Shares of Ugro Capital Ltd. hit an eight-month high on Friday after its net profit more than doubled in the fourth quarter of fiscal 2024. Net profit jumped 132.75% year-on-year to Rs 32.68 crore in the January-March period, according to an exchange filing. Sequentially, net profit rose only 0.48% due to higher tax expenditures.

Net interest income for the period rose to Rs 191.8 crore, compared to Rs 182.8 crore in the previous quarter and Rs 141.1 crore in the year ago quarter.

The company also plans to raise Rs 1,323 crore via compulsory convertible debentures and warrants, as well as acquire the Bangalore-based lending app 'MyShubhLife' for an aggregate consideration of Rs 45 crore.

"This capital raise received strong commitment from Samena Capital, one of the company's existing private equity investors, which committed Rs 500 crore through warrants," an exchange filing said. "In addition to institutional investors like Aregence, some of India's marquee family offices have committed to CCD and warrants."

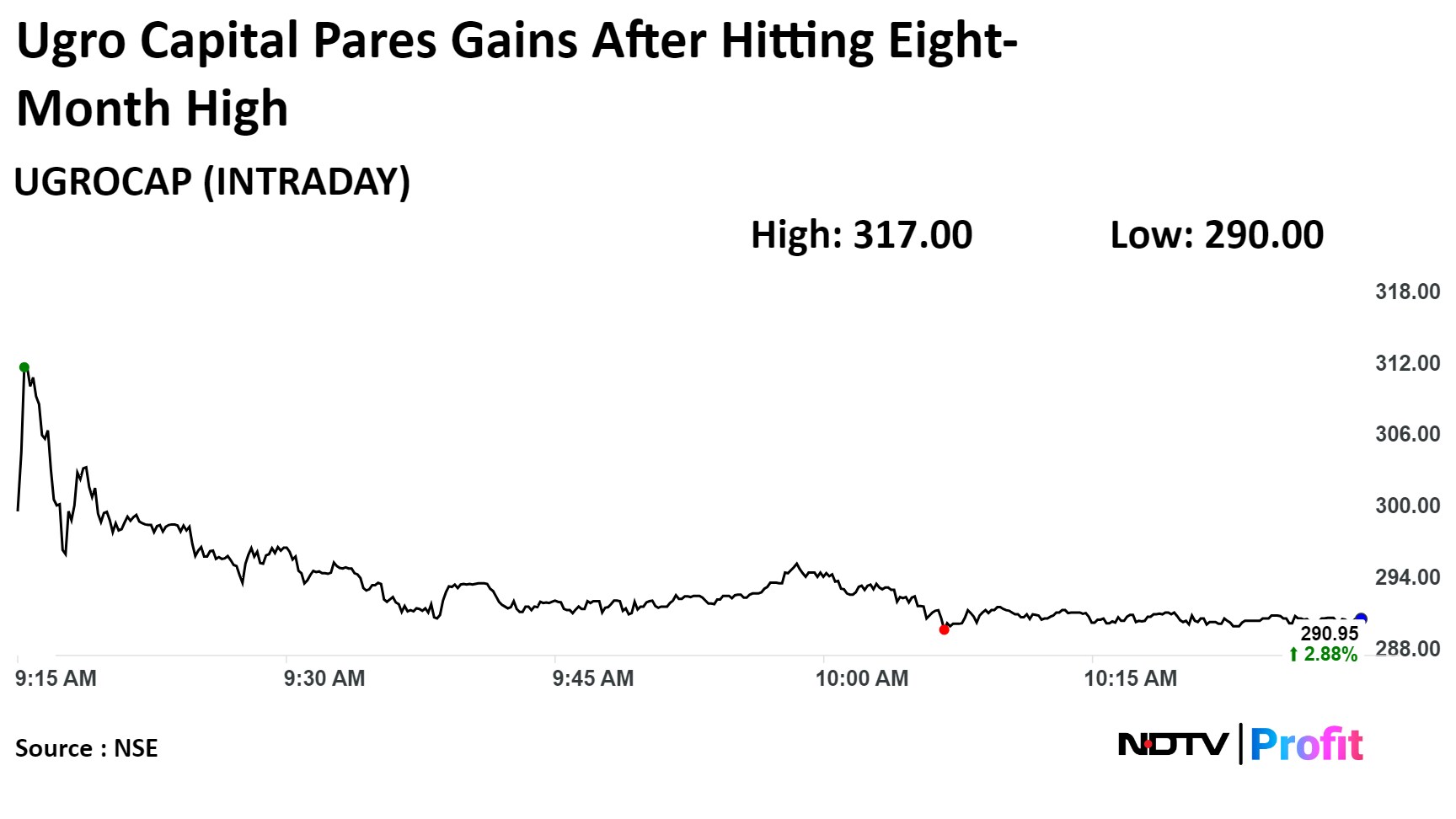

Shares of the company rose as much as 12.09% intraday, its highest level since Sept. 5, 2023. They pared gains to trade 2.9% higher at 10:27 a.m., compared to a flat Nifty 50.

The stock has risen 16.84% year-to-date. Total traded volume so far in the day stood at 26 times its 30-day average. The relative strength index was at 72.94, indicating that the stock may be overbought.

All six analysts tracking the company maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month analysts' price target implies an upside of 32.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.