The Indian rupee weakened against the dollar amid rising dollar index and an uptick in crude prices as tensions heighten in the Middle East amid attacks by Israel.

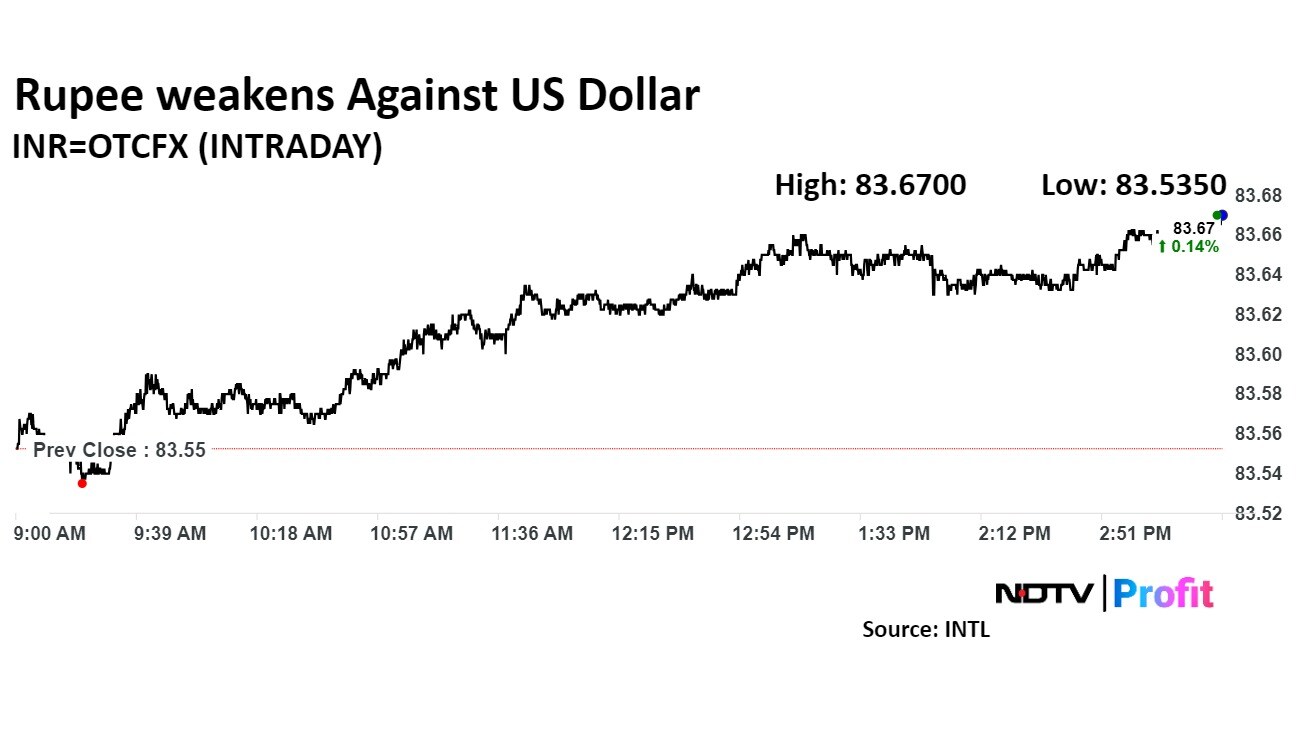

The rupee weakened by 12 paise to close at 83.67 against the US dollar, according to Bloomberg data. The local currency had closed at 83.55 against the greenback on Monday.

Asian stocks edged higher on Tuesday as authorities in China rushed in to revive the economy by easing rates, while the US Federal Reserve is poised for more rate cuts.

The pressing question now is whether the rupee will maintain this level at 83.50 or drift toward its fair value of 83.00, said Amit Pabari, managing director, CR Forex Advisors.

Strong foreign fund inflows entering the Indian market in September is providing a supportive backdrop for the rupee, he said. "The rupee has demonstrated a sharp appreciation, buoyed by momentum from India's robust equity markets, with the Nifty approaching its all-time high of 25,956 and the Sensex nearing 84,980."

The dollar index was up 0.07% at 100.92, while oil prices edged higher by 0.31% to $74.13, after second weekly gain, following a wave of economic support measures from Chinese authorities, while a significant Israeli strike on Hezbollah positions in Lebanon heightened tensions in the Middle East.

The US Dollar Index was 0.11% lower at 100.74 at 6:53 p.m. and Brent Crude was up 2.35% at $74.93 at 6:54 p.m.

The recent uptick in crude oil prices has put pressure on the rupee, according to Pabari. "Weaker-than-expected PMI data from the Eurozone and the UK has contributed to the rise of the dollar index towards the 101.22 level, further increasing pressure on the rupee."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.