As the dust settles on the 2023 United Nations Climate Change Conference (COP28) and countries begin heeding the clarion call to transition away from fossil fuels in energy systems "in a just, orderly, and equitable manner," it's worth reflecting on what it will take to achieve net zero, especially for countries like India that heavily depend on energy imports and are just beginning their developmental trajectory.

In 2021, I spoke about an "equitable" transition at the Global Investor Summit in London before COP26, and it's encouraging to see the word "equitable" in the COP28 headline statement.

When we commissioned our first solar project in 2011, a 40 megawatt (MW) installation in Bitta, Gujarat, the initial tariff was 15 INR per kilowatt-hour (kWh) (almost $0.30) while the panel efficiency was 14-15%. Today, the lowest tariff in India is as low as 1.99 INR per kWh ($0.024), and the panel efficiency is 23%. Advances in material science will further improve efficiency.

While renewables like solar and wind have come a long way, their intermittent nature requires energy storage solutions for when the sun isn't shining and the wind isn't blowing. Decarbonization of industry, heavy-duty transportation and chemicals require a green molecule to replace fossil fuels. Green hydrogen, derived from water electrolysis using renewable energy, is the answer to both.

Viability Of Green Hydrogen

Hydrogen has been known as a potential energy storage medium for over a century. It can produce electricity in fuel cells with water as the only waste product or through combustion in turbines without carbon dioxide (CO2) emissions. It's a feedstock for fertilizers and chemicals. However, almost all hydrogen today is produced from fossil fuels, emitting nearly a billion tons of CO2 equivalent each year.

In contrast, green hydrogen is a clean fuel, a scalable energy storage solution and a zero-emission industrial feedstock. For green hydrogen to fulfil these roles, the cost of production must decline similarly to renewables. That can only happen if the renewable cost of production falls faster than that of green hydrogen, given that 60-70% of green hydrogen's cost is from electricity.

For India, green hydrogen presents a home-grown opportunity as it holds the promise, along with renewables, to lift the yoke of expensive energy imports from its economy – more than $230 billion per year (19.1 trillion INR) for crude imports.

Broadening Adoption

Responsible businesses are electrifying operations in their quest for net zero, adopting biofuels and proactively sourcing renewables. While battery electric vehicles will significantly contribute to emission reduction in mobility, other solutions may be needed for heavy-duty transportation.

Biofuels are a carbon-neutral alternative to fossil fuels but are unavailable in sufficient quantity. Green hydrogen and its derivatives – methanol and ammonia – have the potential to address these challenges. Green hydrogen may be the last mile in the net-zero journey for many sectors, especially in India.

However, the cost of green hydrogen must significantly decrease from the current $3-5 per kilogram (kg) for widespread adoption. With a declining cost of production, green hydrogen will progressively become a clean alternative to fossil fuels in many applications. At $1/kg – equivalent to $7.5 per million British thermal units of heat (MMBtu) – it will be economically viable to decarbonize even the most challenging sectors without a burdensome carbon price.

Overcoming Production Challenges

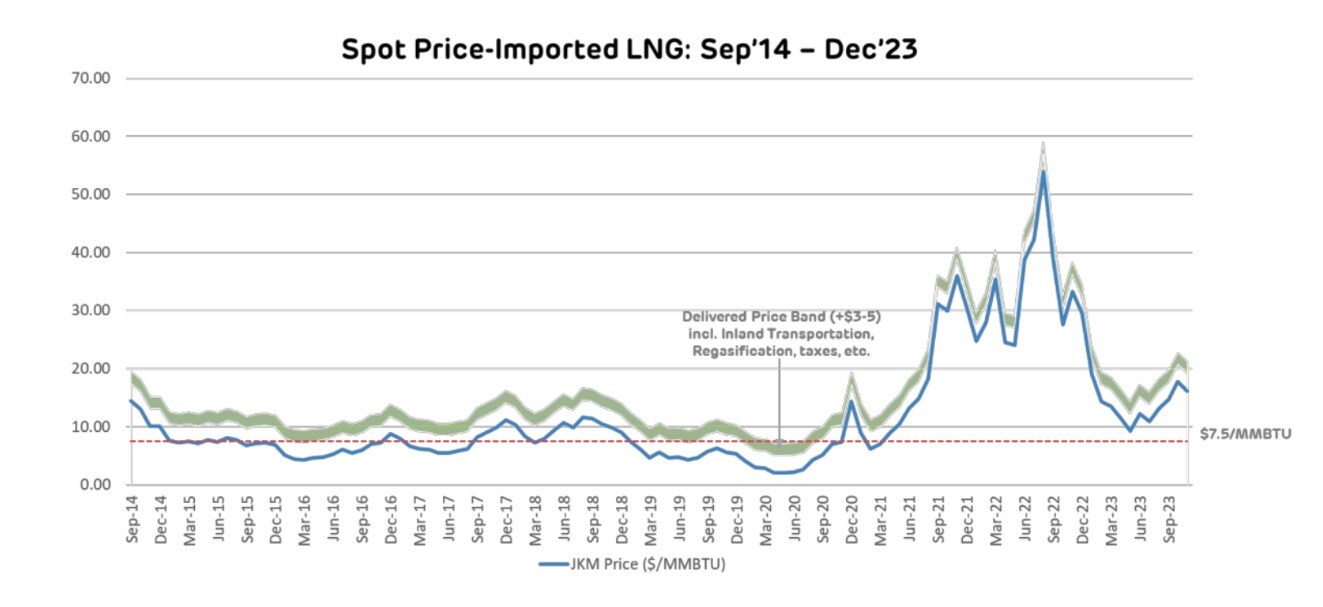

The viability of green hydrogen is particularly relevant for India, which lacks significant proven sequestration reserves, making carbon capture and storage unfeasible. Moreover, the price of imported liquefied natural gas has hovered around $7.5/MMBtu or higher over the past decade, not including additional costs for inland transportation, regasification and various taxes, leaving the country vulnerable to the dollar.

The initial challenges associated with hydrogen transportation mean that the early focus for trade is likely to be on derivatives like green ammonia and methanol. Hydrogen hubs, where the production, use and export of green hydrogen and its derivatives are co-located, are also being promoted.

Internationally, policy measures are being introduced to fast-track green hydrogen:

Enabling faster permitting for renewables.

Aggregating demand for offtake (an agreement to buy the green hydrogen).

Providing contracts for difference to address initial viability gaps.

Introducing production-linked incentives for equipment manufacturing.

Creating certainty of demand via mandates for the progressive adoption of green hydrogen.

Innovation, particularly improving electrolyzer efficiency, will also play a role. A strict definition of green hydrogen and its derivatives regarding total allowable emissions will enable a price premium, unlocking investment. The GH2 Green Hydrogen Standard is a step in the right direction.

Vertical Integration Approach

However, reducing costs will require a relentless focus on vertical integration at scale. The most significant near-term reductions will come from large-scale, vertically integrated projects encompassing the entire supply chain. These projects will include giga-scale manufacturing of solar modules and their ancillaries, wind turbines, electrolyzers, in-house engineering, procurement and construction capabilities and the production of green hydrogen and its derivatives – all in a single location.

Moreover, if this location is also a port with an adjacent industrial ecosystem, encompassing the entire flow of goods and services from source to end consumption, that utilizes green hydrogen and has the infrastructure to export hydrogen derivatives, it can mitigate some early challenges related to long-term storage and transportation. Such mega-projects will enhance execution speed and reduce costs due to fewer intermediaries.

This approach is highly capital-intensive, and vertical integration carries its own risks, such as changes in technology. However, it also promises the greatest acceleration towards the $1/kg mark. It is crucial that discussions on climate finance consider the capital needs of such large integrated projects, particularly for developing countries, where the cost of capital has been a perennial challenge despite businesses being willing to take the risk.

An Equitable Solution

Certainly, adopting green hydrogen-based decarbonization solutions will require early experimentation, investment in infrastructure and continued improvement in learning curves for technologies such as fuel cells and hydrogen turbines. Yet, as the $1/kg milestone becomes attainable, new business models will emerge and mechanisms such as carbon pricing – capturing the external costs of greenhouse gases – will become more effective in accelerating adoption.

For India, the equitable solution is not to replace one fossil fuel with another but to leapfrog to renewables and green hydrogen. The decrease in solar costs can be replicated with green hydrogen. This shift will help India achieve energy security and improve air quality in its cities. It will also contribute to food security by eliminating the uncertainties of imported ammonia prices, a crucial component in fertilizers. Most importantly, it will offer the world a chance to avert the adverse impacts of climate change.

Gatuam Adani is Chairman of the Adani Group.

The views expressed here are those of the author, and do not necessarily represent the views of NDTV Profit or its editorial team.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.