Shares of Varun Beverages Ltd. rose nearly 18% to a record high on Wednesday after its board of directors approved the acquisition of the Beverage Co. to expand its geographical footprint in South Africa.

The company will acquire 100% stake for Rs 1,320 crore in the South African soft-drink maker along with its wholly owned subsidiaries with "an option to accept minority co-investment from large equity fund", according to an exchange filing on Tuesday.

Jefferies Financial Group Inc. said the company would focus on expanding PepsiCo's reach and market shares from the abysmally low levels.

"In fact, while this may sound counterintuitive, the company would likely focus on PepsiCo's brands in a bid to better operating margins despite royalty (concentrate price) payouts as India experience suggests making money in B-brands is always tough, as they fail to see brand pull," it said in a note.

In Namibia and Botswana too, PepsiCo's market share is negligible, which Varun may be eyeing into the future, according to Jefferies.

Here's What Brokerages Say On Acquisition

Jefferies

Jefferies has a 'buy' rating on the stock with target price of Rs 1,132.90.

South Africa is the largest soft-drinks market in Africa with a per-capita carbonated-soft-drinks consumption at 240 bottles per year, much higher than India.

However, the market growth has been tepid at 3% compound annual growth rate in the last five years. Namibia and Botswana also have a high per-capita CSD consumption at 160–260 bottles per year.

BevCo reported volumes of 117 million cases in the last financial year, which is 80% of Varun's international volumes and 15% of the overall volumes.

BevCo has five manufacturing facilities in South Africa, comprising 13 polyethylene-terephthalate lines and two canning lines with a peak month capacity of 22 million cases.

Motilal Oswal Financial Services

The research firm has a 'buy' rating on the stock with target price of Rs 1,285.

Healthy traction within the South African market to aid growth.

The market is expected to reach approximately 1.54 billion cases by 2027, registering a 5.3% CAGR over 2022–27.

Growth in the market will be driven by favourable demographics as 65% of the 60-million population is between 15 and 64 years.

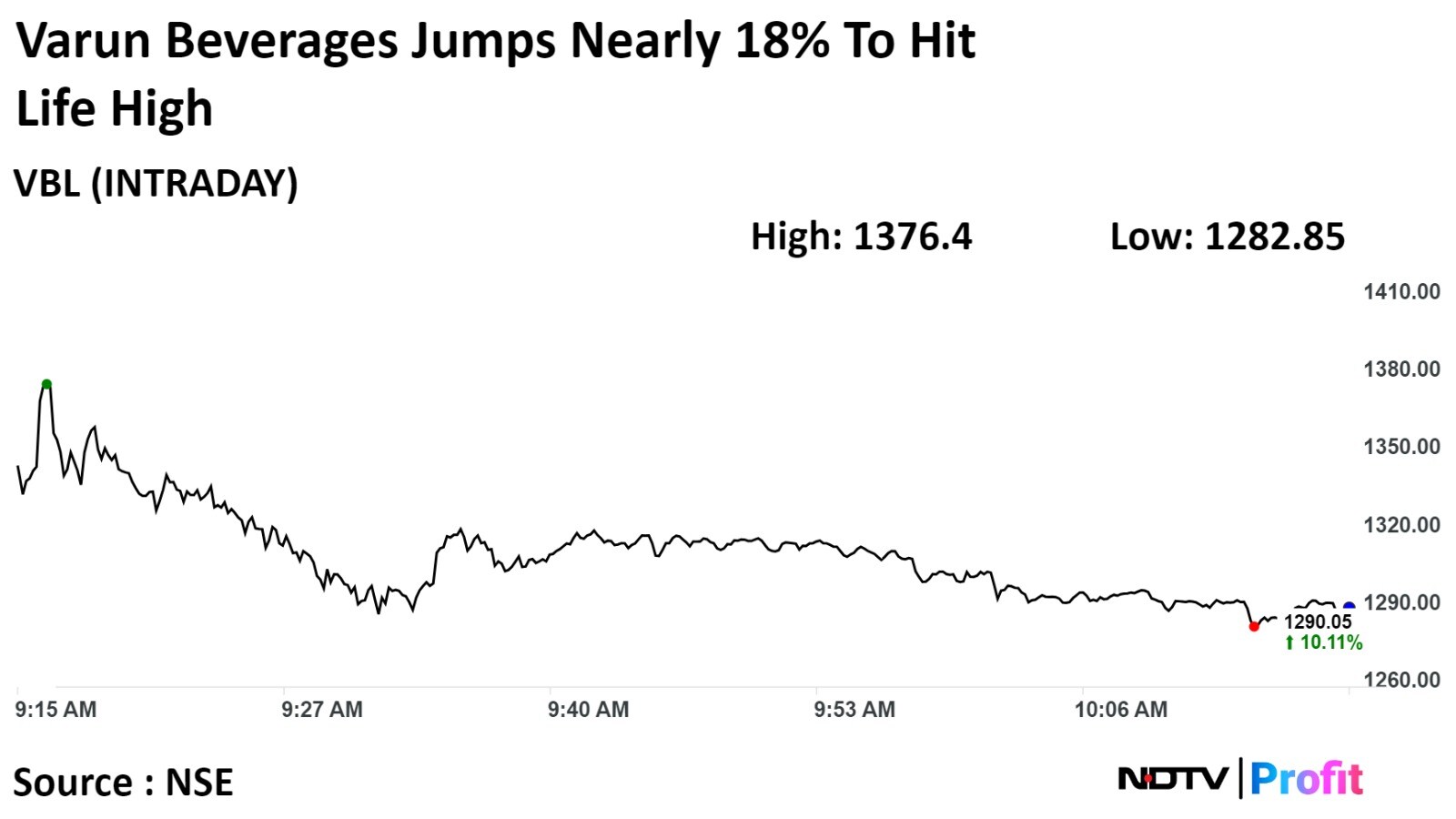

Varun's stock rose as much as 17.78% during the day to Rs 1,380 apiece on the NSE. It was trading 10.61% higher at Rs 1,295.95 apiece compared to a 0.58% advance in the benchmark Nifty 50 as of 9:39 a.m.

The stock has risen 97.07% on a year-to-date basis. The total traded volume so far in the day stood at 22 times its 30-day average. The relative strength index stands at 85, indicating that stock may be overbought.

Fifteen out of the 19 analysts tracking the company have a 'buy' rating on the stock, three recommend 'hold' and one suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a downside of 14.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.