Shares of TVS Motor Co. jumped over 5% on Wednesday after the company reported a 23.3% uptick in net profit in its June quarter earnings for fiscal 2025.

The motorcycle manufacturer's results came in line with analysts' estimates. It reported a bottom line of Rs 577 crore this quarter, compared to Rs 468 crore in the same quarter in the previous fiscal, according to its exchange filling. This compares with the Rs 562-crore analysts' estimate tracked by Bloomberg.

During the quarter, the company introduced new variants to its iQube portfolio, underscoring its attempt in making electric vehicles accessible to the general public.

Here is what brokerages have to say about the first quarter results.

Citi

Maintained a 'sell' rating on the stock and raised the target price to Rs 1,600 apiece from Rs 1,550 earlier, implying a potential downside of 35% from the previous close.

Results marginally above estimates.

Better gross margin was offset by higher selling, general and administrative expenses and employee costs.

Outlook remains positive on domestic industry demand with 10% volume growth for FY25.

New models expected to aid volumes.

Cost reduction, pricing and mix should support margins.

Competition in electronic vehicles is escalating further. It could result in an adverse pricing environment.

Valuations stay elevated. The brokerage continues to value at 29 times the FY25 price to earnings ratio.

Jefferies

Retained a 'buy' rating on the stock and raised target price to Rs 3,000 apiece from Rs 2,525 earlier, implying a potential upside of 20% from the previous close.

Should be a key beneficiary of two-wheeler demand revival in domestic and export markets.

Improving franchise should drive continuous margin expansion.

Three upcoming product launches in the second half of the year.

Norton bike launches are expected at the end of CY25.

Expects earnings per share to more than double between FY24 and FY27.

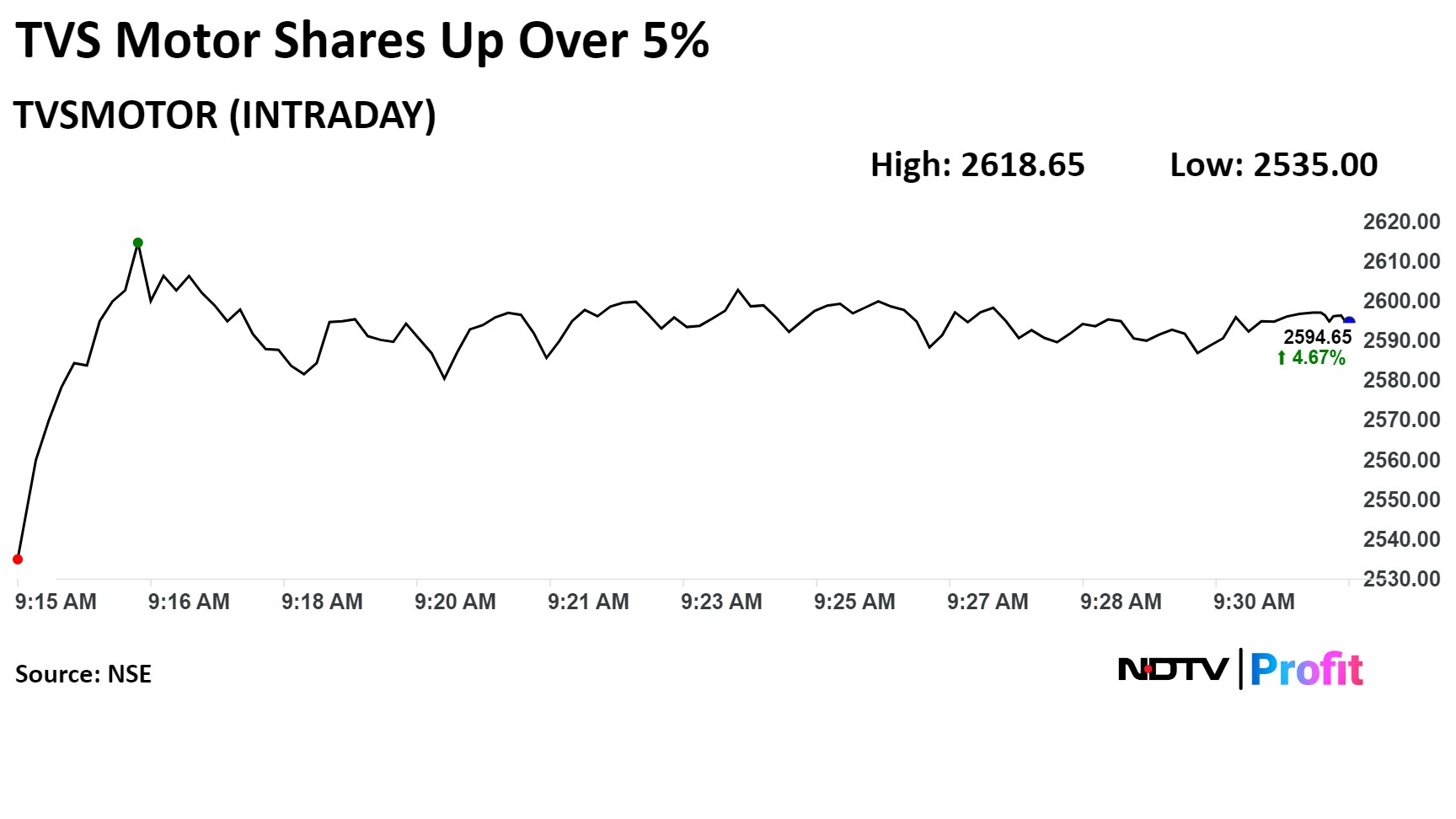

Stock Movement

TVS Motor stock rose as much as 5.64% before paring gains to trade 4.56% higher at Rs 2,591.85 apiece, compared to a 1.16% advance in the benchmark Nifty 50 as of 9:30 a.m.

It has risen 93.06% in the last 12 months and 28.06% year-to-date. The relative strength index was at 63.75.

Twenty out of 42 analysts tracking TVS Motor have a 'buy' rating on the stock, 10 recommend a 'hold' and 12 suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price targets implies a potential downside of 7.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)