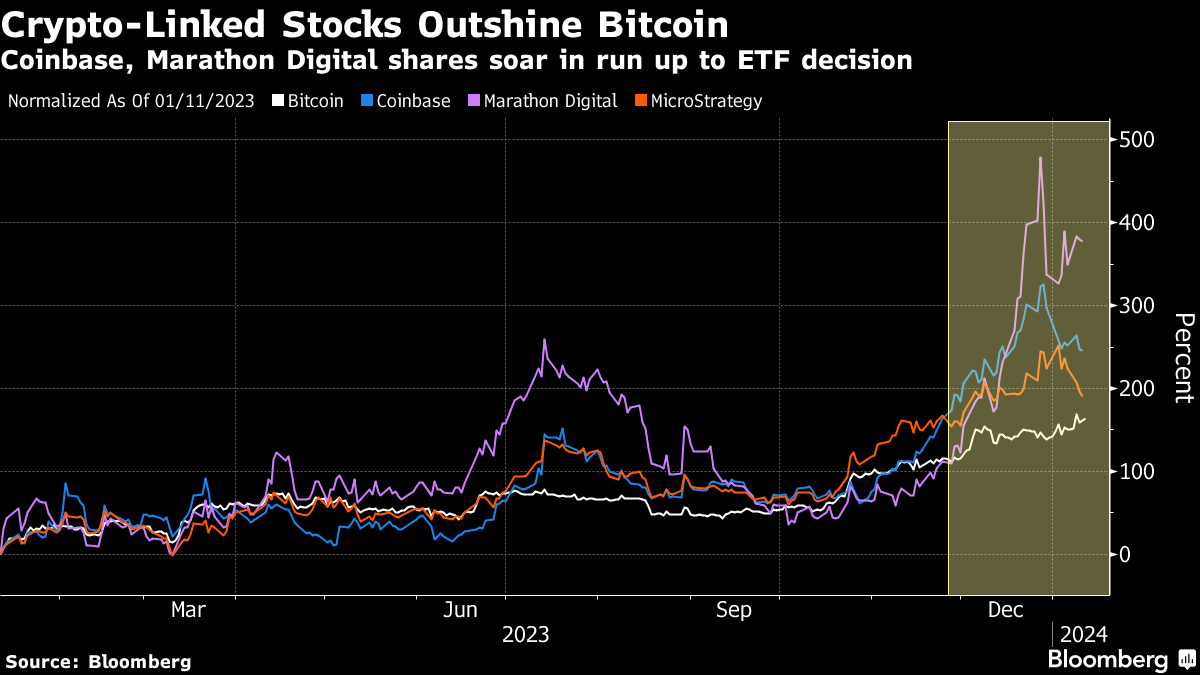

(Bloomberg) -- Stocks linked to cryptocurrencies received fresh impetus from the US financial regulator's approval for exchange-traded funds that invest directly in Bitcoin, extending their gravity-defying gains of the past year.

The landmark decision by the US Securities and Exchange Commission on Wednesday came as a game-changer for the roughly $1.7 trillion digital-asset sector, broadening access to the largest cryptocurrency on Wall Street and beyond. The SEC's decision authorized funds from the likes of BlackRock Inc., Invesco Ltd. and smaller competitors such as Valkyrie.

Shares in exchange platform Coinbase Global Inc. and miners such as Cleanspark Inc. and Marathon Digital Holdings Inc. were among the stocks that posted strong advances during Thursday's premarket session in New York. Coinbase, a crypto-equity poster child, added another 5% to its near-250% in gains of the past 12 months.

Bitcoin hovered near $46,000 after it had jumped more than 160% in the past year in anticipation of the regulatory approval and the prospect for looser monetary policy.

Cryptocurrency stocks had already started to rally before the SEC's decision, even though a false posting on the regulator's X account that pre-empted the decision prompted a momentary selloff.

The approval “marks a significant milestone,” Deutsche Bank analysts Marion Laboure and Cassidy Ainsworth-Grace wrote in a note on Thursday. While the two analysts see Bitcoin gaining throughout the year, they warned investors “not to conflate price gains with broader predictions of cryptocurrency overtaking traditional finance,” according to the note.

“For now, the spot Bitcoin ETF approval opens a new chapter for Bitcoin prices, though volatile conditions are likely to persist,” they said.

--With assistance from Alexandra Muller.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.