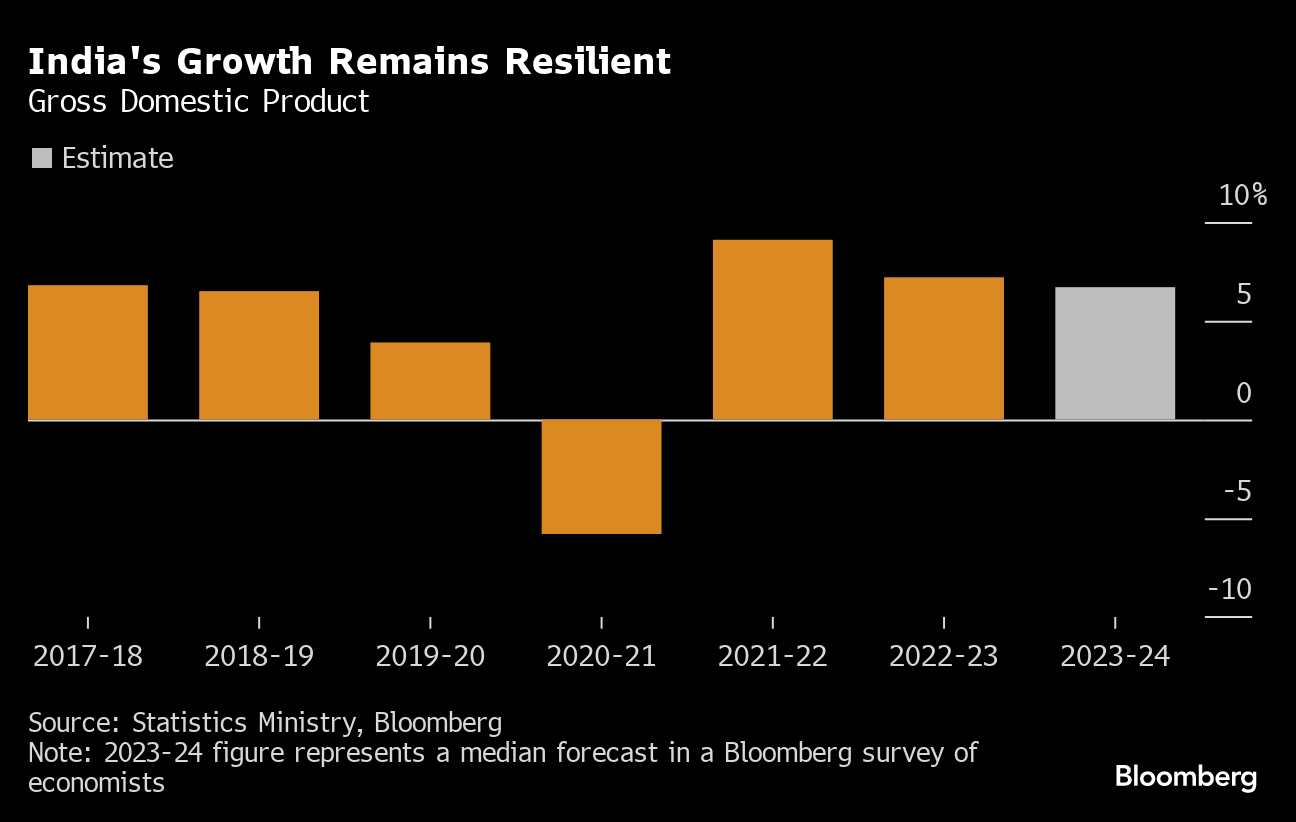

(Bloomberg) -- India's government is likely to estimate economic growth close to 7% in the current fiscal year, keeping it on track to be the fastest-growing major economy in the world.

The first official estimate for gross domestic product, due to be released on Friday, will probably be set at 6.7%, according to economists surveyed by Bloomberg. The Reserve Bank of India has already raised its projection for the fiscal year ending March 31 to 7%, while Bloomberg Economics is predicting 7.3% growth.

Strong consumer and government spending, a robust services sector, and a boost in manufacturing has helped buoy India's economy in the face of a weaker global economy and six RBI rate hikes since 2022. Prime Minister Narendra Modi's government has ramped up spending on infrastructure, while foreign businesses are investing more India, especially in tech manufacturing, as they look for alternative locations to China.

Several major banks, including Barclays Plc and Citigroup Inc., have already raised their full-year projections for the current fiscal year.

Lower commodity prices are also giving a boost to growth. India's basket of crude oil averaged $77.42 a barrel in December, its lowest level since July.

“Falling energy and other commodity prices will give room for corporates to improve their margins, which should positively influence GDP growth ahead,” said Barclays economist Rahul Bajoria.

The Indian government uses the official GDP estimate to assess spending priorities in its budget. Finance Minister Nirmala Sitharaman will present an interim budget on Feb. 1 ahead of elections due in coming months.

What Bloomberg Economics Says

Supportive policies and rapid infrastructure build-out are powering the industrial sector and helping accelerate India's integration into global supply chains.

Abhishek Gupta, India economist

For the full report, click here

Growth may be more challenging in the fiscal year beginning in April. The global economy remains uncertain, while India's inflation is still a worry for policymakers, especially food prices. The RBI has kept interest rates unchanged for five policy meetings now.

“India could see growth over its coming fiscal year slow at the margin, as sticky inflation exerts a drag, but interest rate cuts could come into view just when the country holds national elections,” HSBC Holdings Plc's economist Frederic Neumann wrote in a note. HSBC expects cuts of 50 basis points over 2024.

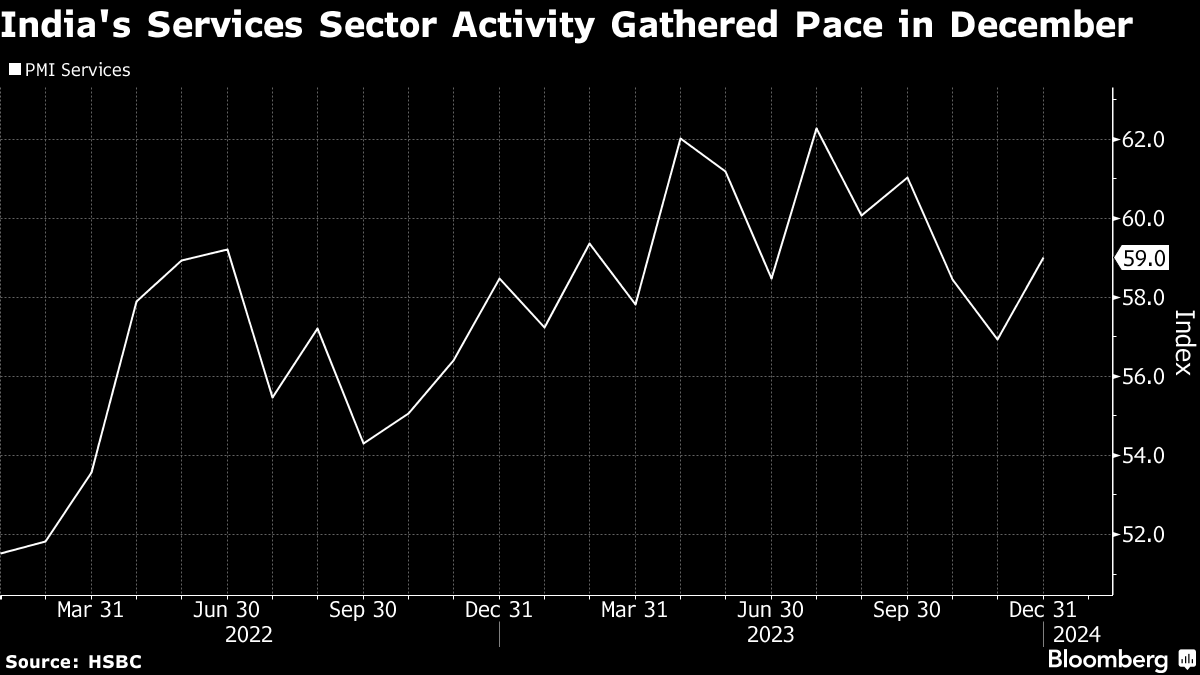

After witnessing some moderation in the past two months, services activity picked up pace in December. The HSBC India Services Purchasing Manager's Index climbed to 59.0 in December from 56.9 a month ago as sellers were able to increase prices despite cost pressures receding to their lowest in nearly three-and-a-half years.

--With assistance from Anup Roy.

(Updates with Services PMI.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.