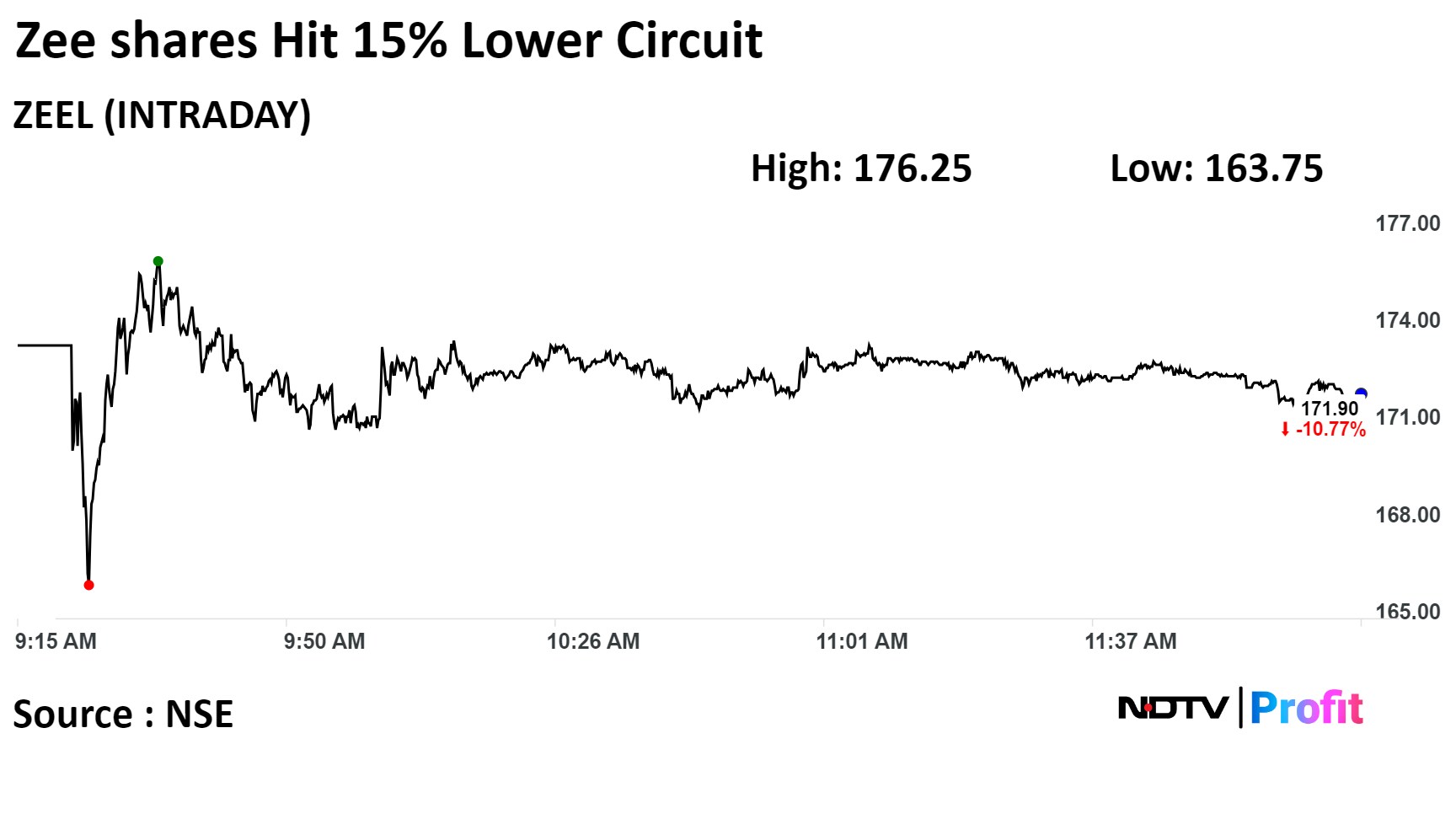

Shares of Zee Entertainment Enterprises Ltd. were trading 10% lower after hitting the 15% lower circuit on Wednesday following a news report that the Securities and Exchange Board of India has uncovered a $241 million irregularity in the company's accounts.

Bloomberg said that the market regulator found that about Rs 2,000 crore, or $241 million, may have been diverted from the embattled media firm.

"That's roughly 10 times more than initially estimated by SEBI investigators," Bloomberg quoted people aware of the development. The regulator has been calling in senior officials at Zee, including founders Subhash Chandra, his son Punit Goenka, and some board members, to explain their stance, the report said.

However, Zee denied the report saying "rumours pertaining to accounting issues in the company are incorrect and false".

"Pursuant to the SAT order, which granted relief to the current Key Managerial Personnel, the company has been in the process of providing all the comments, information or explanation requested by SEBI, and has extended complete co-operation on all aspects,” a company spokesperson told NDTV Profit.

The lower circuit limit of 10% was revised to 15% early in the day. Shares of the company fell as much as 15% to hit the lower circuit of Rs 163.75 apiece on the NSE. It was trading 10.67% lower at Rs 172.1 apiece, compared to a 0.04% advance in the benchmark Nifty 50 as of 12:10 a.m.

It has fallen 18.3% in the last 12 months. The total traded volume of the stock was 3.1 times its 30-day moving average.

Two out of the 22 analysts tracking Zee have a 'buy' rating on the stock, as many as four recommend a 'hold' and 16 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 1.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.