Shares of Texmaco Rail & Engineering Ltd. gained over 3% on Wednesday after the company, during its investor presentation, said it expects about three to five times growth in exports of components and railway castings over the next two to three years.

The company has been in the leading position in the export of freight cars and railway components for the past five decades, it said. "Export track record of over 550 freight cars to international markets over 10 years."

The current order book of the railway wagons stands at Rs 7,460 crore and has the largest-ever order win of over 20,000 freight cars from Indian Railways in 2022.

In July, its board approved the acquisition of Jindal Rail Infrastructure Ltd. for Rs 615 crore in an all-cash transaction to ramp up manufacturing capacity. "This strategic development will significantly enhance Texmaco's capabilities and market presence, positioning us for sustained growth and ongoing innovation,” Indrajit Mookerjee, executive director and vice chairman, said in the presentation.

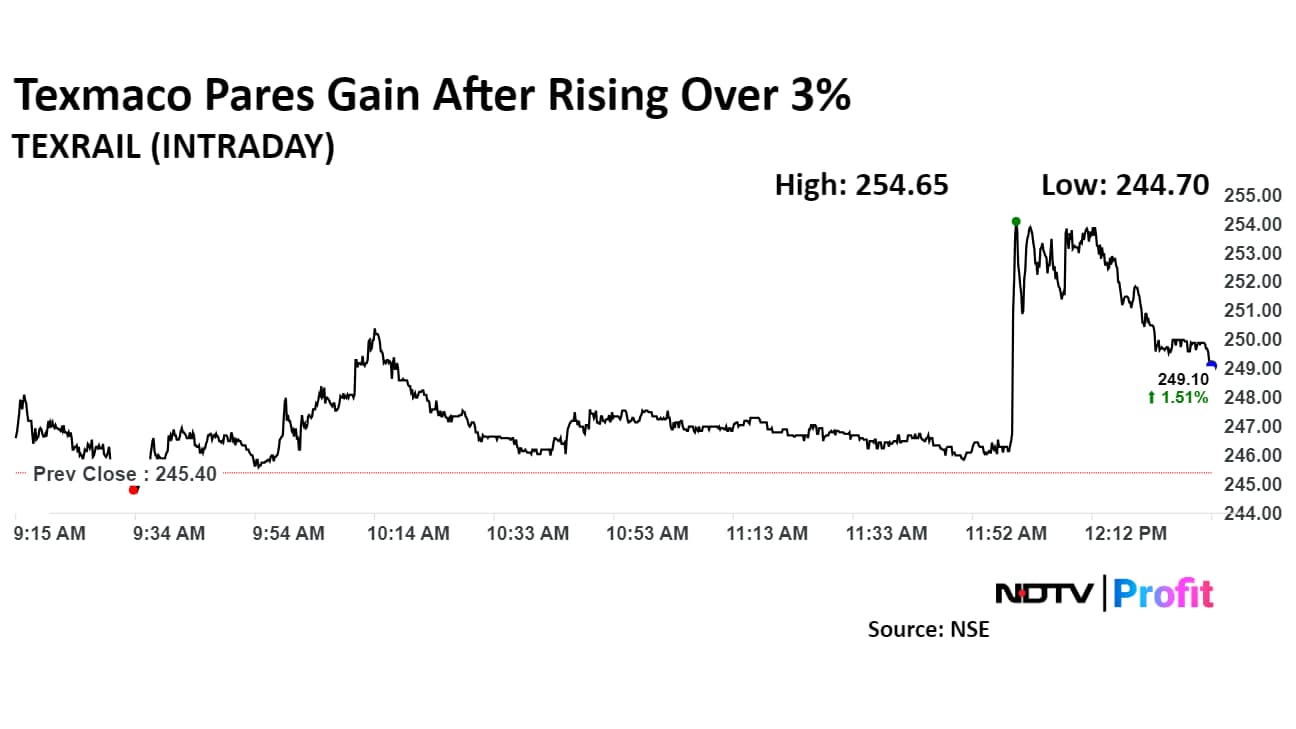

Texmaco's stock rose as much as 3.77% to Rs 254.6 apiece on the NSE. It was trading 1.8% higher at Rs 249.8 apiece, compared to a 0.3% advance in the benchmark Nifty 50 as of 12:31 p.m.

It has risen 68% during the last 12 months and has advanced by 45% on an year-to-date basis. The relative strength index was at 48.

All four analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 33%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.