(Bloomberg Opinion) -- It's Merry Cryptomas, everybody! Bitcoin is up 167% year-to-date. Ethereum is up 91%. If a massive crypto rally was one of your predictions for 2023 a year ago, I take my hat off to you. Compare those returns with other asset classes. The NASDAQ is up 36%. The S&P 500 is up 19%. Gold is up 10.7%. If you were long oil or a broad basket of commodities, you are down 10%-12%.

A year ago, many of us thought — I certainly did — that it was game over for crypto and that the naysayers were going to be vindicated.

Sam Bankman-Fried had blown up. (That part didn't surprise me.) He's now in jail, having been convicted of seven charges of financial fraud, and his exchange FTX is long gone. The fate of rival exchange Binance hangs in the balance, following an investigation by the Justice Department. Its founder, Changpeng Zhao, has pled guilty to money-laundering violations, stepped down as CEO and agreed to pay a $50 million fine, while Binance itself has been fined $4.3 billion.

By this time last year, the reputational storm engulfing crypto exchanges had convinced me that the entire edifice of blockchain-based finance was rotten and that I should immediately sell most of the bitcoin (BTC), ether(ETH) and other tokens I had acquired since becoming a convert to crypto back in 2017.

I was a fool. I had forgotten rule No.1 of crypto investing: Once you have bought the stuff, you should always HODL — hold on for dear life.

It is a sign of how wrong I was to SATB (sell at the bottom) that Nouriel Roubini — who a year ago was gloating at the demise of all “shitcoins” — is now (you've guessed it) launching his own blockchain-based “flatcoin.”

The more profound lesson of the last 12 months is that the crypto exchanges — or other custodial intermediaries — are not and never were the key to the future of blockchain-based fintech.

The starting point of it all was, let's not forget, the dream of peer-to-peer transactions without intermediaries such as banks, and without the associated problem of state surveillance. On reflection, there should never have been a period when crypto was dominated by exchanges, the centralizing role of which was antithetical to the original concept of decentralized finance.

The only reason the exchanges sprang up was the technical trickiness of actually exchanging crypto without an intermediary. Early adopters used a website called LocalBitcoins which functioned like Craigslist. Users would post ads to buy or sell bitcoins, which they would settle using whatever payment method they chose. It still is tricky, as I can confirm having had my fair of anxiety attacks while using Ledger and Metamask. But it's getting easier.

Yet the key process of on- and off-ramping to and from crypto is now almost entirely monopolized by regulated exchanges, of which Coinbase looks like the survivor and therefore winner. Crypto remains a risky industry partly because of the centralization of the nexus between traditional and decentralized finance.

The year-long rally of BTC and ETH is telling us three things.

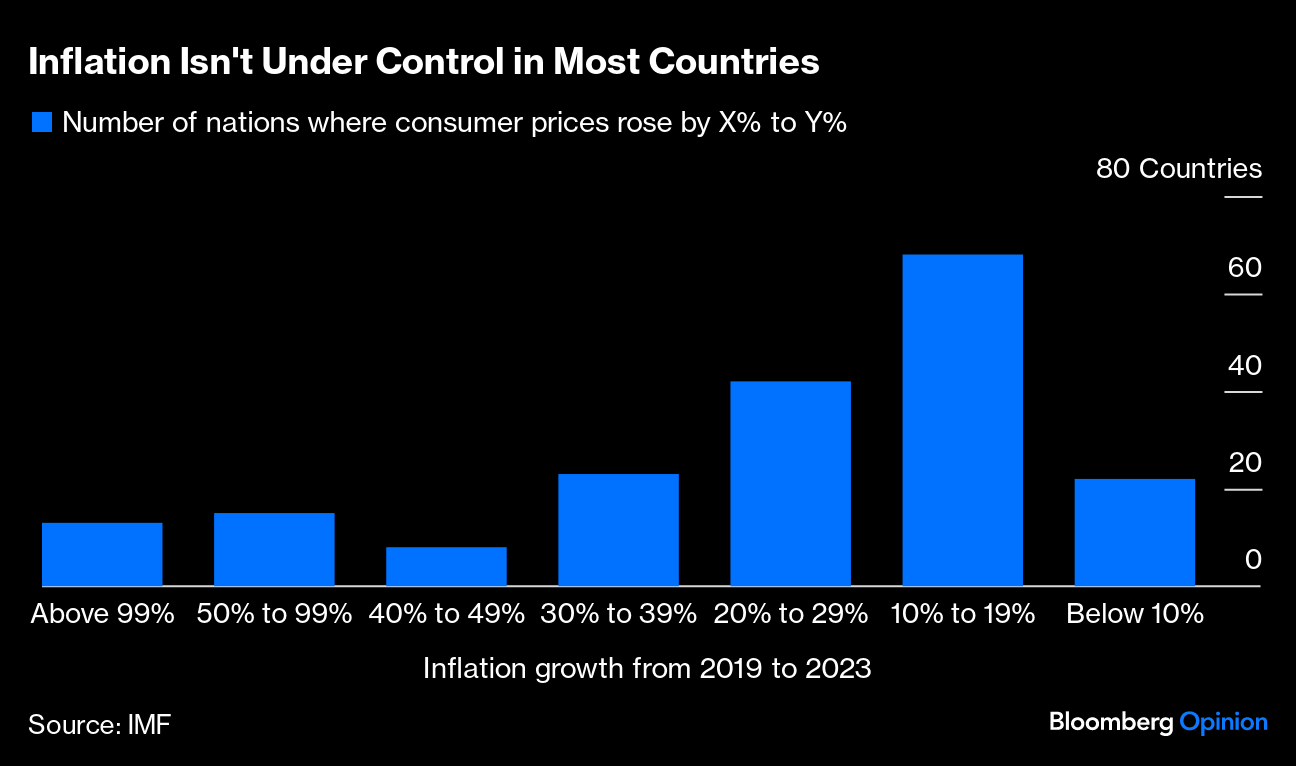

First, after two decades of historically low inflation, the world is witnessing so much mismanagement of fiat currencies that the appetite for crypto is bound to keep on growing. Of the 191 countries in the world for which data are available from the International Monetary Fund, only 22 have seen consumer prices rise by less than 10% since 2019. A further 68 had four-year inflation of between 10% and 19%; 42 between 20% and 29%; 46 between 30% and 99%; and a sorry 13 have seen prices go up by 100% or more. That last group would be bigger if we had reliable data for Lebanon and Syria this year.

Prices have risen eightfold in four years in Argentina, 103 times in Sudan, 159 times in Zimbabwe and more than 5,000 times in Venezuela.

The more disastrous the inflation, the more attractive crypto becomes. The current mood in Argentina is illustrative. Last Sunday, the libertarian economist Javier Milei was sworn in as president. Unlike crypto, this was something I got right this year: I assured my Argentine friends all year that, when the inflation rate reaches 100%, voters will choose the radical option, not the mainstream one.

Milei is radical to the point of eccentricity. He wears his hair like an aging Sixties rock star — it almost seems to have escaped from an old Yardbirds album cover. His presidential baton has a silver engraving depicting his five English mastiffs and their names: Conan (named after his previous dog from whom all five dogs were cloned), Milton after the University of Chicago free-market economist Milton Friedman, Murray after the Austrian-influenced libertarian Murray Rothbard, and Robert and Lucas for Robert Lucas, another great of the Chicago School.

Some English-language media have erroneously lumped Milei together with right-wing populist figures such as Brazil's Jair Bolsonaro. Milei belongs to a quite different species. At a time of surging global anti-Semitism, he has announced his intention to convert to Judaism and chose to pay his first foreign visit as president-elect to the grave of an obscure Hasidic rabbi in Queens.

“We have no alternative to a drastic fiscal adjustment,” Milei told the crowd at his inaugural address, warning them of a coming recession. The crowd responded with “Motosierra! Motorsierra!” (“Chainsaw! Chainsaw!”) — a reference to Milei's promise to slash public spending. He told them: “No hay plata.” (“We have no more money.”) They cheered. His proposed plan for balancing the budget is the boldest shock therapy the world has seen since Margaret Thatcher's first term as British prime minister.

Yet it has been explained to Milei that his cherished wish — to switch the Argentine currency to the US dollar — is not a viable option. The central bank lacks the dollars and the very mention of dollarization risks tipping the ailing currency into hyperinflation. The result is that Argentines who get paid in pesos and save in pesos are bound to see yet more depreciation of their currency, beginning with last week's deep devaluation.

What wouldn't every Argentine give for a fistful of bitcoins at a time like this?

The second lesson is that crypto has evolved.

Crypto's first bull market was almost entirely driven by belief in Bitcoin's potential to provide censorship-resistant digital cash. It was interrupted by the first major hack of the Mt. Gox exchange in 2011, which lost about 25,000 bitcoins. Although Bitcoin soon recovered, this era ended in 2013 and 2014, following the FBI's closure of dark web marketplace Silk Road and the collapse of the Mt. Gox exchange, which at that time handled 70% of Bitcoin transactions.

Crypto's second bull market began around 2016, kicked off by a mania for initial coin offerings (ICOs) launched primarily on the Ethereum network. ICOs were speculative sales of tokens to retail investors by teams promising to build better smart-contract blockchains to compete with Ethereum. However, once it became clear that these networks hosted very little useful activity, the industry entered yet another winter.

The 2020 bull market seemed to answer these doubts about utility, beginning with “DeFi Summer” and followed by crazes for decentralized autonomous organizations (DAOs) and nonfungible tokens (NFTs). It appeared that crypto networks were now hosting activity from actual users, both retail and institutional, though much of it was highly speculative and risky, often involving massive leverage. It was the excessive risk levels and poor financial engineering that caused the downfall of projects such as Terra and the blowup of funds such as Three Arrows Capital.

Today, the total value of assets locked (TVL) on DeFi smart-contract protocols remains pretty much where it was in 2022. But, according to an analysis by my Hoover Institution colleague Manny Rincon-Cruz, this hides a transition away from high-risk instruments into safer, bond-like assets.

The DeFi protocols with the highest usage during the 2020 bull market were margin-lending platforms and decentralized exchanges. In contrast, DeFi today is mostly yield-bearing assets, which can include not only interest-bearing lending positions, but also tokenized real-world assets such as Treasury bills.

But the most important yield-bearing assets these days are liquid-staking protocols, which are simply ways for users to delegate their network tokens to validate and secure a blockchain network. For example, users can deposit their ETH to the Lido protocol, which delegates to a network of Ethereum validators the work of building the transaction blocks on the network to earn fees in ETH, which are then passed back to the users. (Liquid staking is roughly analogous to users of Bitcoin being able to use bitcoins to participate in bitcoin mining.) The largest liquid-staking protocols today use roughly 56% of all DeFi TVL, up from 0.1% at the start of 2021.

It is unclear what will come of this focus on yield, but it seems likely that the crypto industry in 2024 and 2025 will continue to evolve more useful — and less speculative — ways of using peer-to-peer protocols.

The third lesson of 2023 is that traditional finance continues to adopt crypto, despite the efforts of regulators and legislators to discourage it.

Among the asset managers who have filed paperwork with the SEC this year for exchange-traded BTC and ETH funds are Franklin Templeton and BlackRock, along with the first kid on the block, Grayscale, which created the initial over-the-counter traded BTC fund back in 2013. Grayscale applied to convert its bitcoin trust into an ETF in 2017, but withdrew after negative comments from the Securities and Exchange Commission. Today, the SEC keeps extending its deadline, which suggests it cannot think of a good enough reason not to approve these ETFs.

Meanwhile, US companies holding crypto will be required to record their tokens at the most up-to-date price or “fair value,” according to a new set of crypto accounting rules issued a few days ago by the Financial Accounting Standards Board.

Adoption is a key reason why predictions of the death of crypto were wrong. In the 2018 revised edition of my book “The Ascent of Money,” I made this point and should have stuck with it:

Bitcoin is portable, liquid, anonymous and scarce. It is “digital gold” by design. A simple thought experiment would imply that $6,000 is therefore a cheap price for this new store of value. Around 17 million bitcoins have been mined to date. The number of millionaires in the world, according to Credit Suisse, is 36 million. Their total wealth is $128.7 trillion. If millionaires collectively decided to hold just 1 per cent of their wealth as Bitcoin, the price would be above $75,000 – higher, if adjustment is made for all the Bitcoins that have been lost or hoarded. Even if the millionaires held just 0.2 per cent of their assets as Bitcoin, the price would be around $15,000.

That range has been almost exactly right. At its peak in November 2021, the price of bitcoin was $63,621. At its trough a year later, it was $15,460. The current price of $43,000 is roughly the midway point.

The trend of adoption is one you should welcome if, like me, you believe that the law-abiding citizen should not by default have his or her transactions open to government scrutiny.

We read a lot these days about the First Amendment — a feature of the Constitution recently discovered at Harvard when students adopted anti-Israeli chants — not to mention the Second, which tends to feature in Republican primary campaigns. But free speech and the right to bear arms are not the only liberties that concerned the framers.

The Fourth Amendment states:

The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.

One of the most striking papers I read this year on any subject was “Electronic Cash, Decentralized Exchange, and the Fourth Amendment,” by Peter van Valkenburgh of Coin Center.

The assault on our Fourth Amendment rights, Valkenburgh argues, began in 1970 with the passage of the Currency and Foreign Transactions Reporting Act. This law and its subsequent amendments, along with other related statutes, have come to be known as the Bank Secrecy Act.

The BSA requires banks to keep records of cash purchases of negotiable instruments, to file reports of cash transactions with a daily aggregate amount exceeding $10,000, and to report suspicious activity that might be indicative of money laundering. The automatic reports that US financial institutions are obliged to produce are known as Currency Transaction Reports and Suspicious Activity Reports (SARs). Banks are reimbursed for their compliance.

In the eyes of some, this legislation was obviously at odds with the Fourth Amendment. “I am not yet ready to agree that America is so possessed with evil,” wrote Justice William O. Douglas in a dissenting opinion, “that we must level all constitutional barriers to give our civil authorities the tools to catch criminals.”

But Douglas — a notably progressive figure with a strong commitment to civil liberties — was in the minority. The BSA was upheld by the Supreme Court in (1974) and (1974), which established the principle that, if one hands over financial information to a third party such as a bank, then the information is no longer private.

Today, this third-party doctrine is being challenged because so much of our electronic data is now in third-party hands — those of the big tech companies. Since (2018), for example, the authorities require a warrant to obtain an individual's mobile-phone location history.

Nevertheless, the BSA's scope continues to expand, partly because cash transactions have declined as a share of total transactions, but also because of the increased surveillance mandated after the 9/11 terrorist attacks. The volume of SARs has soared from 60,000 in 1990s to 3.6 million in 2022.

The possibility created by blockchain technology of true peer-to-peer transactions poses a fundamental challenge to this regime of financial surveillance. As Valkenburgh acknowledges, Bitcoin is not truly “crypto” because identities can be derived from the ledger on which every transaction is indelibly recorded.

However, innovations such as Tornado Cash are now enabling truly anonymous peer-to-peer transactions. There is no third party involved, unless you pretend the software developers are the third party and require them to gather data on users.

Truly decentralized finance, Valkenburgh concludes, “is essential for preserving human dignity and autonomy as the world moves increasingly toward fully intermediated and surveilled payments technologies like Alipay, WeChat, or so-called Central Bank Digital Currencies. … Anonymous electronic cash and decentralized exchange software [are] the endgame for all cryptocurrency networks.”

You do not need to know Senator Elizabeth Warren or SEC Chair Gary Gensler personally to surmise that they will be vehemently opposed to this argument. They and others are bound to call for BSA obligations to be imposed on crypto software developers as well as the individual users of that software. Yet this would surely be unconstitutional under the Fourth Amendment, as it would amount to a warrantless search and seizure of private information.

The reason the administrative state will likely win this fight is obvious. So long as there are Bankman-Frieds in this world, and terrorists who can benefit from unscrupulous crypto operators, the government will continue to argue, in effect, that the Fourth Amendment must be honored in the breach.

Yet what the government cannot do — even if JPMorgan Chase CEO Jamie Dimon wishes it would — is shut down crypto altogether and leave the dwindling number of American banks to reap the benefits of a monopoly on financial transactions.

Merry Cryptomas everybody. Hold on for dear life to whatever you've got. Just don't expect the Fourth Amendment to protect you.

More From Niall Ferguson at Bloomberg Opinion:

- Law of Unintended Consequences Caused the Great Bond Rout

- Henry Kissinger Was a Complex Man for a Complex Century

- In Cold War II, the US Risks Playing the Soviet Role

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Niall Ferguson is a Bloomberg Opinion columnist. He is the Milbank Family Senior Fellow at the Hoover Institution at Stanford University and the author, most recently, of “Doom: The Politics of Catastrophe.”

More stories like this are available on bloomberg.com/opinion

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.