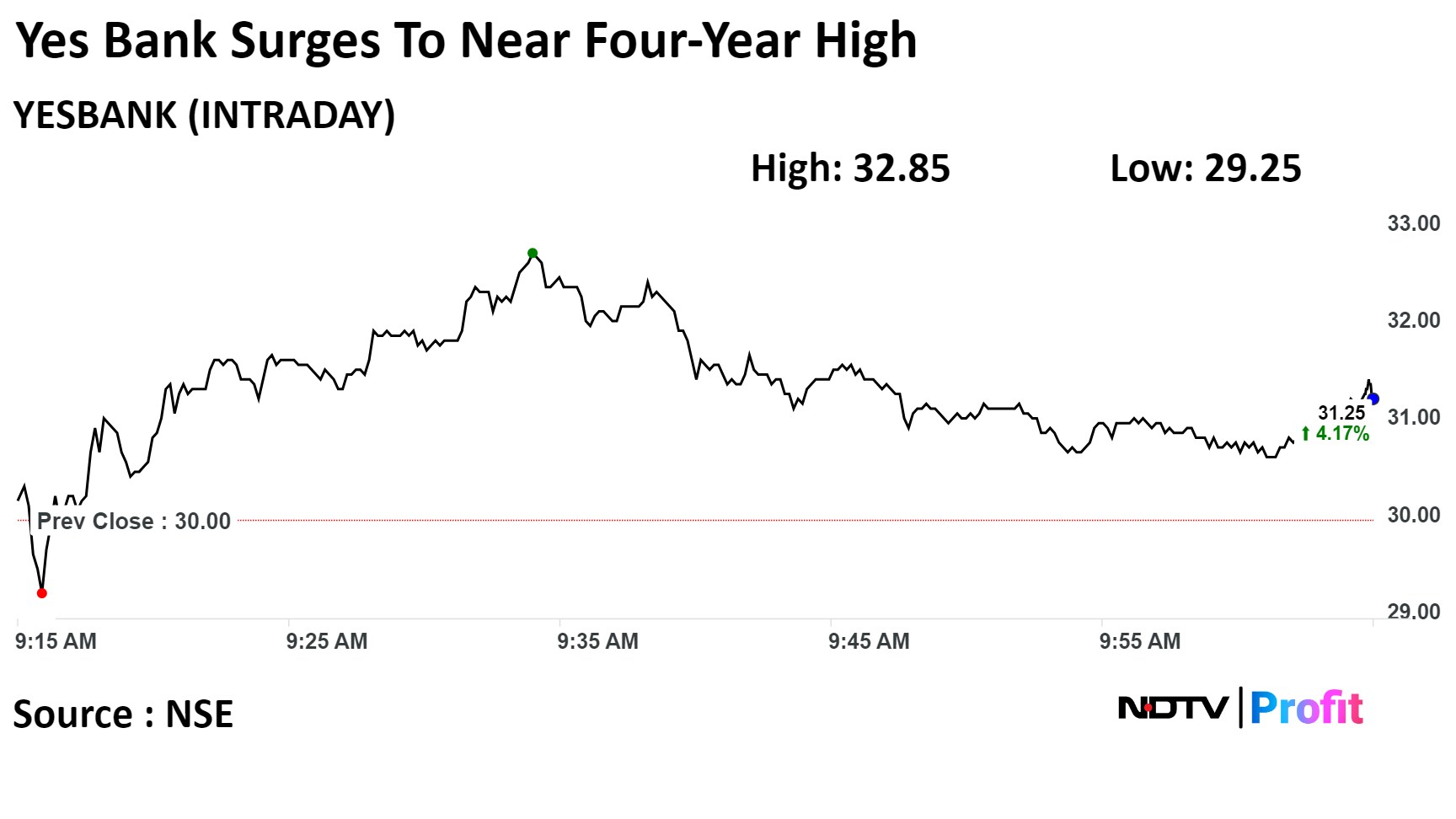

Shares of Yes Bank Ltd. surged over 9% to a near four-year high on Friday after the State Bank of India clarified that it is not divesting a stake in the private lender.

There are no such talks about selling SBI's shares in Yes Bank, and the news in media reports is "factually incorrect", both lenders told the exchanges on Thursday.

Shares of the private lender has been surging for past four days. On Tuesday, HDFC Bank Group received regulatory approval from the Reserve Bank of India to acquire 9.5% stake in six banks including Yes Bank.

SBI holds a 26.13% stake in Yes Bank, while the HDFC Bank hold 3% stake in the private lender, according to shareholders' data available on BSE.

Shares of the private lender rose as much as 9.50%, the highest level since March 27, 2020, before paring gains to trade 3.30% higher at 10:04 a.m. This compares to a 0.21% decline in the NSE Nifty 50.

The stock has risen 24.7% in 12 months. Total traded volume so far in the day stood at 5.4 times its 30-day average. The relative strength index was at 76.66, implying the stock is oversold.

Of the 13 analysts tracking the company, four recommend a 'hold', and nine suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 48.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.