Shares of Yes Bank Ltd. rose during early trade on Tuesday on reports of a stake sale by the bank. But the private lender clarified that the reports of the central bank's nod for a majority stake sale were factually incorrect.

According to media reports, the Reserve Bank of India had given green light for a sale of up to 51% stake in Yes Bank. The potential stake sale might value the private bank by assets at around $10 billion, the reports said.

The central bank has not given any in-principle approval and this clarification is issued voluntarily to dispel the "baseless media article", it said in an exchange filing on Tuesday. The bank clarified that the contents of the article are "factually incorrect and purely speculative in nature".

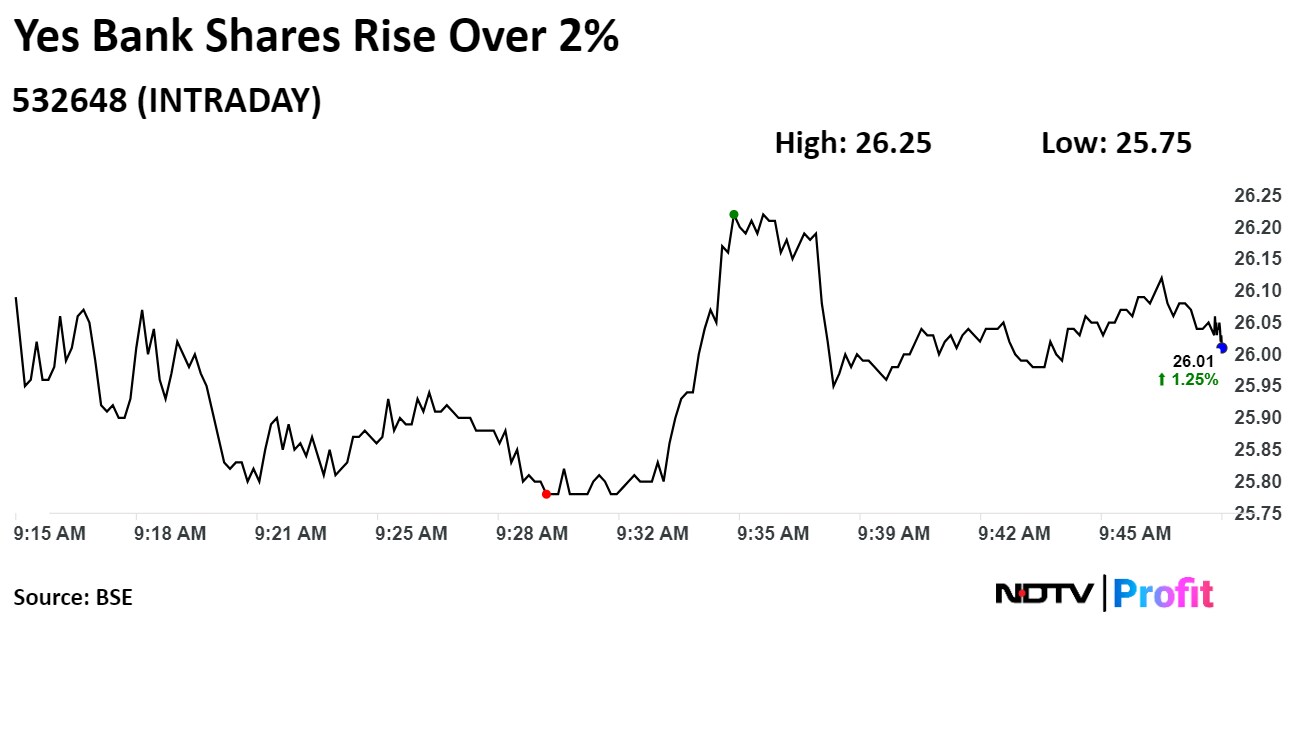

Yes Bank's stock rose as much as 2.22% in early trade to Rs 26.25 apiece on the NSE. It was trading 1.56% higher at Rs 26.08 apiece, compared to a 0.22% advance in the benchmark Nifty 50 as of 9:47 a.m.

The share price has risen 52% in the last 12 months and 21% on a year-to-date basis. The total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 66.

One out of the 11 analysts tracking the bank has a 'hold' rating on the stock and 10 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 33%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.