(Bloomberg) -- There's likely fewer than 30 days left before the crypto world's inevitable leap into traditional finance offers digital-money proponents a path to redemption post-FTX.

That's the bullish narrative in virtual-currency land as the clock ticks down to Jan. 10 – when US regulators must finally decide whether to greenlight a physically-backed Bitcoin ETF. The Securities and Exchange Commission will by that time be required to either accept or deny an application from Cathie Wood's ARK Investment and 21Shares, who were the first to file during this year's batch of applicants. It could at that time also rule on other similar filings. More than 10 companies are working toward getting these ETFs — which would directly hold Bitcoin — green-lit.

Should approval finally happen, it would mark a significant moment for the digital-assets industry, which is still in recovery mode following 2022's massive failures, including that of the collapse of the FTX exchange.

“This decisive date has been the center of attention for Bitcoin investors since October and will be an extremely important date to watch,” K33's Vetle Lunde wrote in a note about the January deadline. He predicts that the funds will get regulatory blessing.

While issuers have been trying to get a spot-Bitcoin product approved since 2013, excitement has built up this year in particular given the participation of Wall Street heavyweights such as BlackRock, Invesco and Fidelity in the race. Crypto fans argue that the launch of such a fund will help the digital-assets space become a bigger part of traditional finance as money managers will be able to buy with greater ease the ETFs for clients. The spot-Bitcoin ETF market has the potential to grow into a $100 billion juggernaut in time, according to Bloomberg Intelligence estimates.

“Past periods have been deemed the era of the institutionalization of Bitcoin,” Lunde said. “However, none have been anywhere near resembling 2023's changes.”

That's a point similarly echoed by Dan Morehead, founder and managing partner at Pantera Capital. “Institutional adoption has accelerated. The headline news has been the imminent approval of spot Bitcoin ETFs sponsored by large names in traditional finance – like BlackRock and Fidelity – and the leader in blockchain ETFs, Bitwise,” he wrote in a note. “Similar to the first international gold ETF in 2003 and US gold ETF in 2004, this opens a new channel for traditional capital to flow into ‘digital gold' that might not have participated previously.”

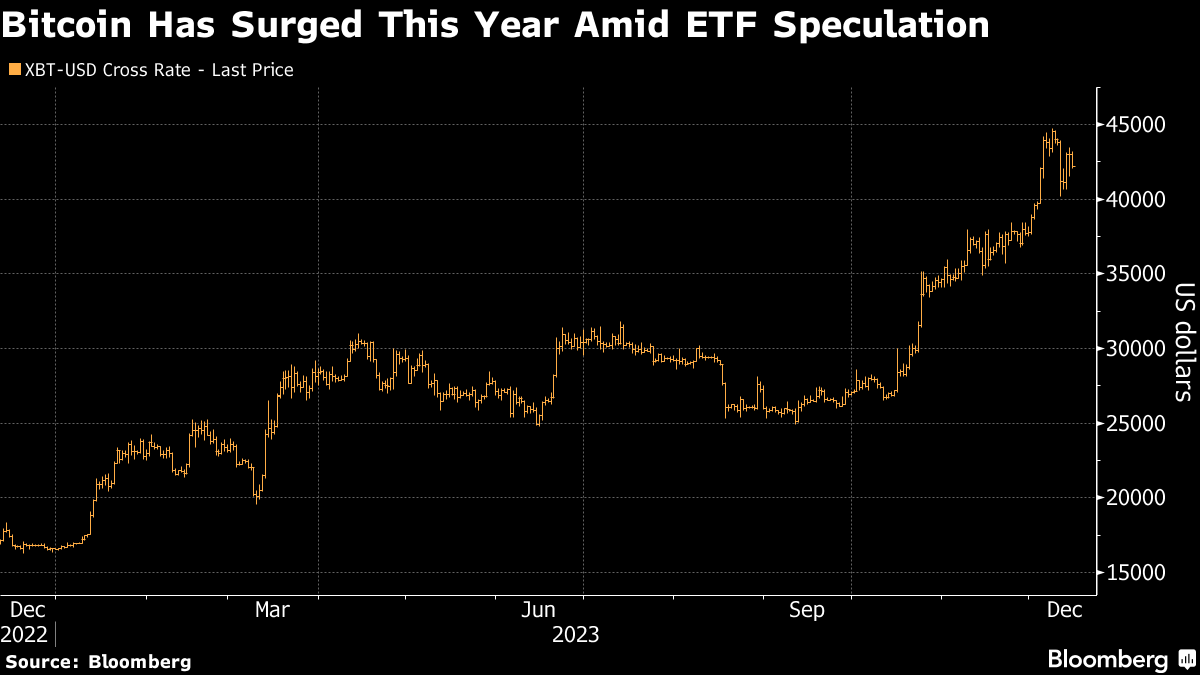

All of it's led to big gains for cryptocurrencies, with Bitcoin more than doubling this year to trade above $40,000 once again. Other smaller coins have also surged. Mark Newton at Fundstrat posits that the so-called “crypto winter” — a prolonged period of bearishness and declining prices — is over.

“Bitcoin looks to be giving off strong signals that the crypto winter that has kept most coins in bear markets over the last couple years has finally run its course,” he said.

Still, there seems to be some sticking points for regulators, as the final ETF details look to be getting hashed out with issuers. One of the big contentions centers around in-kind versus cash redemptions for the funds, a mechanism that's a delineating feature of ETFs.

For in-kind redemptions, an ETF issuer exchanges the fund's underlying securities with a market maker to create and redeem shares rather than transacting in cash. In the second scenario, fund managers take on the responsibility for selling the securities to distribute cash to the redeeming shareholders. Regulatory officials are unlikely to allow in-kind redemptions for Bitcoin ETFs as they don't want broker-dealers to have to handle Bitcoin, meaning that issuers are now likely working toward resolving this sticking point.

Read more: Bitcoin ETF Redemptions Pose a Challenge: Bloomberg Crypto

Crypto-centric exchange-traded products have seen inflows on the back of the price increases and overall industry exuberance. The ProShares Bitcoin Strategy ETF (ticker BITO), which tracks Bitcoin futures, has seen more than $200 million come in so far this quarter, with its assets crossing above $1.5 billion, a record for the fund. Meanwhile, the 2x Bitcoin Strategy ETF (BITX) from Volatility Shares, a leveraged futures product that launched in June, crossed above $100 million in assets recently.

All in all, crypto-centered ETFs round out the list of the 10 best-performing non-leveraged equity ETFs in the US this year, with the best-performing — the VanEck Digital Transformation ETF (DAPP) — up more than 200%. Within the leveraged lineup, the GraniteShares 1.5x Long COIN Daily ETF (CONL) has been a standout with its roughly 500% year-to-date gain.

Still, trading volumes, though they've risen amid Bitcoin-ETF speculation, remain depressed. And retail investors remain apathetic — their presence in the market has actually declined this year, according to K33. The researcher cites crypto-exchange website traffic, which has continued to come down.

“The main excitement will be about the end of this long arduous process,” Bloomberg Intelligence's James Seyffart said of the potential Bitcoin ETF launches. “Issuers first filed for this over a decade ago and many have spent years working with and arguing against the SEC. There has been an extreme amount of man hours put into this. So, if approval happens in January, it might be more of a relief than excitement to some.”

--With assistance from Allyson Versprille and Katie Greifeld.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.