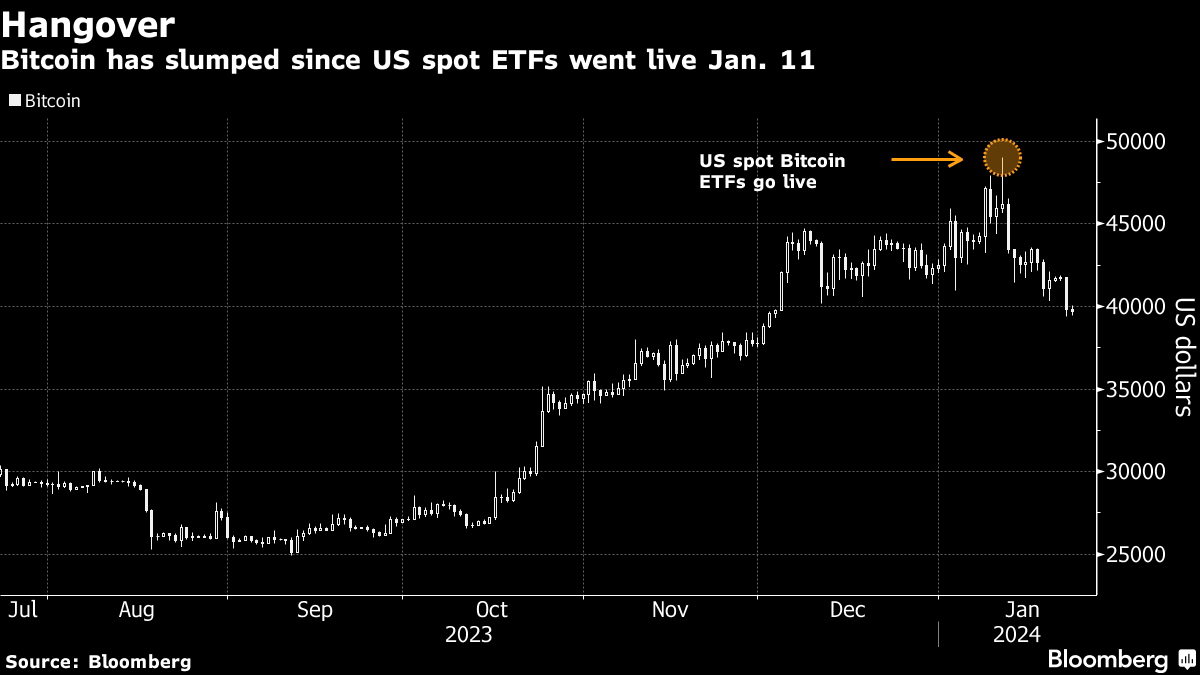

(Bloomberg) -- Bitcoin has fallen almost 20% since the Jan. 11 launch of the first exchange-traded funds investing directly in the token as speculators become more cautious about the potential impact of the products.

The digital asset spiked to $49,021 on the day the ETFs from issuers including BlackRock Inc. and Fidelity Investments went live. Bitcoin traded at $39,718 as of 8:33 a.m. Tuesday in Singapore, a 19% drop from that intraday peak.

Nine new US spot Bitcoin funds started trading on Jan. 11, while the $22 billion Grayscale Bitcoin Trust — or GBTC — converted from a closed-ended structure into an ETF. A net $1.2 billion flowed into the group in the first six days, Bloomberg Intelligence's Senior ETF Analyst Eric Balchunas wrote on X.

BlackRock's iShares Bitcoin Trust and the Fidelity Wise Origin Bitcoin Fund garnered most of the influx, while a $2.8 billion exited the Grayscale fund, Balchunas said. Among the sellers was the estate of bankrupt crypto exchange FTX, which disposed of the majority of its shares in the Grayscale vehicle.

“Over the past two weeks, Bitcoin has been challenged by tougher macro conditions — evidenced by rallying rates and a strengthening dollar — and significant selling pressure from traders unwinding their GBTC arbitrage positions along with the FTX bankruptcy estate offloading assets,” Sean Farrell, head of digital-asset strategy at Fundstrat Global Advisors LLC, wrote in a note.

The disposals by FTX potentially remove a supply overhang, suggesting that the “intense selling pressure from GBTC may soon subside,” Farrell added.

Bitcoin surged almost 160% last year, outperforming traditional assets such as stocks, amid speculation that the ETFs would catalyze wider adoption of the cryptocurrency by institutional and individual investors. The token has been retreating since the turn of the year and trailing global markets.

Tokens such as Ether and BNB struggled in Asia on Tuesday along with Bitcoin, the largest digital asset, which is some $30,000 below its 2021 pandemic-era record of almost $69,000.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.