Shares of Torrent Pharmaceutical Ltd. rose to a lifetime high on Monday after its profit jumped in the fourth quarter, prompting brokerages to raise the stock's target price.

The drug maker's net profit rose 56.4% year-on-year to Rs 449 crore in the quarter ended March 2024, according to an exchange filing. Analysts polled by Bloomberg estimate the net profit at Rs 449 crore.

The company also plans to raise up to Rs 5,000 crore by issuing equity shares and convertible bonds through a qualified institutional placement. The drug maker will follow through with the QIP after getting approval from the board members at its upcoming annual general meeting.

Torrent Pharmaceuticals Q4 Results: Highlights (Consolidated, YoY)

Revenue up 10.2% to Rs 2,745 crore. (Bloomberg estimate: Rs 2,780 crore).

Ebitda up 21.5% to Rs 883 crore. (Bloomberg estimate: Rs 896 crore).

Margin at 32.2% versus 29.2% (Bloomberg estimate: 32.2%).

Net profit up 56.4% to Rs 449 crore. (Bloomberg estimate: Rs 449 crore).

Board recommends final dividend of Rs 6 per share.

To raised up to Rs 500 crore.

Citi maintains a 'buy' rating on the stock while raising the target price to Rs 3,000 apiece from Rs 2,960 apiece earlier. The brokerage tweaked its EPS estimates for the company by -6% to +7% for FY25–27, factoring in better Ebitda margins.

However, Citi noted that better Ebitda margins will partly be offset by an increase in the tax rate in FY25–26. The brokerage also expects the company's return on capital employed to expand from 22% to 35% over FY23–27, unless the company makes any major acquisitions, and therefore valuations may expand further.

Motilal Oswal has also raised the stock's target price to Rs 2,575 from Rs 2,450 earlier. "With field force expansion, new launches, and market share gains in existing products, the company continues to exhibit superior growth in the branded generics segment across domestic formulations and LATAM (Latin America)," it said.

"With regulatory issues behind it, Torrent Pharmaceuticals is expected to improve growth prospects in the US generics segment on the back of new approvals and subsequent launches."

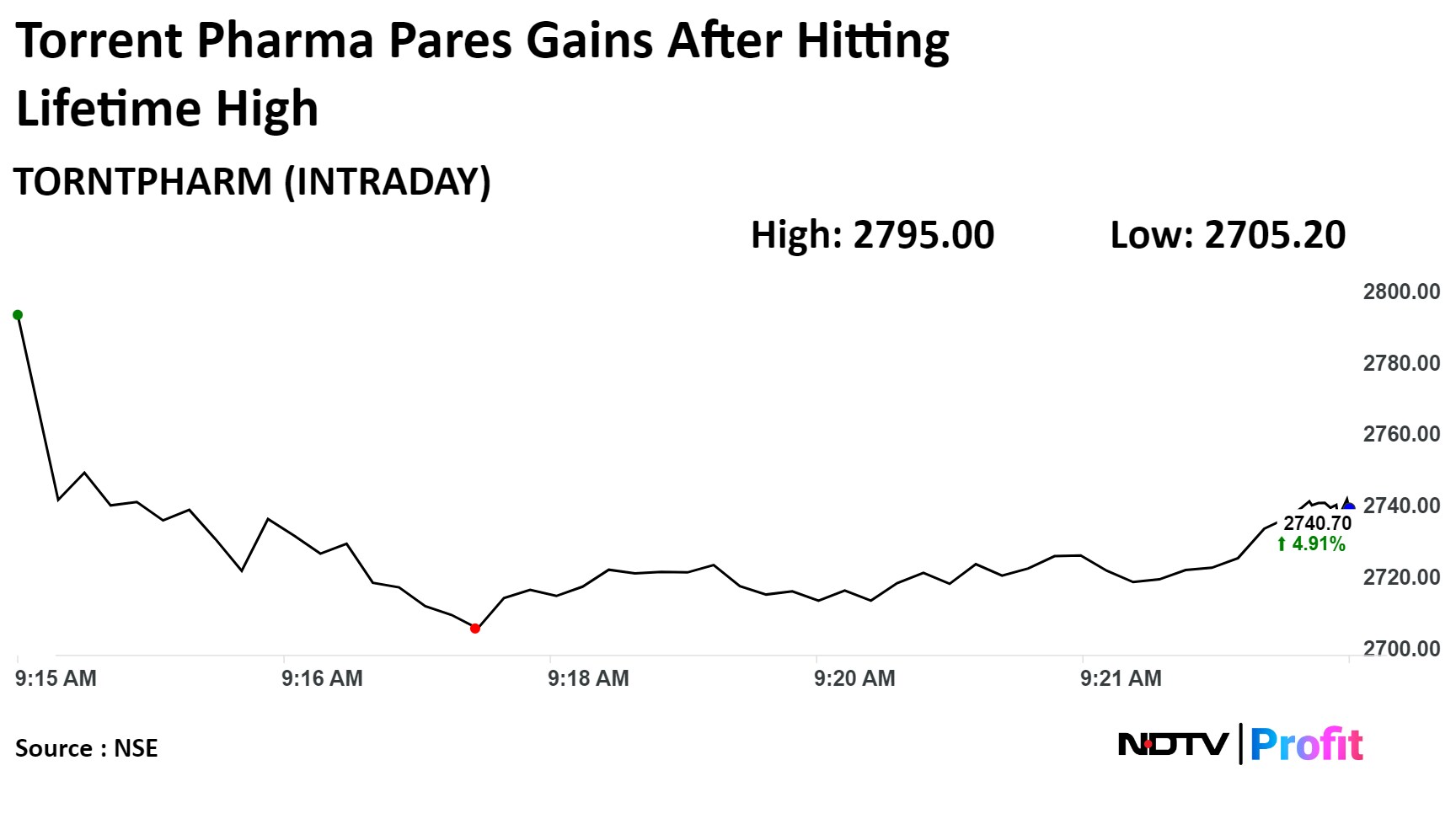

Shares of the company rose as much as 6.98% to hit a record high of Rs 2,795 apiece. It pared gains to trade 4.9% higher at Rs 2,738.50 apiece as of 10:01 a.m. This compares to a flat NSE Nifty 50.

The stock has fallen 23.62% on a year-to-date basis, but risen 15.9% in the last 12 months. The total traded volume so far in the day stood at 2.66 times its 30-day average. The relative strength index was at 58.37.

Out of the 36 analysts tracking the company, 29 maintain a 'buy' rating, five recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.