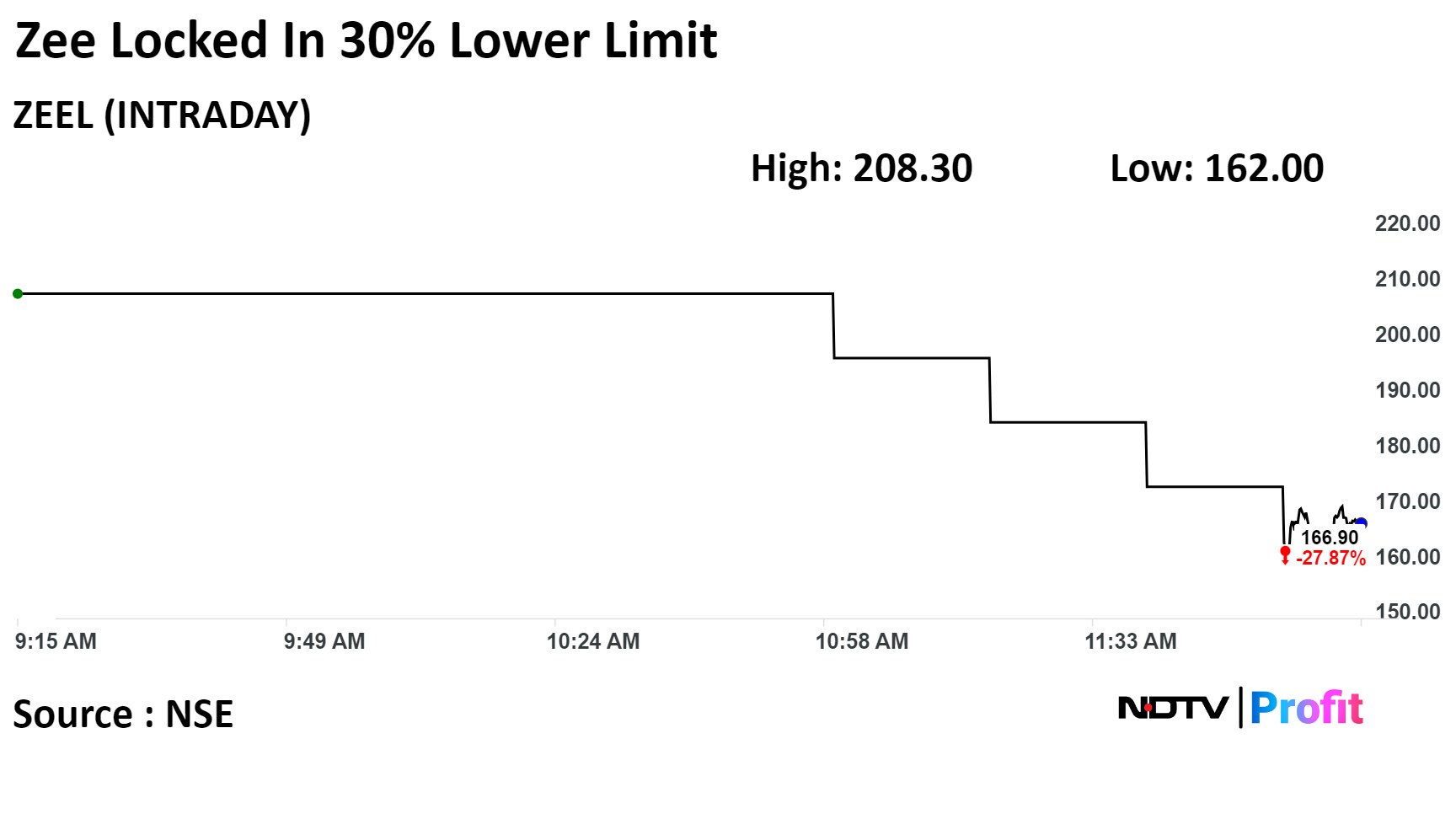

Shares of Zee Entertainment Enterprises Ltd. were locked in a revised lower circuit of 30%, falling to their lowest in over three years, on Tuesday as brokerages downgraded the stock after Sony Group Corp.'s Indian unit terminated the merger agreement.

The merger did not close by the end date as, among other things, the closing conditions were not satisfied by then, according to a statement released by Sony Group. Culver Max Entertainment Pvt. had issued a notice to Zee on Monday, terminating the definitive agreements.

Several brokerages have downgraded the stock to a 'sell' on concerns related to increased competition and corporate governance issues.

Citi Research has cut target price on the stock to Rs 180 from Rs 340 earlier. CLSA has also lowered its target price to Rs 198 from Rs 300 earlier.

"Competition should intensify with the reported merger of Reliance and Disney Star," CLSA said. The valuation is likely to decline to levels seen prior to the merger announcement, it said.

Elara Capital said if the Disney contract is honoured, the target price may move to Rs 130, citing losses in the sports segment. The brokerage has reduced the target price to Rs 170 from Rs 340 and downgraded the rating to 'sell' on Zee.

Near-term valuation of Zee to stay suppressed due to Sony seeking a termination fee, according to Nuvama.

Zee's stock fell as much as 30% to Rs 162 apiece, the lowest since Aug. 14, 2020, compared to a 0.86% decline in the benchmark NSE Nifty 50.

The stock saw the biggest drop since Jan. 25, 2019, when it fell 33.55% during the day. The shares had opened 10% lower, the first lower circuit, which was later revised to 15%, 20%, and 25%.

The share price has fallen 24.61% in the last 12 months. The total traded volume so far in the day stood at 0.4 times its 30-day average. The relative strength index was at 19.96, indicating that the stock may be oversold.

Out of 22 analysts tracking the company, five have a 'buy' rating on the stock, as many recommend a 'hold' and 12 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 20.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.