The measures announced today by the finance minister are not enough to take care of the demand side of things and more was needed, according to Jaxay Shah, national chairman of the Confederation of Real Estate Developers Association of India.

“Looking at the grave situation of the real estate industry, I think this is not enough. The government has just scratched the surface,” Shah said. “We would've been more happy if the ECB bit directly benefited the developer instead of the HFC or the customer.”

The disruption for real estate from the triple whammy of GST, RERA and demonetisation was an elephant in the room. If everyone can see the elephant, why can the government not? The government has failed to give confidence to the housing industry.Jaxay Shah, National Chairman, CREDAI

The special fund, with about Rs 20,000 crore, could help protect about 3-3.5 lakh dwelling units, according to Anuj Puri, Chairman of Anarock Property Consultants.

“I think this is fantastic. The announcement on ECB and the fund are addressing the liquidity problem. And the second announcement (house building advance) is trying to address the demand problem,” Puri told BloombergQuint.

That said, these funds are not enough to give relief to the real estate sector as a whole. There are more than 5.5 lakh units that are stuck or delayed in top 7 cities alone which would be much higher if we consider all cities and towns.Anuj Puri, Chairman, Anarock Property Consultants

Keki Mistry, chief executive officer of HDFC Ltd., said that the special fund for stuck projects is a welcome step to allievate a lot of stress but guidelines will have to be looked at.

Mistry explained that if a project is stuck due to lack of funding and the developer has not made three monthly installments to the lending bank, then it will get classified as a non-performing asset. In which case, Mistry said, it will no longer be eligible for last-mile funding through the special window.

“This could restrict the number of projects that will benefit from the special window,” Mistry told BloombergQuint. “That is something that needs to be looked at.”

Mistry also said that if the fund will be professionally managed then HDFC will be open to making contributions to it.

The net impact from additional revenue foregone by replacing the MEIS scheme with the new dispensation will be around Rs 5,000 crore to Rs 10,000 crore, the Directorate General of Foreign Trade Alok Chaturvedi said.

The Forum for People's Collective Efforts, a not-for-profit representing homebuyers, has said that this is a landmark step by the government.

“This shows intent of Govt to clear legacy issues and this is step in that direction,” Abhay Upadhaya, President of FPCE said.

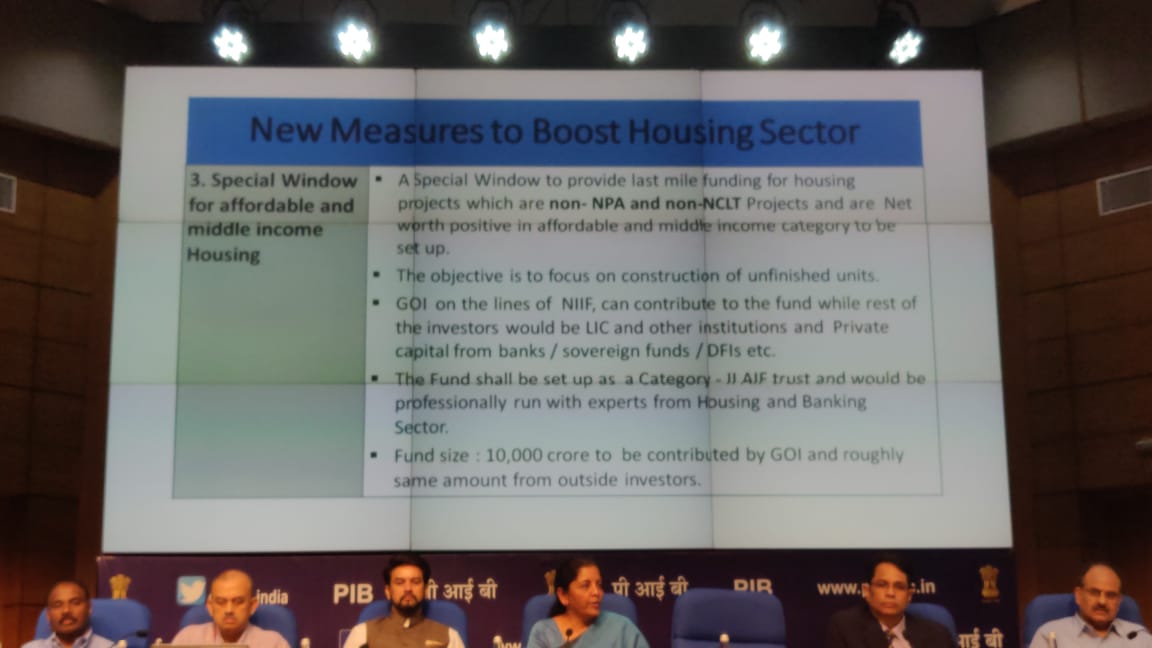

Sitharaman said that a special window will be established to provide last-mile funding for housing projects that are stalled due to a cash crunch.

The window will be applicable to projects that are not NPAs and not in the NCLT. Such projects also need to have a positive net worth in the affordable and middle-income income category.

The government will contribute Rs 10,000 crore to the fund, and roughly the same amount will come from outside investors. The government will not operate this, but will bring in external professionals to run this.

They will identify projects across the country that are middle income and affordable scheme related where nearly 60 percent of the work is complete and they don’t have any more cashflow to complete the rest of the 40 percent.Nirmala Sitharaman, Finance Minister

As a result, the middle income and affordable housing groups, where people are waiting for houses to be delivered can now find relief, Sitharaman said.

The fund will be set up as a Category-II Alternate Investment Fund trust.

Sitharaman said that a special window will be established to provide last-mile funding for housing projects that are stalled due to a cash crunch.

The window will be applicable to projects that are not NPAs and not in the NCLT. Such projects also need to have a positive net worth in the affordable and middle-income income category.

The government will contribute Rs 10,000 crore to the fund, and roughly the same amount will come from outside investors. The government will not operate this, but will bring in external professionals to run this.

They will identify projects across the country that are middle income and affordable scheme related where nearly 60 percent of the work is complete and they don’t have any more cashflow to complete the rest of the 40 percent.Nirmala Sitharaman, Finance Minister

As a result, the middle income and affordable housing groups, where people are waiting for houses to be delivered can now find relief, Sitharaman said.

The fund will be set up as a Category-II Alternate Investment Fund trust.

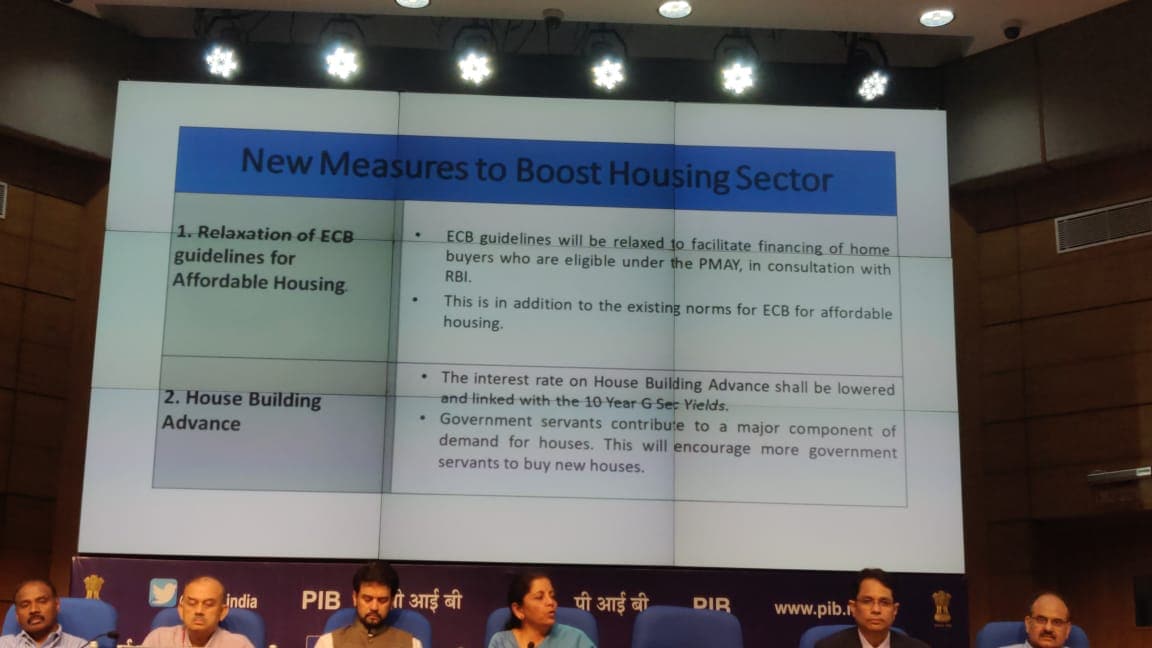

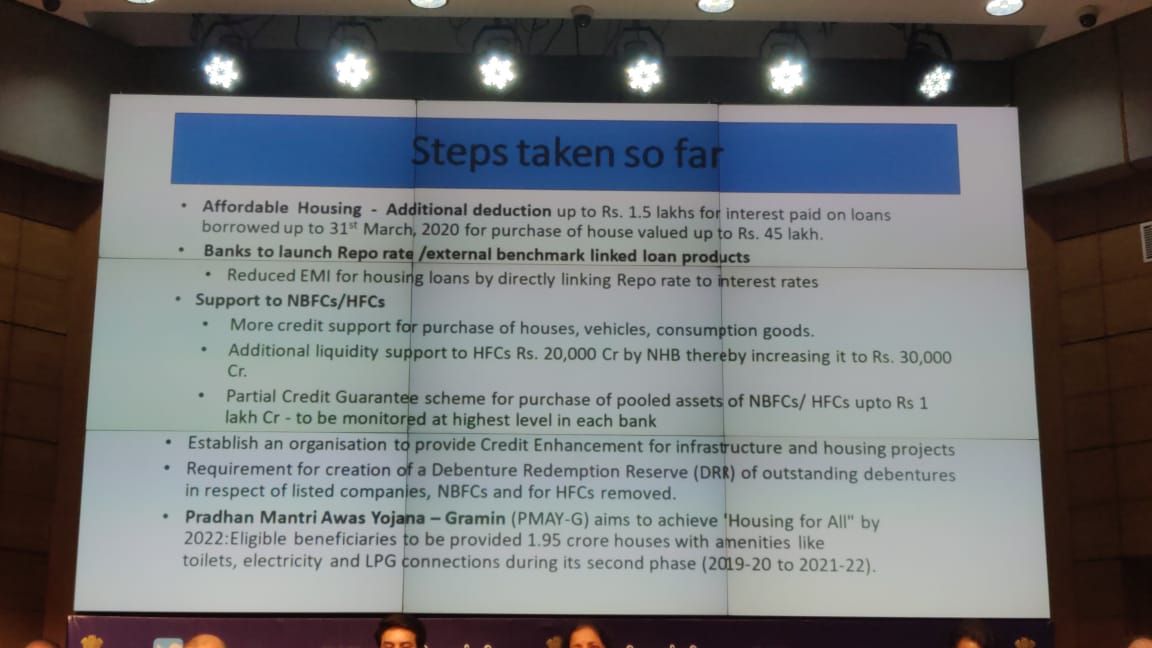

The Finance Minister announced that ECB guidelines will be relaxed to facilitate the finance of homebuyers who are eligible under the Pradhan Mantri Awas Yojana, in consultation with the RBI.

The Finance Minister announced that ECB guidelines will be relaxed to facilitate the finance of homebuyers who are eligible under the Pradhan Mantri Awas Yojana, in consultation with the RBI.

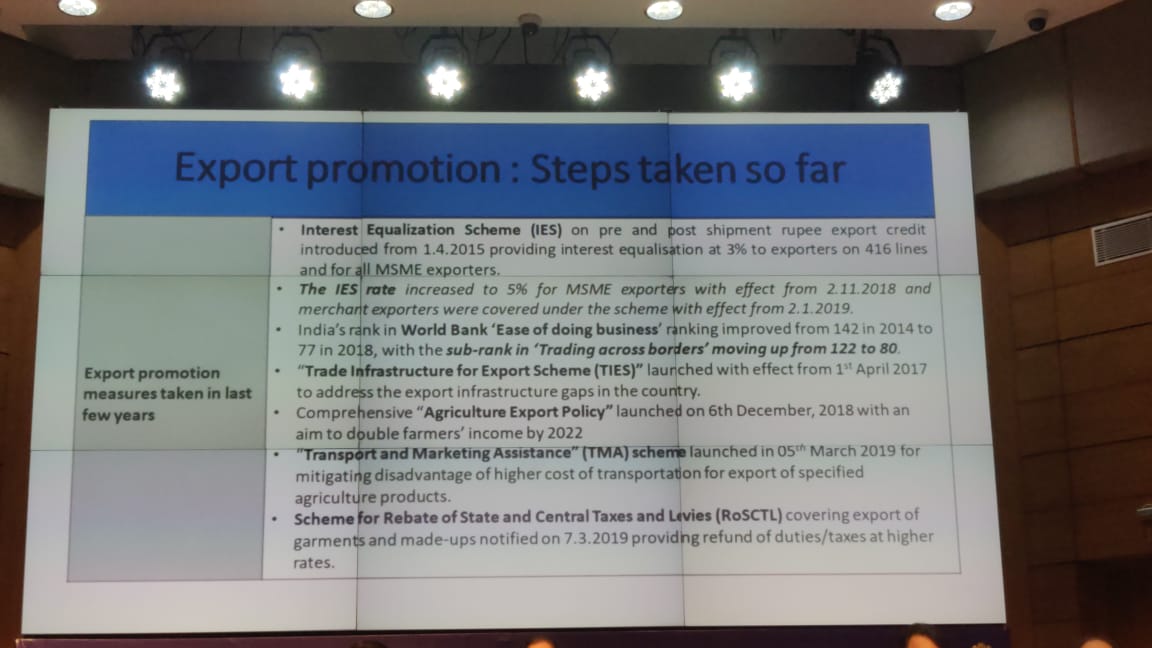

The Finance Minister announced that a special dispensation will be set up for facilitating and on-boarding handicraft artisans and cooperatives directly on e-commerce portals.

This will enable seamless exports, Sitharaman said.

The Finance Minister announced that there will be time bound adoption of all necessary mandatory technical standards and their enforcement.

A working group will be set up to address the issue of sub-standard imports.

The Finance Minister announced that there will be time bound adoption of all necessary mandatory technical standards and their enforcement.

A working group will be set up to address the issue of sub-standard imports.

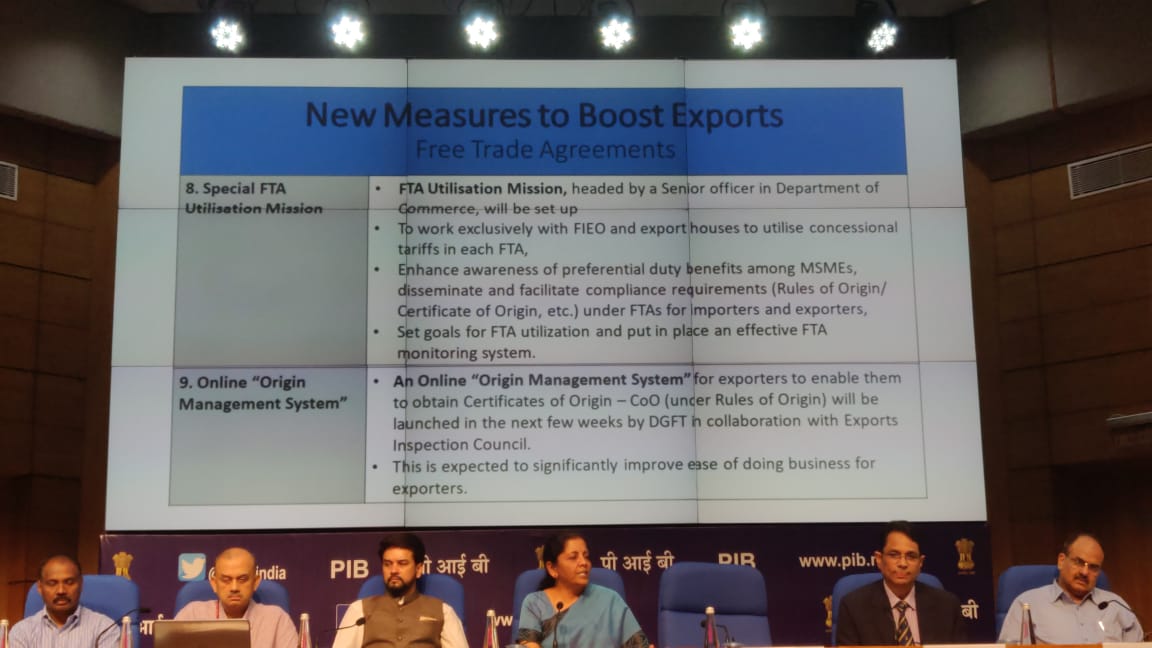

The government will set up a free trade agreement utilisation mission which will be headed by a senior officer in the Department of Commerce.

The mission will work exclusively with the Federation of Indian Export Organisations and export houses on how to best utilise the concessional tariffs that they get under various free trade agreements.

An online origin management system for exporters will also be launched in the next few weeks that will help them to obtain the Certificate of Origin.

The government will set up a free trade agreement utilisation mission which will be headed by a senior officer in the Department of Commerce.

The mission will work exclusively with the Federation of Indian Export Organisations and export houses on how to best utilise the concessional tariffs that they get under various free trade agreements.

An online origin management system for exporters will also be launched in the next few weeks that will help them to obtain the Certificate of Origin.

Sitharaman announced that the government will organise an annual mega shopping festival in four places in March 2020.

Sitharman announced that the government will further leverage technology for to reduce the time it takes to export and the turnaround time taken at ports.

An action plan in airports and ports will be benchmarked to international standards and implemented by December 2019.

Actual turnaround times will be published in real time and monitored by another inter-ministerial group.

Sitharaman said that data on export finance will be actively monitored by an inter-ministerial group in the department of commerce. This is already being done by the RBI currently.

The government has examined priority sector lending norms for export credits and the guidelines are under consideration with the Reserve Bank of India.

This will release an additional Rs 36,000 crore to Rs 68,000 crore as export credit under priority sector.

The Exports Credit Guarantee Corporation will now offer higher insurance cover to banks that are lending towards working capital for exports, the finance minister announced.

The premium incidence for MSMEs will be also be moderated "suitably".

This initiative will cost about Rs 1,700 crore per annum. It will reduce overall cost of export credit, especially to MSMEs, Sitharaman said.

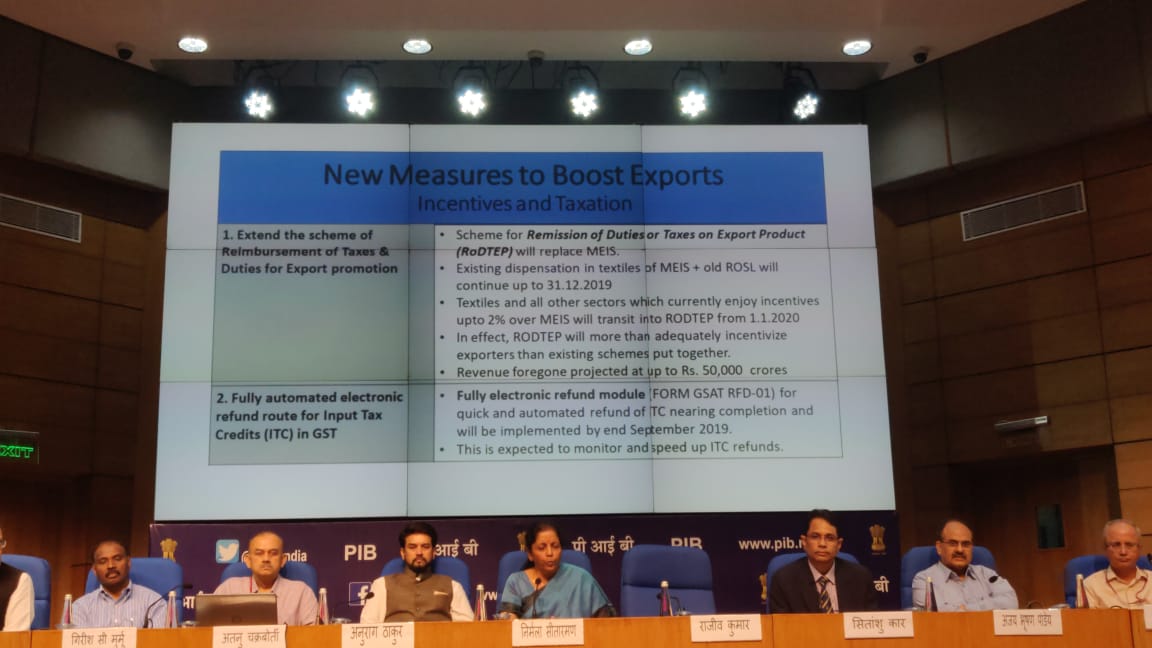

The full electronic refund module for ITC refunds in Goods and Services Tax is nearing completion and will be implemented by end of September 2019

The Finance Minister has announced that the scheme for Remission Of Duties Or Taxes On Export Products will replace the Merchandise Exports from India Scheme.

The new scheme will completely replace MEIS for all goods and services for which coverage was given by the textile and commerce ministries.

The existing dispensation will continue till Dec. 31, 2019. “Since exporters already have taken up orders, we are giving them more time,” Sitharaman said.

The new scheme will result in revenue foregone of up to Rs 50,000 crore.

The Finance Minister has announced that the scheme for Remission Of Duties Or Taxes On Export Products will replace the Merchandise Exports from India Scheme.

The new scheme will completely replace MEIS for all goods and services for which coverage was given by the textile and commerce ministries.

The existing dispensation will continue till Dec. 31, 2019. “Since exporters already have taken up orders, we are giving them more time,” Sitharaman said.

The new scheme will result in revenue foregone of up to Rs 50,000 crore.

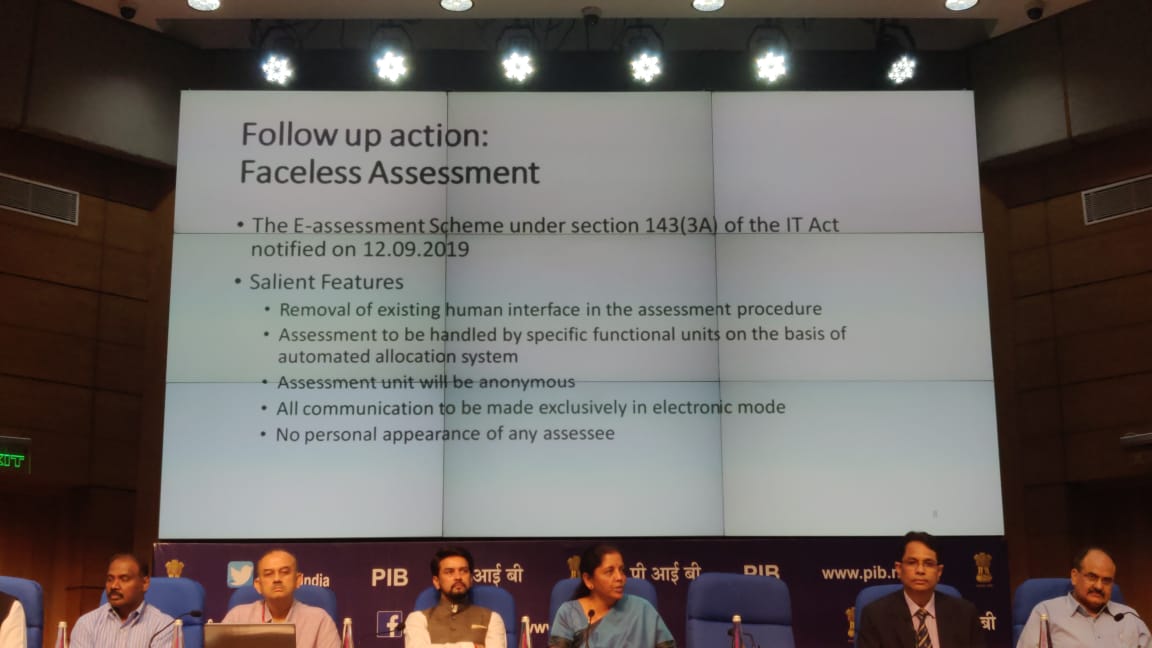

Small taxpayers with minor tax defaults will not be prosecuted, Sitharman said. Those who have minor procedural defaults will not have to go through the prosecution route.

The Finance Minister said that the scheme for tax e-assessment scheme has been notified.

The Finance Minister said that the scheme for tax e-assessment scheme has been notified.

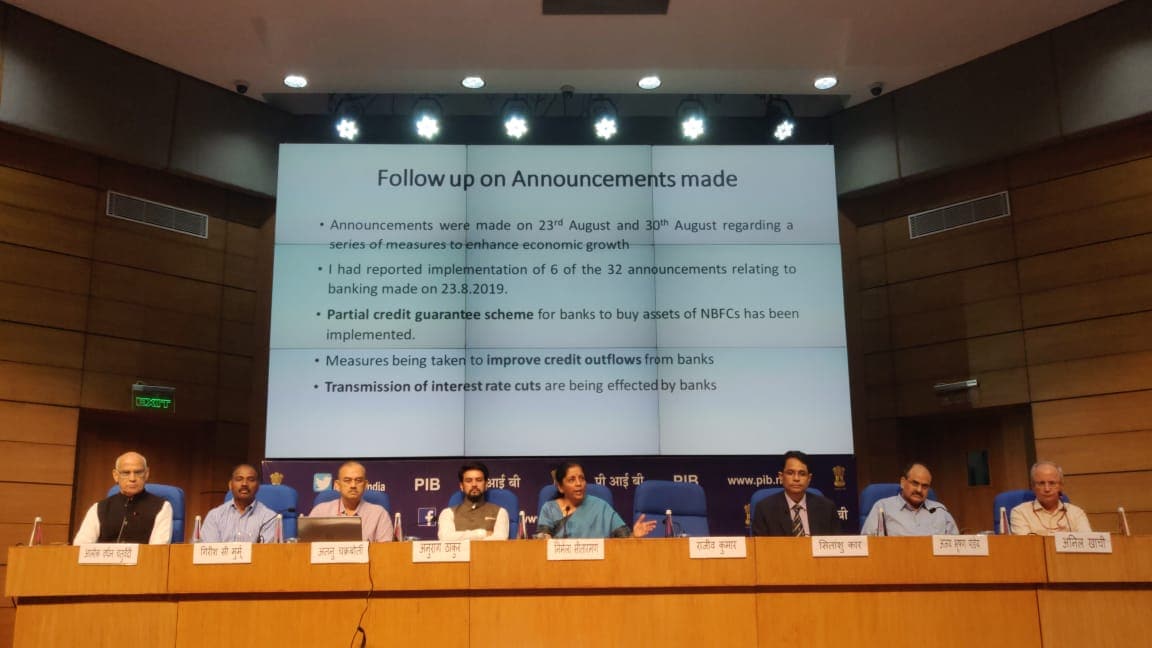

The Finance Minister said that implementation of the two sets of announcements made earlier in August has already begun. This includes measures to improve credit flow from banks and transmission of interest rate cuts.

The Finance Minister said that implementation of the two sets of announcements made earlier in August has already begun. This includes measures to improve credit flow from banks and transmission of interest rate cuts.

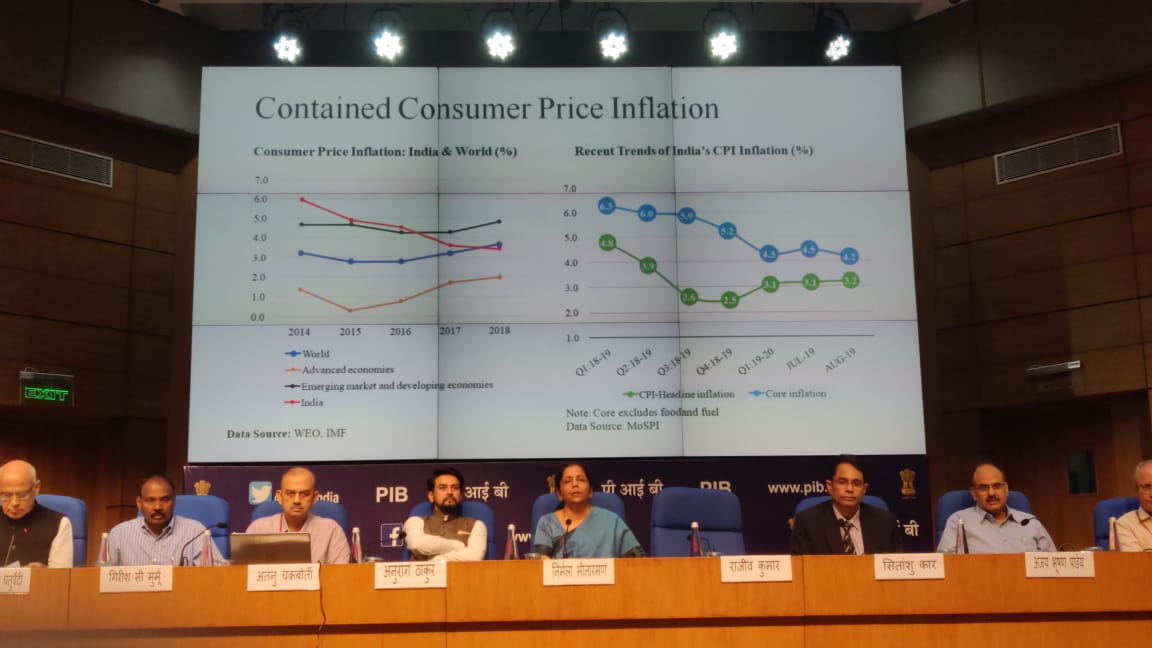

Sitharaman said that the industrial production data shows "clear signs of revival" in the April-June quarter.

The Finance Minister said that inflation has been kept under control. “Between 2.5-4 percent is considered safe. Inflation has always been held well under 4 percent. One of the very strong indicators is that inflation is being held,” she said.

The Finance Minister said that inflation has been kept under control. “Between 2.5-4 percent is considered safe. Inflation has always been held well under 4 percent. One of the very strong indicators is that inflation is being held,” she said.

Finance Minister Nirmala Sitharman announced set of measures aimed at providing relief to the housing sector and boosting exports.

The big announcement was the setting up of a special fund that will provide last-mile funding to affordable and middle income housing projects that are stalled due to a liquidity crunch.

The fund will be run by external professionals. The government will contribute Rs 10,000 crore to the fund while other investors will put in roughly the same amount, Sitharaman said.

The other big announcement, related to exports, was that the existing Merchandise Exports from India Scheme will be completely replaced by a new dispensation named the Remission Of Duties Or Taxes On Export Products. The existing dispensation will continue till Dec. 31, 2019.

Catch all the updates here:

Keki Mistry, chief executive officer of HDFC Ltd., said that the special fund for stuck projects is a welcome step to allievate a lot of stress but guidelines will have to be looked at.

Mistry explained that if a project is stuck due to lack of funding and the developer has not made three monthly installments to the lending bank, then it will get classified as a non-performing asset. In which case, Mistry said, it will no longer be eligible for last-mile funding through the special window.

“This could restrict the number of projects that will benefit from the special window,” Mistry told BloombergQuint. “That is something that needs to be looked at.”

Mistry also said that if the fund will be professionally managed then HDFC will be open to making contributions to it.

Watch the analysis with Mistry and other leading voices from the real estate industry here:

Sitharaman’s full presentation can be seen here

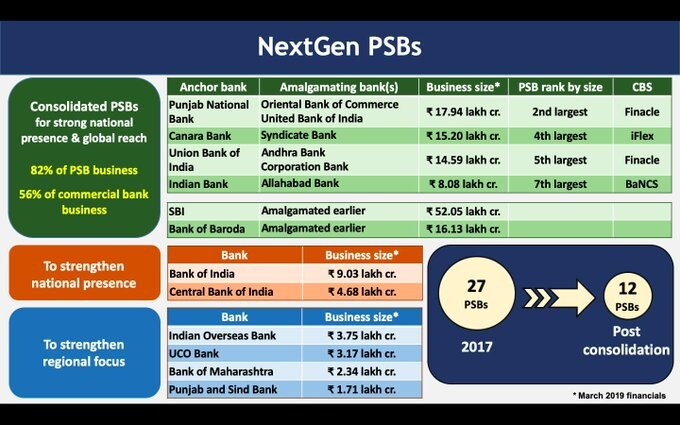

The government outlined plans to merge 10 public sector banks into four in another press meet held in the last week of August.

The bank mergers would help in better management of capital, said Finance Minister Nirmala Sitharaman while announcing the proposal as a part of a package of reforms for the economy. Sitharaman also announced a series of governance of government banks in the hope that the capital infused by the government into the lenders would result in stronger banks.

The government outlined plans to merge 10 public sector banks into four in another press meet held in the last week of August.

The bank mergers would help in better management of capital, said Finance Minister Nirmala Sitharaman while announcing the proposal as a part of a package of reforms for the economy. Sitharaman also announced a series of governance of government banks in the hope that the capital infused by the government into the lenders would result in stronger banks.

Related Coverage:

In an effort to boost India’s economy from a five-year low, Finance Minister Sitharaman announced a slew of measures on Aug. 23 including removal of the tax surchange on foreign portfolio investors, front-loading of the Rs 70,000-crore bank recapitalisation plan and steps to revive the automotive industry.

At that briefing, she had said that the government was finalising more measures to prop up the economy and that the announcements would be made shortly.

On Aug. 28, the Narendra Modi government relaxed foreign direct investment rules for single-brand retail, commercial coal mining and contract manufacturing. The cabinet also approved Rs 6,268-crore sugar export subsidy.

Finance Minister Nirmala Sitharaman will address a press conference at 2:30 p.m. on Saturday to announce “important decisions” of the government. Earlier, Sitharaman had said that the government was working on measures to alleviate the stress in the real estate sector.

Press Conference by Union Finance Minister @nsitharaman to announce important decisions of the government.

— PIB India (@PIB_India) September 14, 2019

⏰: 2:30 PM, Today

📍: National Media Centre, New Delhi

Watch on PIB's

YouTube: https://t.co/vCVF7r3Clo

Facebook: https://t.co/7bZjpgpznY

This is the third press briefing by the finance minister in as many weeks, as the government announced a slew of measures to support the slowing economy. In mid-August, the government rolled back enhanced surcharge for domestic and foreign investors. This was followed by a proposal to merge 10 public sector banks into four.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.