Shares of TV18 Broadcast Ltd. hit a lower circuit on Thursday after Paramount Global entered into an agreement to sell its entire stake in Viacom18 Media Pvt. to Reliance Industries Ltd. for Rs 4,286 crore.

Viacom18 is a material subsidiary of TV18 and it holds a 57.48% stake in the subsidiary. Paramount will be selling a 13.01% stake and it will continue to licence its content to Viacom 18, according to an exchange filing.

After the completion of the transaction, Paramount will be exiting its holding in Viacom 18 and the stake held by TV18 will increase to 70.49%. The transaction is subject to the completion of the previously announced joint venture between Reliance, Viacom 18 and Star Disney.

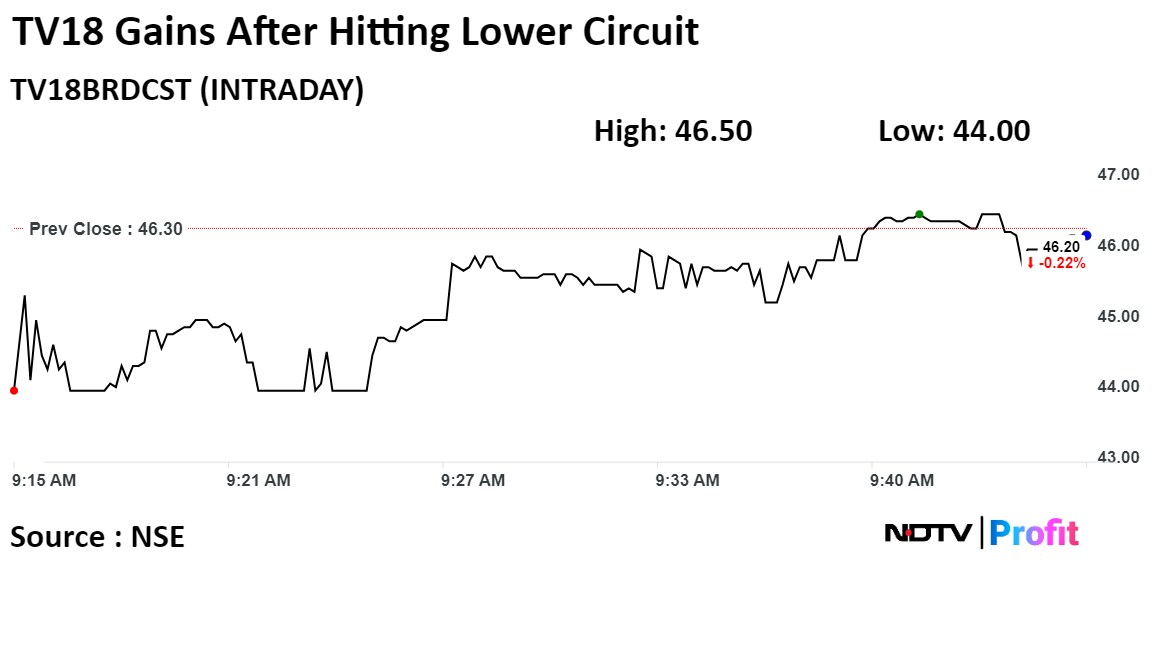

TV18's stock fell as much as 4.97% during the day to Rs 44 apiece on the NSE. It pared losses to trade 0.11% higher at Rs 46.35 apiece, compared to a 0.04% advance in the benchmark Nifty 50 as of 9:42 a.m.

The share price has risen 53.48% in the last 12 months. The total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 26, indicating that it was oversold.

An analyst tracking the company has a 'sell' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 51.5%.

RIL's stock rose as much as 1.14% during the day to Rs 2,897.05 apiece on the NSE. It pared gains to trade 0.43% higher at Rs 2,876.70 apiece as of 11:39 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.